Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In a recent article by Bloomberg, the agency draws investors' attention to a large part of the stock market that may be exposed to cryptocurrency risks while their holders have no idea about it.

According to the research, more than 50 companies that share the $7.1 trillion market capitalization have some part in exposure to digital funds. While there are companies exclusively functioning inside the industry or working with digital assets, there are also entities that hold Bitcoin on their balance sheet just like Tesla and MicroStrategy.

In addition to companies that only hold cryptocurrencies, businesses like JPMorgan Chase & Co are only looking to purchase and get exposed to cryptocurrency assets.

The popularity of digital assets among institutional investors has increased in 2021. More companies are looking forward to using digital currencies as a tool of diversification. In addition, cryptocurrencies can be used to increase the overall volatility of one's financial portfolio.

The main drawback for the company's supporters will be the fact that, while owning any part of digital funds, a business will be exposed to financial risks tied to the volatile and unstable nature of the cryptocurrency market. Back in May, for example, Bitcoin retraced for more than 40% in one week, leaving the majority of the market with significant losses.

The absence of regulations for both Bitcoin and the altcoins market also put additional risks on investors' shoulders. By keeping digital funds on the balance sheet, organizations might get under the regulatory roller if the SEC decides to change its policies toward cryptocurrencies for whatever reason.

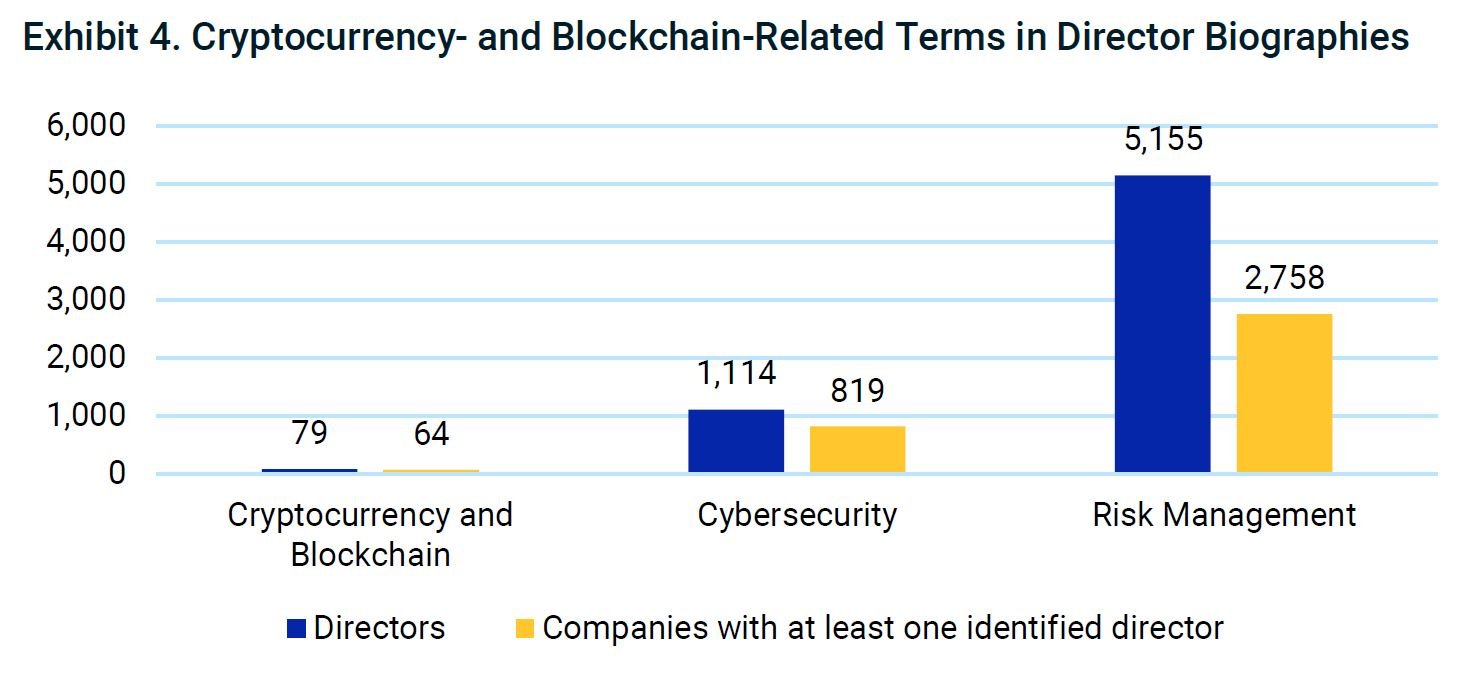

The main concern of MSCI was the lack of crypto expertise among board members of companies that already own digital funds. Only 79 out of 6,500 board members included references to cryptocurrencies or blockchain. Most board members had expertise in cybersecurity and risk management, rather than digital funds.

Vladislav Sopov

Vladislav Sopov