Crypto journalist Colin Wu, based in China and offering coverage of all events related to the blockchain and crypto industries, has taken to Twitter to share news of the progress of two major Bitcoin mining pools.

SBI Crypto and Foundry have entered the top 15 list of crypto mining companies in the world. Both are subsidiaries of two crypto giants: Ripple's top partner, SBI, and Digital Currency Group, the parent company of Grayscale.

SBI Crypto comes in twelfth

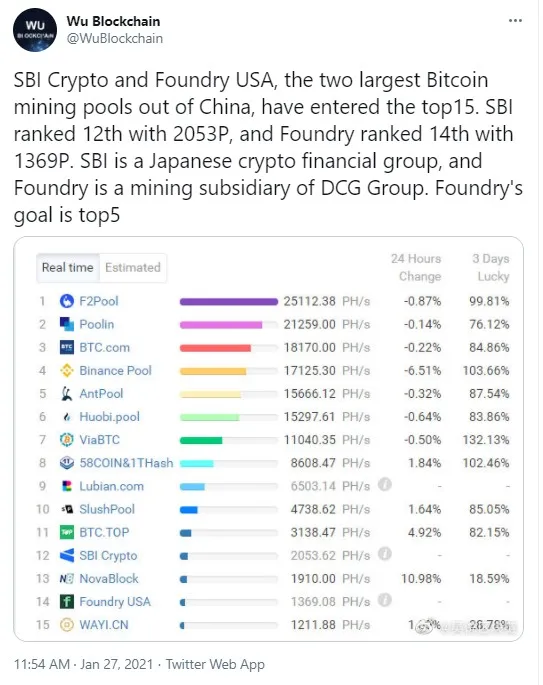

Colin Wu has tweeted that two of the biggest Bitcoin mining pools beyond China—SBI Crypto and Foundry—have entered the top 15 list of hash rate providers.

SBI Crypto is a mining subsidiary of SBI Investments, a major partner of Ripple in Japan, and Foundry was created by Barry Silbert's Digital Currency Group, the parent company of Grayscale Investments fund.

According to the tweet, DGC Group's mining subsidiary is ranked 14 (earlier, reports came out that it was in 10th place) and it aims to take fifth.

SBI Crypto is ranked 12 on the list of crypto mining companies. Wu posted a screenshot from BTC.com—the website of a major mining pool owned by Bitmain.

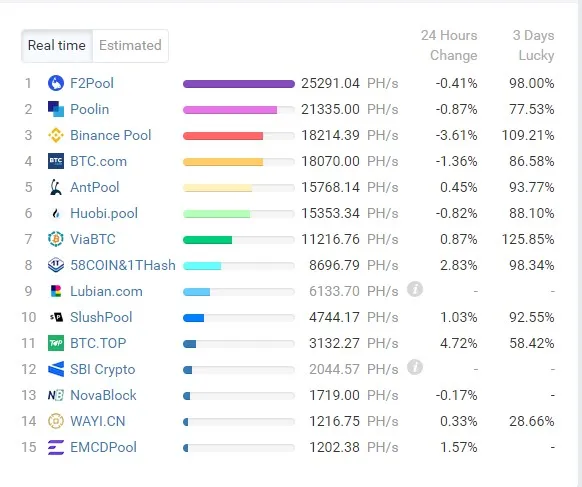

Data from the website shows that, at press time, Foundry is not in the top 15, while SBI Crypto holds onto twelfth. Binance Pool is now in spot three, having gained one place.

Grayscale added BTC mined within two months in just 30 days

On Jan. 19, crypto influencer Whale Panda published a tweet saying that, over the past 30 days, Grayscale (another subsidiary of Barry Silbert's DCG) has acquired 60,000 Bitcoins ($1,887,018,000 at the current rate). It takes miners two months to emit that.

On the previous day, Grayscale purchased 16,000 Bitcoins ($503,204,800 at the present BTC/USD rate). Whale Panda pointed out that this acquisition was the equivalent of 18 days of work by miners, with 900 BTC mined daily.

Foundry was launched last year, and now the Digital Currency Group has expanded into both Bitcoin mining and crypto investing (Grayscale)—basically mining Bitcoin and then selling it to financial institutions at a premium.

However, today, this premium is less than five percent, according to founder of Capriole Investments Charles Edwards.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin