Contracts for difference (CFD) on WTI (West Texas Intermediate) crude oil showed a massive price drop today, losing around thirty-eight percent. Now, a barrel of oil costs less than $13. This is the biggest one-day drop since 1982.

? BREAKING ?

— Javier Blas (@JavierBlas) April 20, 2020

WTI front-month contract (May) plunges 37%, biggest one-day drop since the launch of the oil futures market in 1982. WTI hit an intraday low of $11.42 a barrel | #OOTT

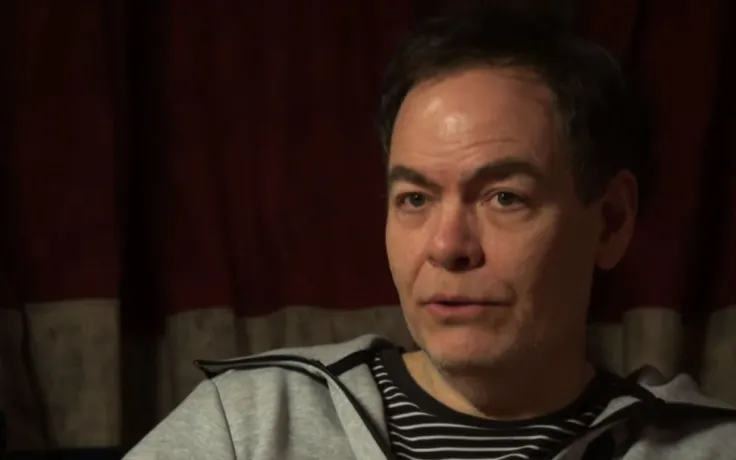

Some are now stating that oil might be dropping to zero. However, prominent investor and Bitcoin supporter Max Keiser says that next to this price fall Bitcoin does not look volatile.

Top analysts and economists have shared their view of the situation with oil, along with Max Keiser and the Euro Capital CEO Peter Schiff.

Max Keiser praises Bitcoin over oil

Investor and trader Max Keiser has commented on the massive crude oil price fall, hinting that anyone who has been saying that Bitcoin is highly volatile, can now eat their words.

‘Bitcoin’s too volatile’

— MAX & STACY RIOT ?? (@realmaxkeiser) April 20, 2020

Oil: Hold my beer

As oil plummets further demand for USD will fall: Peter Schiff

First reports stated that the crude oil futures price plummeted 38 percent.

Crude oil (front month) -38% today, trading at its lowest level since Dec 1998. $CL

— Alex Krüger (@krugermacro) April 20, 2020

Spread between first & second months reached 100%. pic.twitter.com/aQZxop0vba

Now, it seems that this crucial for the global economy commodity has resumed declining.

Now crashing 40% pic.twitter.com/iDmu72BuCx

— Joe Weisenthal (@TheStalwart) April 20, 2020

Joe Weisenthal, a popular Bloomberg TV host, states that 100 USD is now basically worth 8 barrels of oil, while in winter this year, it was 2 barrels.

“It's crazy how costly it's gotten to acquire USD. To get $100, you have to sell 8 barrels of oil. Back in February you only had to sell 2 barrels.”

Prominent gold bug and Bitcoin critic Peter Schiff also joined the discussion, saying that now more nations are making oil rather than producing it. He assumes that because you now need a lot more USD to buy oil, USD will fall in demand.

What's even crazier is that to buy 8 barrels of oil you only need to pay $100. Back in February you needed to pay $400. Since more nations buy oil than produce it, the demand for dollars will fall as fewer dollars are now needed to purchase oil.

— Peter Schiff (@PeterSchiff) April 20, 2020

Buy more oil with one BTC

Meanwhile, the fall of the crude oil futures price has not impacted Bitcoin. The flagship currency remains above $7,000, indeed now looking more stable than crude oil. But Peter Schiff does not seem to be paying attention.

Trading expert and founder of Quantum Economics Mati Greenspan has tweeted that now anyone can buy 610 barrels of oil with just one BTC.

One bitcoin now buys 610 barrels of oil.

— Mati Grrrrrreenspan (tweets aren't trading advice) (@MatiGreenspan) April 20, 2020

Trader Scott Melker tweets:

“Oil is having as bad of a day as Bitcoin did on March 12th. Pretty insane to watch.”

Earlier, Scott Melker shared a forecast from CNBC that crude oil prices may fall to zero over a lack of containers to store it in.

On, CNBC, Jim Cramer just said that oil could trade at 0 next month because there is nowhere to store it.

— The Wolf Of All Streets (@scottmelker) April 20, 2020

So... now they're saying that oil is going to zero.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov