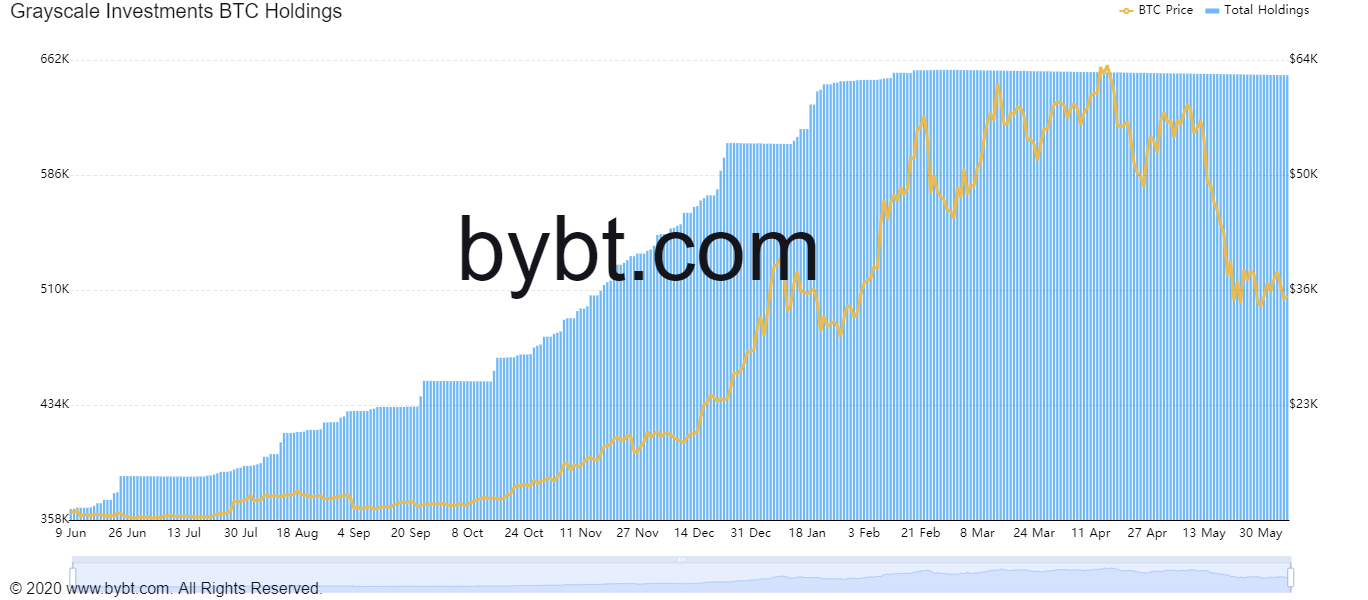

Data provided by the Bybt analytics platform shows that the Bitcoin balance of the popular investment company Grayscale has shrunk just a little bit (in percentage) since February.

A Bybt chart shows that, from Feb. 18 to now, Grayscale's BTC holdings have dropped from 655.44K BTC to 652.27K.

Investor outflows, however, have been frequent recently as the price of the flagship cryptocurrency has been declining after the April all-time high (reached at a point near $65,000). Since then, Bitcoin has lost almost half of its value, trading at the $36,624 mark at press time.

Besides, Grayscale's GBTC is trading at a more than 11 percent discount at the moment and has been for a while.

Grayscale has had two periods recently when it made huge purchases of Bitcoin. The first was between Oct. 17 and Dec. 24, when it added 142.07K BTC.

The second, a smaller one, took place between Jan. 15 and Jan. 22, when it bought another 38.89K BTC.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin