Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bollinger Bands and XRP: the story between the popular technical analysis indicator and third biggest cryptocurrency continues to develop, as was previously observed multiple times by U.Today.

Today's outlook is probably more important than ever as, in the cut of the Bands, the price of XRP came to a crucial point where only two options remain. And, yes, both of them are critical and will define the trajectory for the altcoin in the days to come.

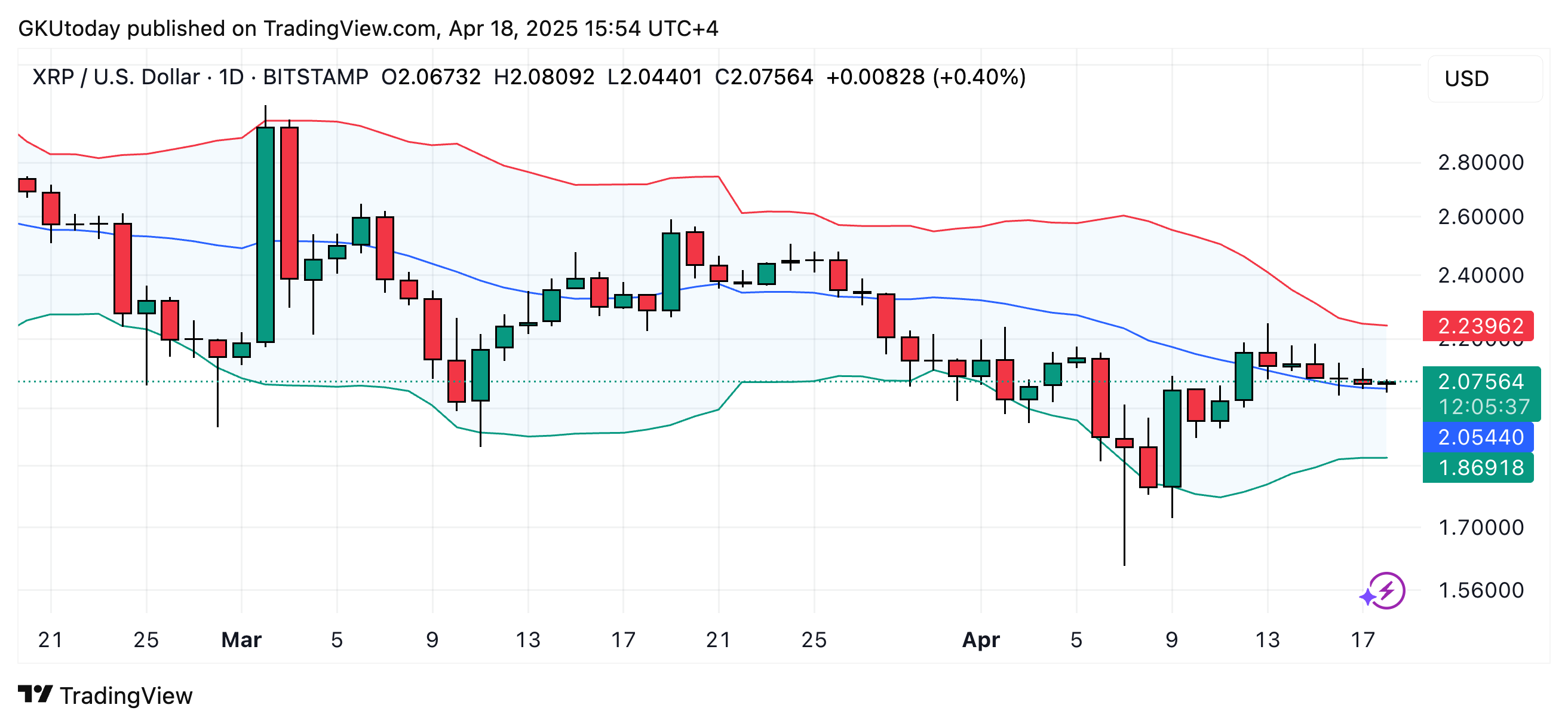

XRP is currently hovering near the middle band on the daily chart, which acts as the 20-day simple moving average. This point often functions as a decision zone where market sentiment gets tested. The asset’s price is now squeezed tightly within narrowing bands, suggesting that a big move might be imminent.

The first scenario suggests a bullish breakout above the middle band, potentially leading to a test of the upper boundary near $2.23. That would be a 7.6% gain from the current price of $2.07.

If successful, this move may mark a return of buying pressure and a reversal from the recent consolidation. However, any failure to sustain above this level could invalidate the short-term bullish outlook and trigger the second scenario.

The second scenario points to a rejection at the middle band followed by a move toward the lower Bollinger band, currently around $1.86 — a 10.1% downside risk from current levels. This would indicate a continuation of the descending trend seen earlier this month, possibly putting XRP under renewed selling pressure.

Both outcomes remain technically possible, and with the Bollinger Bands narrowing, market participants may expect a decisive move in the near term. The choice between breakout and breakdown now depends on whether the XRP price can maintain above the middle band on the daily chart and see multiple candles close there.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin