Decentralized finance (DeFi) protocol Synthetix has announced the launch of an oil-backed token called sOIL on its mainnet.

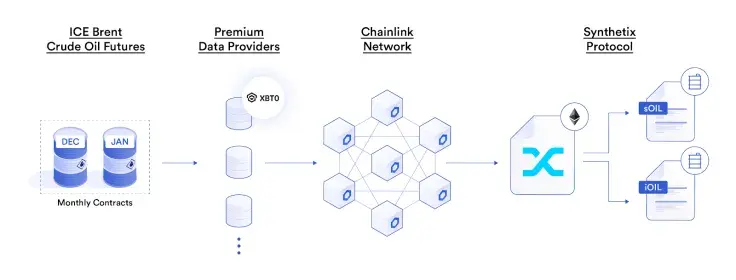

The new derivatives product relies on Chainlink's oracle network to aggregate and deliver off-chain data.

Its backbone is the SIP-62 futures reference algorithm that was created back in May.

The OIL/USD reference tracks the two nearest ICE Brent Crude Futures contracts. The closer a contract is to expiry, the less weight is assigned to in the reference.

The launch of sOIL represents the future of decentralized finance—more and more of the traditional market will soon be accessible through Synthetix, and our integration with Chainlink allows us to continually tap into high quality data providers to provision new assets.

Crypto Market Review: Did XRP Downtrend End? Shiba Inu (SHIB) Taking a Beating, Bitcoin (BTC) Safe Above $80,000U.Today Crypto Digest: XRP Millionaires Awaken, Shiba Inu Buyers Step In, Dogecoin Sees 10,782% Rise in Futures VolumeScaramucci: ‘Get Ready’ as Bitcoin Firms Against Falling GoldXRP Faces Brutal 11,348% Liquidation Imbalance: What Just Happened?

Back in April, FTX—one of the leading crypto derivatives exchanges—rolled out crude oil futures just a few days after the five-month WTI contract went negative for the first time in its history.

Synthetix is an Ethereum-based platform for minting and trading ERC20 tokens that mimic cryptocurrencies or assets such as stocks or gold.

Its native token, SNX, is used to collateralize the protocol. Those who stake the token can earn trading fees denominated by the sUSD stablecoin.

In order to track real-world assets, Synthetix relies on oracle fees. It first announced its collaboration with Chainlink back in March 2019, becoming one of the first projects to integrate with the leading decentralized oracle provider.

Chainlink has already scored over 320 partners to date, including such big names as Google Cloud and SWIFT.

Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya