Blockchain is mainly known as the currency that powers Bitcoin. The technology made its grand debut in Satoshi’s legendary white paper, but there were also many precursors to its appearance. Despite the fact that Bitcoin remains its most famous use case, there are plenty of other applications of the DLT technology in a slew of other industries. Not surprisingly, the traditional banking sector was the among the first industries that Blockchain took by storm. However, after the crypto rout, many naysayers still wonder whether banks are still interested in Blockchain in 2019. In this article, U.Today explains why it could be the case.

Major benefits of Blockchain

Here’s how banking institutions can benefit from utilizing the disruptive Blockchain technology:

-

High transaction speed. The major reason why many banks around the world are jumping on the Blockchain bandwagon is the speed of bank transfers. An ordinary bank transfer takes up to three days to be verified, but Blockchain helps to eliminate this long wait by reducing the transfer time to minutes or even seconds. For example, a Switzerland-based startup called Liquineq has managed to design a Blockchain-powered bank transfer platform that is able to process up to 50,000 transactions per second with the help of sharding. In the long-term perspective, Blockchain would allow exchanging money with the speed information moves at today.

-

Top-notch security. Apart from an impressive-speed, Blockchain technology also offers a high level of security. Reduced transaction time means that there are fewer possibilities for someone to intervene with the transactions. Each transaction is secured with the help of keys (the private key, as the name suggests, is only revealed to those parties that conduct the transaction).

One should also keep in mind the fact that Blockchain is an immutable ledger, which cannot be tampered with. Blockchains cannot be hackers (hypothetically, it would take a quantum computer to do so, but there are already quantum-proof Blockchains in the likes of IOTA). Considering that 40 percent of financial bodies face economic crimes that lead to significant losses. At the same time, Blockchain’s mechanism is extremely difficult to corrupt.Advertisement -

Greater efficiency. Blockchain would be able to cut the operational costs of major banks by 50 percent. The technology will allow banks to drastically reduce the cost of transactions while simultaneously bringing more transparency to the table. Another study, which was conducted by consultancy firm Bain, shows that Blockchain could reduce trade finance operating costs by up to 80 percent if implemented right. The cost reduction would be primarily the result of faster transactions — according to their estimations, the speed of settlements, billings and payments by four times could experience a three-fold increase.

Use cases for banks

International transactions

Sending money to another country is not an easy feat. For instance, Wells Fargo clients have to pay a $45 fee in order to perform an international wire transfer. This is objectively a huge waste of money considering the yearly volume of cross-border transactions reached $180 trln last year.

Ripple, for instance, is viewed as an alternative to mainstream bank transfer systems (SWIFT remains the main target for disruption). There have been numerous rumors about a potential partnership between the two, with some suggesting that SWIFT could eventually buy Ripple. However, Ripple CEO Brad Garlinghouse dispelled these rumors back in November, stating that they are hell-bent on taking over SWIFT. Garlinghouse also reveals that almost ‘at least’ 100 SWIFT-connected banks are already utilizing their xCurrent product. In other news, Euro Exim Bank, the very first bank that started using Ripple’s xRapid, is testing its new trade finance system with the help of the Ripple Blockchain.

Smart contracts

The cost of commercial claims resolved through litigation around the world reaches a staggering $870 bln (and that sum of money doesn’t take into account contract mismanagement). Smart contracts debuted with Ethereum in 2015. This feature allows encoding information about the terms and conditions of a contract on a Blockchain, and they cannot be tampered with due to its immutability.

It is worth mentioning that smart contracts are also self-enforcing, which means that there are no financial intermediaries. Money is only released from an escrow when the terms of the contract are met. Blockchain could cut the red herring in the banking industry, completely eradicating complicated legal documentation. Smart contracts could be used for loan servicing, insurance, etc.

Know Your Customer (KYC)

Each financial institution has to shell out on average $48 mln in order to conduct KYC for their customers. Back in 2017, Thomson Reuters reported that reported that KYC-related procedures for banking giants with annual revenue of $10 bln exceeded $142 mln. Notably, the cost of such procedures tends to go higher each year.

With Blockchain, storing data that pertains to the customer’s financial history is much easier. An immutable ledger could keep all information about the source of funds, loan history, and the customer’s business activity. The information is securely stored on a Blockchain, and it can be shared with other banks.

Auditing and reporting

Just like in the previous case, Blockchain could significantly reduce the cost of auditing and reporting information to regulatory authorities. Undoubtedly, regulatory compliance is crucially important, but it doesn’t necessarily have to be that expensive.

U.Today already reported that Big-Four auditors are trilling Blockchain technology within a consortium with 20 Taiwanese banks. The tamper-proof technology is the perfect choice for verifying the authenticity of transactions.

Cryptographic wallets

Digital wallets represent a huge threat to the banking industry. Hence, banks take matters into their own hands while the industry is still nascent. The total number of people with a credit card is 1 bln, which is 40 times bigger than the size of the public with a cryptographic wallet (25 mln). Rabobank, a major Dutch multinational banking company, already planned to integrate a cryptocurrency wallet into its online banking system. Bank of America, for instance, was awarded a patent for secure crypto storage, which gave ground to many speculations that it’s going to operate a crypto wallet.

Syndicated lending

It may come as a surprise, but in the age of bleeding-edge technologies, people still mainly rely on fax for syndicated lending (when multiple institutions join forces in order to provide a loan). On average, it takes 19 days for a bank to approve your loan, and your loan amount will most likely get disbursed in 5-7 working days.

Yes, you guessed it – Blockchain could substantially alleviate the process of taking out a loan. That’s exactly why global banking giant Credit Suisse launched a commercial platform for Blockchain-powered syndicated loans in 2019.

Blockchain disrupting the banking sector worldwide

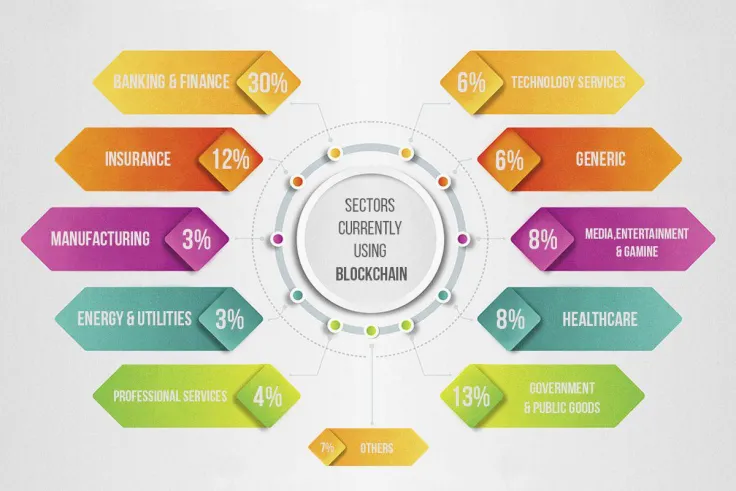

Literally, almost every bank under the sun. Currently, up to 99 percent of banks and investment firms are either exploring the new technology or already utilizing it. CEOs of the biggest banking institutions in the world recognize the disruptive potential of Blockchain, and they are actively working on new use cases that are based on the new technology in order not to be left behind if it indeed explodes and becomes bigger than the Internet.

North America

As U.Today reported earlier, Bank of America (BofA) is one of the leading companies by the amount of Blockchain-related patents, along with such behemoths as IBM and Alibaba. On the flip side, the fact that BofA is fighting tooth and nail in order to become the leader in the Blockchain race doesn’t necessarily mean that it’s going to use all of its patents. It’s more likely that the second largest bank in America is simply reserving a spot for the future. The trend is seen worldwide — only 10 percent of banks have actually implemented Blockchain.

Meanwhile, JPMorgan Chase went as far as creating a separate division for exploring the potential of Blockchain (the Quorum division). Similarly, Goldman Sachs enjoys a reputation as one of the most crypto-friendly banks. The Bank of Montreal also debuted a Blockchain-powered system for fixed-income transactions.

Europe

In June 2018, Deutsche Bank collaborated with US tech giant IBM to test bank transfers that are powered by Blockchain. Earlier, Deutsche Bank’s CIO also claimed that Blockchain’s potential is huge. IBM’s Martin Schroeter explained that major financial institutions in the likes of Deutsche Bank are using Blockchain to enhance the level of security and scalability.

Santander Group, a multinational commercial bank in Spain, was among the first to roll out the Ripple-Net powered service 'Santander One Pay FX' for conducting cross-border transactions.

Eight of the biggest Polish banks are currently testing a Blockchain-based platform designed by Billon Group for storing and managing the customer’s personal data. In the future, Billon Group plans to introduce Blockchain-powered solutions for other major banks, including transferring fiat money.

Russian banking giant Sberbank has been on the Blockchain train since 2017. Sberbank CEO Herman Gref recently predicted that industrial-level adoption of Blockchain will take place in one or two years. Raiffeisen Bank also announced that it would use the DLT technology for issuing digital mortgages.

Asia

China is already jumping feet-first into the Blockchain industry in spite of its infamous crackdown on crypto. On Dec. 29, the China Banking Association (CBA) signed over ten major Chinese banks (including HSBC and Bank of China) to a new Blockchain-powered trading platform. In the nearest future, CBA expects that smaller-caliber banks will follow suit. While China strives to be at the forefront of Blockchain innovations, it would be rather challenging for the country to make this transition given that its local trade ecosystem is still paper-based and labor-centric.

On Jan. 29, the Economic Times reported that major Indian banks, including ICICI Bank, HDFC bank and Axis Bank, have formed a consortium to launch the very first Blockchain-powered funding platform for small and medium-size businesses. When it comes to cryptocurrency, however, a hostile line persists.

The Middle East

The Gulf Region channels China’s ambitions when it comes to adopting Blockchain in banking. Remarkably, the UAE, Saudi Arabia, and other countries are also not big fans of crypto, but they recognize the aforementioned advantages of decentralization in the banking industry.

On Dec. 27, U.Today reported about the National Bank of Kuwait (NBK) teaming up with Ripple in order to launch a cross-border remittance service dubbed ‘NBK Direct Remit’. Jordanian citizens will be able to send transactions in a matter of seconds.

Africa

African banks are also warming up to Blockchain. Namely, Barclays Africa Group, the third biggest bank in South Africa, became the first financial institution in the country to join other 45 R3 members. The South African Reserve Bank (SARB) spearheaded the collaboration of the country’s biggest eight banks for Project Khokha, which utilizes the Ethereum-based Quorum Blockchain for performing fast bank-to-bank payments. Still, the pace of adoption remains sporadic across the country.

Latin America

On Dec. 15, Reuters reported about Brazil’s Itaú Unibanco becoming the very first bank to close its club loan. That was conducted with the help of R3 Corda Connect, which cuts the red herring, helping banks approve club deals digitally. It is worth mentioning that the country’s central bank started dipping its toes into the Blockchain technology long before that by starting to test Ethereum and Quorum back in 2017.

Back in July, the Central Bank of the Argentine Republic also requested 42 books in order to understand Blockchain technology in a better way, which shows that they are ready to openly accept the currency.

Blockchain as a replacement for banks

The abovementioned use cases show how much potential the technology has, but it doesn’t mean that we should write off the world’s banking industry (at least for now). Some experts predict that it would take a very long time for Blockchain to replace traditional banking, and it would have to undergo years (or even decades) of additional transformations to come up as a viable replacement. The technology is still facing the so-called ‘scalability trilemma’, which refers to the tradeoff between scalability and security for the sake of optimization.

card

The issues that have to be resolved

Blockchain is currently in the very early stages of its development. In the future, there could be global coordination between multiple banks that could utilize the technology for the common good. As of now, the major challenge is to come up with common standards for financial institutions, which are necessary for implementing new solutions.

Another obstacle that currently hinders the adoption is lack of awareness about Blockchain. According to a PwC report, only 24 percent of executives in the banking industry are familiar with the technology.

Key stakeholders within a certain financial institution have to realize the benefits of Blockchain.

Lastly, we cannot ignore the elephant in the room – regulations. Mainstream adoption won’t happen without a proper legal framework. However, as of recently, it seems like lawmakers are finally warming up to the new-fangled technology. Case in point: Wyoming, a crypto-friendly US state that recently unanimously passed a Blockchain bill that would give a huge push to Blockchain integration in the cowboy state. On Jan. 29, they passed yet another Blockchain bill.

Blockchain is not an expense-saving machine

Umar Farooq, who spearheads the Blockchain department at JPMorgan, believes that DLT technology can indeed offer applications for banks, but its cost-saving abilities are largely exaggerated. Blockchain, according to Farooq, is mainly about creating new products. Meanwhile, simply using it as a tool for cutting expenses and labor force significantly limits its possibilities.

Blockchain banking for the unbanked

Yes, the adoption rate is still rather slow, and major banks are not going anywhere, but there is one sector where Blockchain is already making waves: banking the unbanked. About 2 mln people around the world still remain unbanked. That issue is not restricted to third-world countries – nationwide, almost 8 percent of households in the US remain unbanked. Not surprisingly, things are getting much worse in regions with a low level of financial inclusion, as 34 percent of people in sub-Saharan Africa remain without a bank account.

CNBC earlier reported that people in South Africa (one of the most developed regions) still transfer funds with the help of a bus driver given the inefficiency of bank transfers, which is why it’s becoming one of the focal points of the crypto gold rush. As of now, there are plenty of Ethereum-based projects that are designed to tackle the issue.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov