Cinneamhain Ventures partner Adam Cochran compared some financial metrics of two centralized exchange giants, Coinbase and FTX. It looks like FTT has a chance to outperform its competitors' stocks.

What the numbers tell us

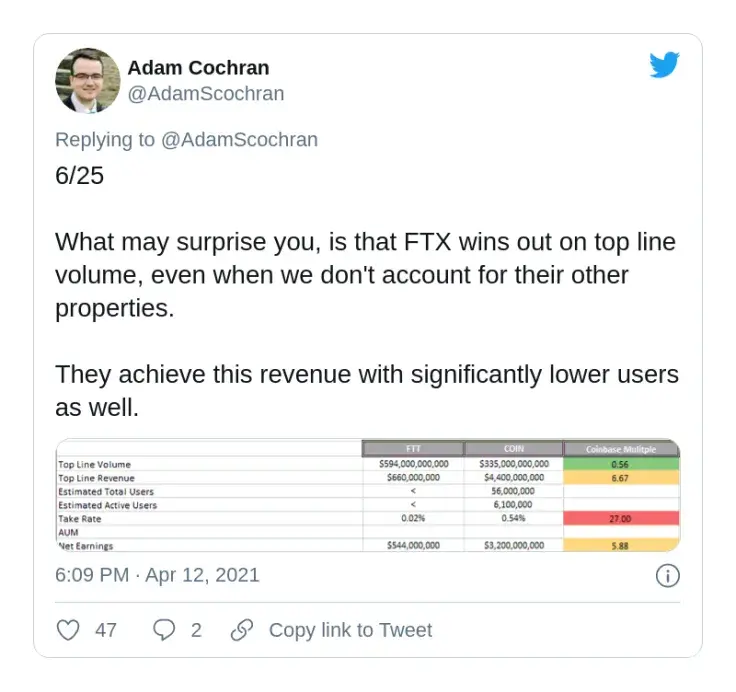

Mr. Cochran has taken to Twitter to reveal his comprehensive analysis of Coinbase's COIN stocks and FTX's FTT native token. He has downplayed the value of the latter.

First, FTX Exchange witnesses a much higher "top line volume" compared to its U.S.-based rival, although its net user count and active user count are less than those of Coinbase. Coinbase charges its users with a higher taker fee (0.54 percent compared to 0.02 percent on the FTX Exchange).

At the same time, FTX Exchange periodically burns a whopping amount of FTT tokens, just like Binance burns Binance Coins (BNB). This makes the asset scarcer. As a result, its "unit economy" indicators—financial return, value capture and marketshare capture—looks healthier than Coinbase's numbers.

Regarding the price-earnings ratio, FTX looks dramatically undervalued: its P/E sits at 12x while Coinbase's metric is above 42x. Thus, even with some special considerations (better brand awareness of Coinbase, restriction of U.S. traders on FTX, etc.), FTT token's fair value is far higher than its actual price.

FTT: long road ahead

Mr. Cochran recalled that FTX Exchange acquired Blockfolio and inked a number of strategic partnerships with industry leaders. Thus, its product has huge room for growth.

Should it manage to keep its lowest fees in the whole industry and reach only 23 percent of Binance (BNB)'s total trading volume, the four-digit FTT evaluation looks reasonable to the analyst.

His set of estimations is based on pre-IPO valuation of COIN registered on FTX over $500 per "share." Meanwhile, he stressed that this valuation could increase after the IPO.

Tomiwabold Olajide

Tomiwabold Olajide Caroline Amosun

Caroline Amosun