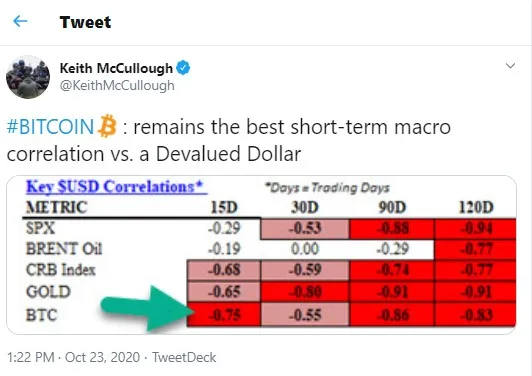

In his recent tweet, the founder and chief executive of Hedgeye Risk Management, trader and investor Keith McCullough stated that Bitcoin remains the best short-term macro correlation versus the devalued US dollar.

Curiously, around two weeks ago, just before Bitcoin price accelerated to surge above $11,000, McCullough got rid of all his Bitcoin.

Dumping Bitcoin for no obvious reason

On October 6, McCullough announced on Twitter that he had ditched all of his Bitcoin, without providing any reason for that. Many large crypto traders and even the head of Binance, CZ, immediately responded.

Two days later he stated that, in his view, the US economy was heading to Quad 4 due to a market outlook that signified an upcoming deflation.

In an interview to the Wall Street Journal, he explained that Quad 4 refers to the lowest level of the economic cycle. It occurs when both economic metrics get to slow down and the economy starts moving towards its cyclical bottom.

Numerous Bitcoiners with such big-names as Michael Saylor and Jack Dorsey (the head of Twitter) among them have been recently calling BTC the store of value that has been outperforming gold this year.

The companies of these CEOs – MicroStrategy and Square – allocated substantial part of their budgets into Bitcoin recently, with the total equaling to more than $500 mln.

Ditching Bitcoin days before bullish rally begins

Keith McCullough does not seem to be a Bitcoin believer. Still, four days after the Hedgeye CEO dumped his BTC, the flagship cryptocurrency surged higher than $11,000.

On October 21, Bitcoin surpassed the $12,000 level. On Thursday, October 22, the king crypto broke higher than $13,000 and is now trading in the $12,900 zone.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin