ICO stands for Initial Coin Offering, a term which is heard pretty much non-stop today in the fast-paced world of cryptocurrency. In many ways, ICO is very similar to the older term IPO (Initial Public Offering), in which members of the public are offered to purchase shares of a company. Accordingly, ICOs are essentially a form of crowdfunding needed to allocate enough monetary resources in order to support and secure a new crypto unit release.

The first cryptocurrency to use this method of funding was Mastercoin in 2013, followed by Ethereum in 2014, and then Waves in 2016. Alas, the ICO scene is shrouded in scandal with some crypto minds allegedly fleeing their investors with stuffed pockets; however, billions of dollars are still being raised every month by new, legitimate crypto players.

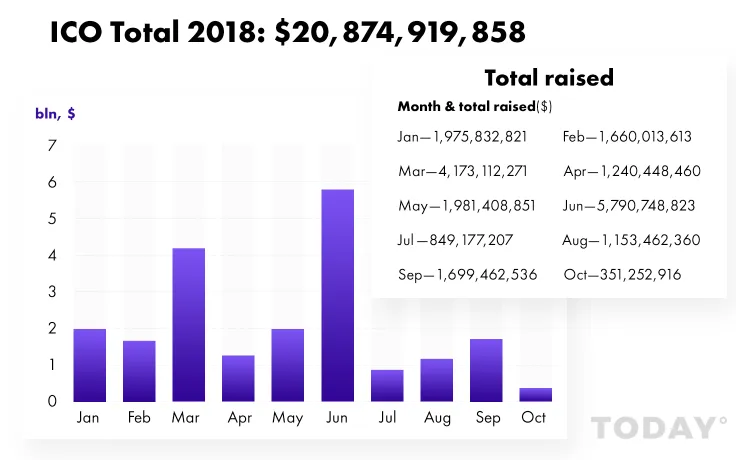

The graph below shows what the ICO situation is like right now. The year started with January gathering almost 2 billion US dollars in ICO funds; March saw over 4 billion; and June, this year’s record so far (and likely to remain so), saw close to 6 billion dollars in funding.

After the subsequent wane in the late summer and early autumn, October has gathered around 350 million US dollars in its first ten days. Let’s wait and see how this crypto year wraps up as Christmas is fast approaching.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov