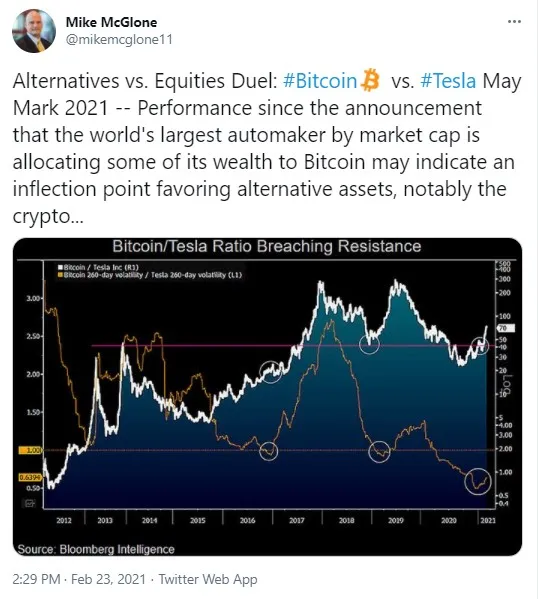

In a recent tweet, market intelligence analyst at Bloomberg, Mike McGlone, stated that Tesla's embracing of Bitcoin may be a sign that the market is turning its back on traditional stocks and equities and is starting to favor alternative assets, and crypto in particular.

Tesla becomes "crypto locomotive"

Mike McGlone commented on Tesla's recent mammoth-sized Bitcoin purchase of $1.5 billion. This was an eye-opener for many as other companies subsequently began acquiring BTC and talking about Bitcoin as a likely reserve asset in the future instead of gold and USD.

He tweeted that this move by Tesla may "indicate an inflection point favoring alternative assets, notably crypto."

Market bleeding as Bitcoin, Ethereum plunge

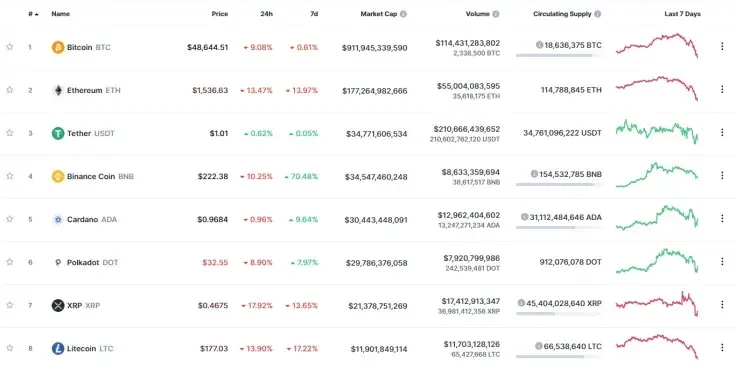

Since Monday's statement about Bitcoin by U.S. Treasury Secretary Janet Yellen, in which she referred to it as an "extremely inefficient way for conducting transactions," the flagship cryptocurrency has been in decline.

On Monday, it plunged from the $53,000 zone to the $48,000 area. Earlier today, BTC collapsed to the $44,900 level briefly and is now changing hands at $48,787 per coin.

The second-largest cryptocurrency, Ethereum, has also been declining from its recently reached all-time high of $2,000 and sitting at the $1,536 mark at press time.

Other coins are also in the red.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin