Exchange platforms are a major part of the modern fintech sector, where buyers and sellers meet in virtual spaces to trade their crypto fortunes.

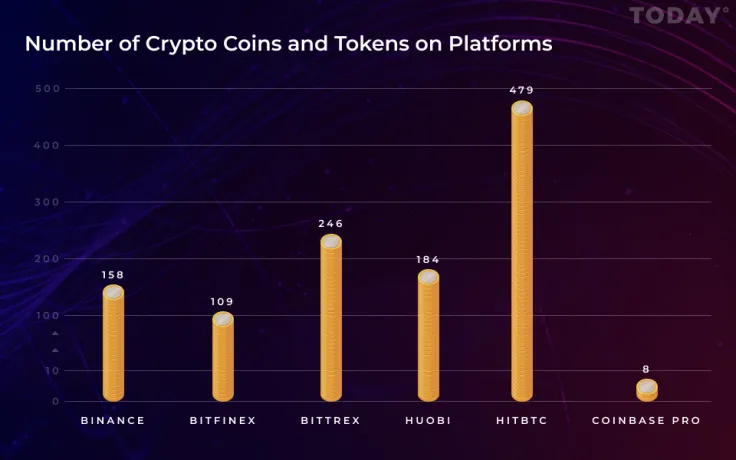

Today, based on the stats received from our partners Datalight, we bring you the following chart that outlines some of the major crypto exchange platforms and their corresponding numbers of tradable coin and token types:

The Hong-Kong based HITBTC, founded in 2013, has the most types currently listed, 479. The US-based BITTREX (Seattle, Washington), also founded in 2013, follows with 246 types. The Singapore-based Huobi, established in the very same year, is next with 184 types. Then it’s Binance, founded in China last year, now based in Japan (due to the Chinese ban) with 158 types. Another well-known Hong-Kong based exchange, Bitfinex, founded in 2012, has 109 types listed. And finally, the US-based Coinbase Pro, established in 2012 and headquartered in San Francisco, California, is last with 8 crypto coins currently offered for trade on its exchange platform: clearly they prefer fewer strong players as opposed to many weaker ones.

Be sure to also check out these:

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin