Some of the present market’s indices appear rather alarming: the bear does tend to roar and stomp. But exceedingly more alarmingly, some experts view it as the green light to peddle pessimism and panic to all around. While, for aught we know, this is but a phase, and must be taken as such. Traders should probably be less reckless, newcomers more vigilant, but the market isn’t going anywhere: it shall recover soon enough. Don’t sweat it.

Signs of the Supposed Crypto Armageddon

Bitcoin is down to around 5 500 USD, the lowest figure in over a year. To make matters worse, Bitcoin’s market cap figure has dropped below 100 billion USD, also for the first time in over 12 months. The past 24 hours have seen a decrease in total crypto market capitalization numbers by more than 30 billion USD.

Tether, being a stablecoin pegged to USD, saw a drop in its price on Kraken, where it trades for fiat. In addition to other factors, because of this compromised parity, crypto exchanges that trade against Tether, e.g. the Hong-Kong based Bitfinex, have seen the price of Bitcoin move down against the USD in return.

The fork-riddled Bitcoin Cash, which is about to be split into two separate altcoins (core/ABC and Satoshi’s Vision), Ethereum, and Ripple are all seeing declines of up to 12% a day in their values on the market. As a by-product of this freneticism, Ripple (18.7 billion USD) is now in second place by market cap after Bitcoin having recently surpassed Ethereum (18.35 billion USD).

STOP_BOT

The Bright(er) Side of the Coin

It’s important to understand that any industry, any financial sector, any economy will go through a period of stagnation and recession. There have been numerous examples of it from the Revolutionary War to the Great Depression. Heck, the Blockchain technology itself emerged in the aftermath of the 2008 global crisis. Lows give way to highs and improve the nature of the market in the process. It’s inevitable.

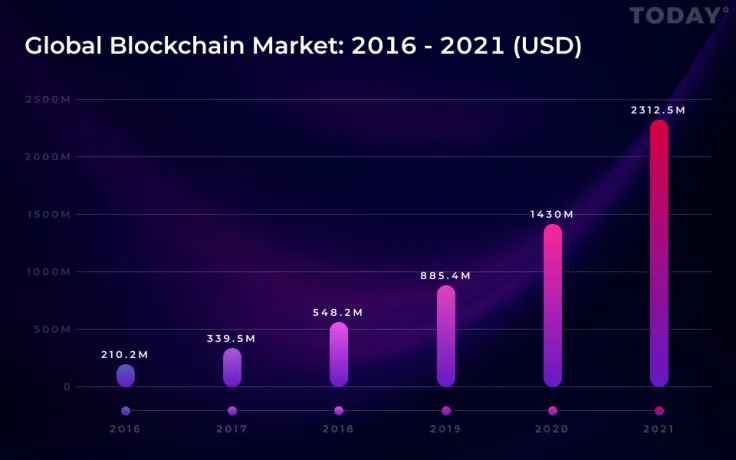

At the same time, even in today’s dire crypto-economic conditions, many vital indicators tell a positive story nonetheless. While there may be problems with diminishing cryptocurrency market cap values and falling prices on exchanges, the big picture is not solely a grey one. The Blockchain market itself is growing regardless, and it is projected to continue doing so in the future.

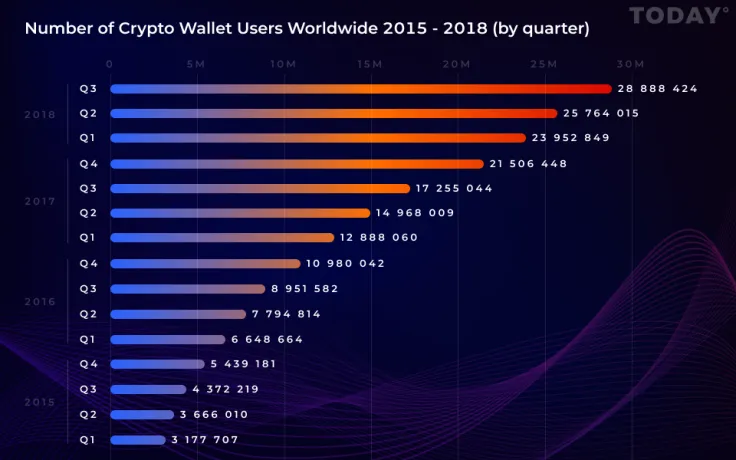

One of the very reliable sub-indicators of the fact that it is happening is the number of crypto wallets, which is growing by the day. Too promising a figure for those trapped in quicksand, surely.

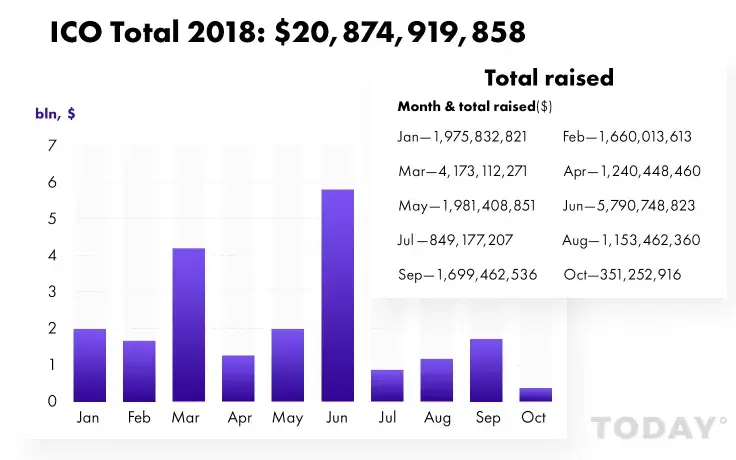

Furthermore, the ICOs are not vanishing, quite on the contrary. In spite of the Chinese government’s ban on this type of fundraising, the global figures are going up, which has been corroborated by numerous independent publications.

Concurrently, some of the economic trends, however fragmental, are still bullish; Bitcoin, for one, until very recently, has been demonstrating a great deal of stability, and where longitudinal volatility is low, the whining voices should perhaps be tactfully sidelined.

All in all, despite the pressure and the stress, there is little time for poor-me-ness right now, when the overall crypto aura is that of vigor and, as mundane as it sounds, hope: after all, right this very second, whole crypto communities are working on new and yet newer ways to crypto-revolutionize the world and change the very nature of modern economy, from payment methods to employment.

Afterthought

“Abandon your posts! Flee, flee for your lives!”

A memorable line borrowed from Denethor, the infamous character from The Lord of the Rings trilogy. And we all know how that strategy worked out for him. Not too well really...

Instead, perhaps we should follow Gandalf’s orders and prepare for battle, the crypto battle that never ceases, be the market bear or bull. And yes, right now we are indeed in a bear market. The prices are plummeting, the grip is becoming weak: this is the very definition of it.

In actuality, all this means nothing more than the fact that the bull market has got to be on the way, its eager horns already glaring through thick mist somewhere in the distance. It’s coming. Despite the rocky road ahead, sooner or later, it is. In the meantime, keep your head above water and do not overdramatize. Be Zen. It’s going to be fine.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov