Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Stablecoins or cryptocurrencies with rates pegged to fiat currencies should be considered as pivotal elements of the global digital assets ecosystem. For some use cases, they can easily replace traditional currencies: people use them as stores of value, mediums of exchange and cross-border transfer instruments.

That is why choosing the right stablecoin is a crucial step for every trader and investor. Holders of collapsed TerraUSD (UST), Fei (FEI) and Neutrino USD (USDN) lost millions as their stablecoins de-pegged.

Top stablecoins to watch in 2023: Basics

In this review, U.Today is going to cover the most crucial trends in the stablecoin segments and highlight some assets that are definitely worth noticing in 2023. Here are some tendencies that are expected to dominate the stablecoins segment in the upcoming year:

- Top three centralized stablecoin blue chips (U.S. Dollar Tether [USDT] by Tether Limited, USD Coin [USDC] by Circle Inc. and Binance USD [BUSD] by Binance and Paxos) will remain unchallenged;

- Meanwhile, USDC can surpass USDT by market capitalization in 2023;

- In the decentralized stablecoin sphere, turbulence is in the cards: current designs fail to prevent assets from being de-pegged again and again: Maker’s DAI is the obvious beneficiary of this process;

- The segment of Euro-pegged stablecoins will gain traction as the industry badly needs reliable regulated EUR-based stable cryptocurrencies;

- Last but not the least, we should expect the emergence of new stablecoins pegged to unusual assets, including Offshore Yuan (CNH) and even commodities like Gold (XAU) and Silver (XAG).

In general, centralized stablecoins will retain their role as “fuel” for the upcoming bullish run. This sphere will migrate to larger transparency, and more attestations and audits will be published.

However, it is still unclear whether major centralized stablecoins will be able to reach new capitalization highs in 2023. The decentralized stablecoin segment will remain fragile: more painful “de-pegs” should be expected.

What are stablecoins

Stablecoins are cryptocurrencies that attempt to keep their price pegged to assets from other classes: fiat currencies, commodities and so on. In this case, “stable” means that the stablecoins’ prices are far more predictable than those of the majority of cryptocurrencies.

As such, stablecoins address the major flow of cryptocurrencies, i.e., highly volatile prices. That is why people use them to rebalance their portfolios as well as instruments of reliable value storage and low-cost money transfers.

Centralized stablecoins

There are two major classes of stablecoins, centralized and decentralized or algorithmically backed ones. Centralized stablecoins are pegged to underlying assets (U.S. Dollar, Euro or Gold) protected by the issuer which, in turn, is a centralized entity. Technically, it looks not unlike the central bank, which releases banknotes backed by state reserves.

Mainly, сentralized stablecoins are backed by commercial papers, 10-year U.S. treasuries, reserves in cash and cash equivalents, and so on. Periodic audits or attestations by third-party services are designed to check whether the balance of the centralized stablecoin is healthy.

Centralized stablecoins are the largest class of stable assets; all three top stablecoins by market capitalization belong to this group.

Decentralized stablecoins

Decentralized stablecoins keep their peg stable via a sophisticated architecture of smart contracts. These systems protect the value of decentralized stablecoins by periodic minting/destroying of reserve cryptocurrency assets.

Some decentralized stablecoins are governed by DAOs. As such, these systems are more aligned with the decentralization ethos of cryptocurrencies though being more vulnerable to attacks. Decentralized stablecoins DAI and FRAX are responsible for the lion’s share of the segment’s capitalization.

Top stablecoins to watch in 2023: Majors

The right moment has come to review all major centralized stablecoins, which are the backbone elements of the stablecoins sphere: combined, they are responsible for 92.1% of stablecoins’ market capitalization.

USDT

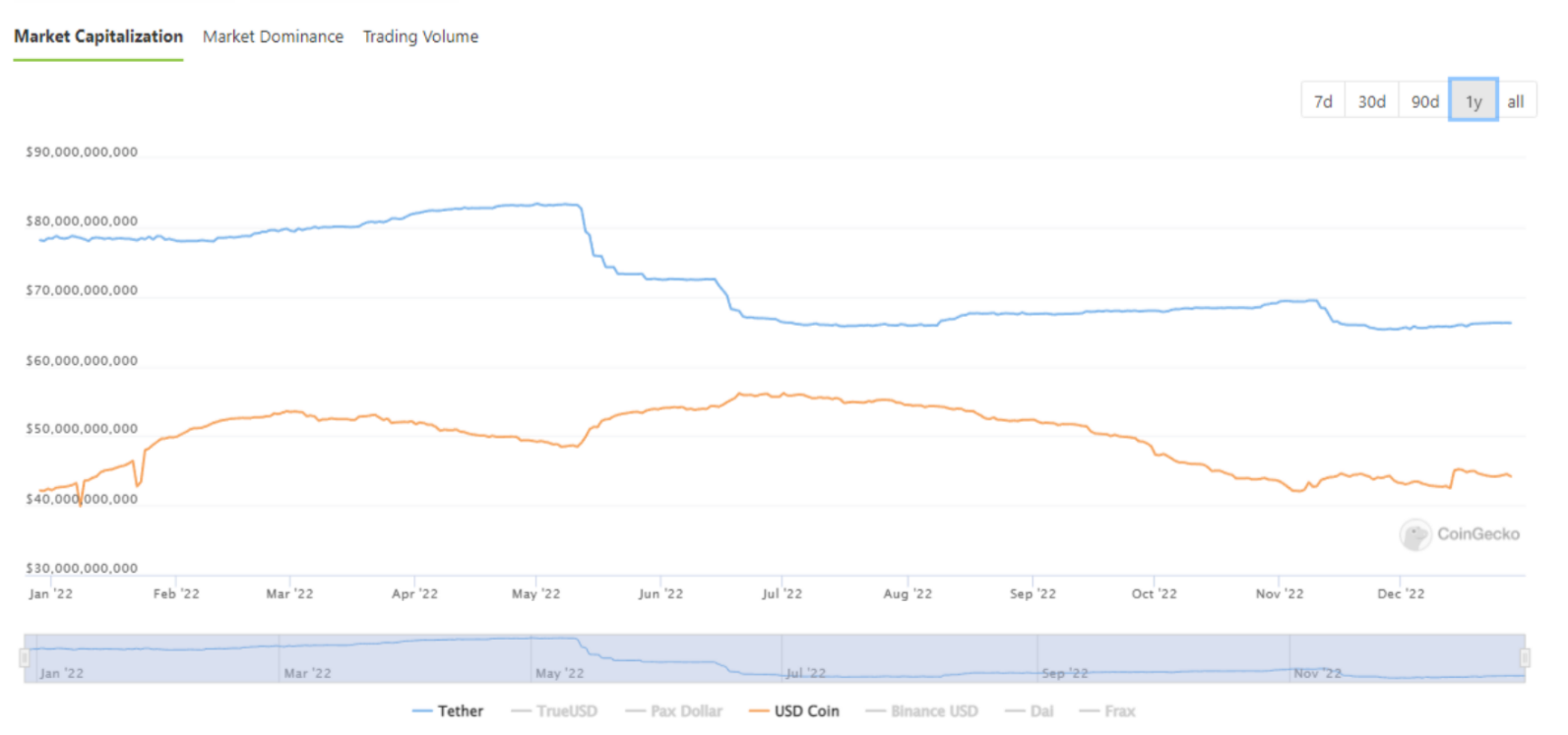

Launched by Tether Limited in 2014, U.S. Dollar Tether (USDT or USD₮) is the largest stablecoin in the world by trading volume and market capitalization. Its net supply peaked in May 2022, when it exceeded $84 billion. By press time, the stablecoin keeps its capitalization at $65 billion.

In 2022, Tether’s USDT proved itself as a reliable store of value and payments: when numerous mainstream stablecoins lost their peg amid the Alameda/FTX collapse, USDT looked stronger than the others.

To advance the level of stability of its peg, Tether (USDT) reduced USDT exposure to commercial paper and increased the role of U.S. bonds in its basket.

USDC

USD Coin (USDC) was launched by Circle Inc. in September 2018, as Tether's competitor. This year, it was closer to surpassing its rival than ever before: in late June 2022, USDC capitalization peaked over $58 billion.

As of Q3, 2022, its reserves were backed by short-dated U.S. Treasuries (80%) and cash Dollars (20%); both types of assets were stored in U.S.-regulated institutions. Besides increasing the circulating USDC supply — despite severe bearish recession, USDC capitalization added $4 billion since January 2022 — Circle enhanced its transparency and security toolkits.

Analysts noticed that in 2022, USDC managed to surpass USDT by numerous indicators, including usage among whales, supply and daily transactions count on Ethereum (ETH), and so on.

BUSD

The youngest asset in the Big Three, Binance USD (BUSD), was launched in collaboration between Binance and Paxos in September 2019. It is 1:1 collateralized by fiat USD held in Paxos-owned bank accounts in the U.S.

Binance USD (BUSD) is a native stablecoin of Binance, the world’s largest cryptocurrency ecosystem. It also demonstrated significant growth in 2022: its market capitalization added almost 30% year-to-year, which is the most impressive result among all major stablecoins.

In Q4, 2022, the stablecoin expanded to Polygon Network (MATIC) and Avalanche (AVAX), two major high-performance smart contracts platforms.

Top stablecoins to watch in 2023: Decentralized stablecoins

While 2022 was painful for the majority of cryptocurrency assets, decentralized stablecoins are among its worst sufferers. That is why it would be interesting to check which decentralized stablecoin would be able to pass the exam in 2023.

DAI

Dai (DAI), a veteran decentralized stablecoin by Ethereum (ETH) vet Maker DAO, was launched in September 2017. It is the only example of a massively adopted decentralized finance (DeFi) protocol. It is collateralized by cryptocurrency itself: Ethers (ETH) and Maker (MKR) tokens play crucial roles in their design.

In 2022, Dai (DAI) was used in a compensation program for holders of Fei (FEI), a now-defunct stablecoin. Also, the token expanded to Ethereum’s L2s Arbitrum and Optimism and increased APYs for its built-in savings product.

FRAX

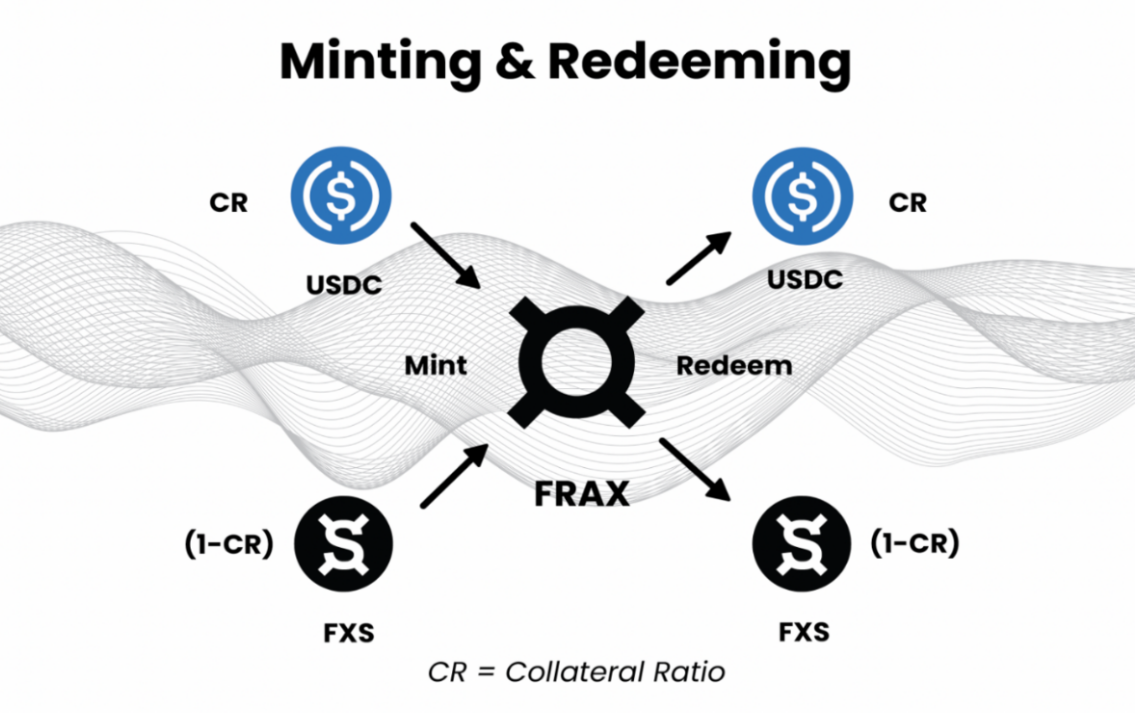

Launched in December 2022 by Frax Finance, USD-pegged stablecoin FRAX pioneers the concept of a hybrid stablecoin as it is partially backed by collateral and partially stabilized algorithmically. FRAX is a part of Frax Protocol, which also features a governance token, Frax Shares (FXS).

FRAX is fully on-chain: it leverages Chainlink oracles for better sustainability of the FRAX/FXS system. Its collateral ratio is floating: if FRAX is changing hands under $1, the protocol immediately raises the collateral ratio.

As covered by U.Today, in December 2022, FRAX came to the BNB Chain.

USDD

USDD, an algorithmic crypto-collateralized stablecoin by TRON DAO ecosystem, was unveiled in 2022. USDD is backed by an over-collateralized basket of various cryptocurrencies, including Bitcoin (BTC), Tronics (TRX) and USDT. As of late December 2022, USDD is 2x overcollateralized.

USDD is being promoted as a blockchain-agnostic stablecoin that can work on the top of Tron (TRX), Ethereum (ETH), BNB Chain and other networks. Its 1:1 peg to the price of the U.S. Dollar is guaranteed by Peg Stability Module (PSM), a proprietary swap tool by TRON DAO.

Top stablecoins to watch in 2023: EURO-pegged stablecoins

Stablecoins pegged to the Euro, the currency of the EU and some other countries in Europe, are still underrepresented in the segment. Here’s how Web3 teams are addressing this discrepancy.

EUROC

Euro Coin (EUROC) by Circle Inc. was introduced in Q3, 2022. As Circle is an issuer of major USD Coin (USDC) stablecoin, it expanded the 100% collateralization design of its new product. That being said, EUROC is fully backed by Euros held in Euro-denominated bank accounts in regulated institutions.

Euro Coin (EUROC) is launched on Ethereum (ETH) blockchain. By the end of 2022, it has already been integrated by major CEXes (Bitmart, BitPands), DEXes (Curve Finance, Uniswap), payments processors (BitPay) and on-chain wallets (Legder, MetaMask).

EURT

EURT (also EURt or Euro Tether) is a Euro-pegged stablecoin by Tether Limited, USDT’s creator. It was launched in 2020. Meanwhile, it has not become mainstream yet: its supply is capped at €400 million on Ethereum (ETH).

The stablecoin is backed by Tether Limited reserves in its entirety. Currently, it is only listed by Bitfinex exchange. At the same time, in December 2022, Tether also announced that EURt was coming to Huobi.

EUROe

Unveiled in mid-December 2022, EUROe is the first attempt to develop an EU-regulated stablecoin pegged to the Euro. EUROe is the brainchild of Helsinki-headquartered Web3 infrastructure firm Equilibrium Labs.

The stablecoin will be launched in mainnet in Q1, 2023. Once live in mainnet, it will be fully compliant with the much-criticized Markets in Crypto Assets regulation (MiCA), the strictest regulatory framework for digital assets ever.

Top stablecoins to watch in 2023: Exotic assets

Wrapping up our review, let’s focus on two unusual stablecoins that are not pegged to the U.S. Dollar or Euro.

XAUT

Tether Gold (XAUT) is a pioneering multi-purpose stablecoin that is backed by physical Gold. Its issuer, Tether Limited, promotes this asset as a “safe haven” amid the increasing market volatility of both digital and fiat currencies:

From ancient civilizations, humans have used gold as money and a store of value. Since then, and especially in times when the overall macro market has been in distress, gold has been used as a hedge.

With its market cap of $443 million in equivalent, Tether Gold (XAUT) reserves include 611 Gold bars, or 7643.71 kilograms of physical Gold.

TCNH

TrueUSD (issuer of TUSD stablecoin), together with TRON DAO, released TCNH, a stablecoin product pegged to Offshore Chinese Yuan. CNH is an offshore "version" of the Chinese Yuan (renminbi) and, therefore, is not regulated by Chinese law.

¥>$. Few understand.

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) December 15, 2022

CNH is primarily used on offshore Asian forex markets, including Hong Kong and Singapore. Unlike “on-shore” Chinese Yuan (CNY), its price is formed by demand/supply dynamics, not by government monetary policy.

Closing thoughts

In 2023, stablecoins will remain the backbone of the global cryptocurrency remittances segment. Centralized stablecoins will dominate while decentralized stablecoin products will introduce more and more original technical concepts.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin