Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

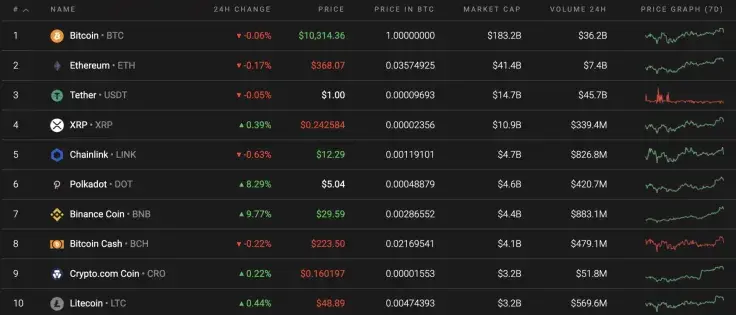

The last day of the week has turned out to be neither bullish nor bearish as some of the Top 10 coins are red while others are in the green zone. The main loser is Chainlink (LINK), whose rate has declined by 0.63% over the last day.

The key information on Bitcoin (BTC), Ethereum (ETH), XRP, Polkadot (DOT) and Binance Coin (BNB):

|

Name |

Ticker Advertisement

|

Market Cap |

Price |

Volume (24h) Advertisement

|

Change (24h) |

|

Bitcoin |

BTC |

$191,083,732,919 | $10,335.54 | $105,339,447,617 | -0.22% |

|

Ethereum |

ETH |

$41,657,331,029 | $370.01 | $91,709,576,660 | -0.83% |

|

XRP |

XRP |

$10,958,998,044 | $0.243472 | $1,853,317,702 | -0.09% |

|

Polkadot |

DOT |

$4,299,805,585 | $5.04 | $1,137,373,625 | 8.35% |

|

Binance Coin |

BNB |

$4,279,373,660 | $29.63 | $1,315,424,359 | 9.18% |

BTC/USD

The passing week for Bitcoin (BTC) was not as positive as previous ones. The price change over the last 7 days has constituted +0.78%.

On the daily chart, Bitcoin (BTC) has made a false breakout at the $10,500 mark. Until it breaks that level, it is too early to consider it a long-term bullish trend. The declining trading volume confirms such a scenario.

In this case, there is a high probability of seeing a further drop to the vital support level of $10,000 within the next few days.

Bitcoin is trading at $10,314 at press time.

ETH/USD

Ethereum (ETH) has been more bearish than Bitcoin (BTC) since yesterday, however, the current week has been positive for the leading altcoin as it has added 4.47% to its value.

From the technical point of view, Ethereum (ETH) is trading similarly to Bitcoin (BTC) even though the past week has been bullish for the cryptocurrency. Liquidity is low at the current levels, which means a price decrease to the support area of $355 is likely to occur. Such price action is relevant for the upcoming week.

Ethereum is trading at $368.39 at press time.

XRP/USD

XRP is the top gainer among the Top 3 coins as the rate of the coin has lost only 0.09% over the previous 24 hours.

On the daily time frame, XRP is not following Bitcoin (BTC) and Ethereum (ETH). There is a high concentration of liquidity in the area of $0.27-$0.30 which confirms a short-term bullish trend. If bulls hold the $0.24 level, the nearest support at $0.2659 may be attained next week.

XRP is trading at $0.2430 at press time.

DOT/USD

Polkadot (DOT) is one of the fastest growing coins. Growth has accounted for 8.35% since yesterday, and the price has risen +9.81% in the past seven days.

On the daily chart, Polkadot (DOT) has bounced off the support at $3.70. The selling trading volume is decreasing, meaning that growth is likely to happen soon. In this case, the nearest support at which bears may show resistance is the $6 mark.

DOT is trading at $5.10 at press time.

BNB/USD

Binance Coin (BNB) is the top gainer on our list. The rate of the native exchange token has skyrocketed by 9.18% over the past day.

Binance Coin (BNB) has exited the consolidation phase, having formed a breakout. Even though the bullish trend remains the main long-term scenario, one may expect a short-term correction. The Relative Strength Index indicator is already located in the overbought area which supports an upcoming drop. If that happens, sellers might get the rate to the support at $26.27 soon.

Binance Coin is trading at $30.39 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov