Bloomberg Intelligence strategist Mike McGlone expects Bitcoin to march toward $100,000.

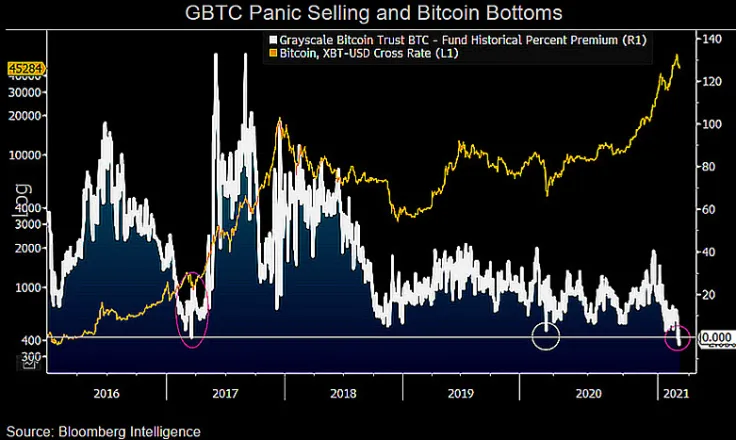

In a report published on Tuesday, he writes that the "steepest ever" Grayscale discount could be viewed as a surefire sign that the largest cryptocurrency is gearing up for another leg up if history is any guide.

The premium at which the shares of Grayscale Bitcoin Trust (GBTC) are trading relative to net asset value (NAV) slipped into negative territory on Feb. 24.

Historically, such sharp drops in the trust's premium would mark the bottom of each Bitcoin correction.

McGlone also points to the "arbitrageur's delight" that can be found in the disparity between CME Group's Bitcoin futures, which are currently trading at a 20 percent premium, and GBTC shares.

In their recent note, JPMorgan analysts explain that Grayscale's sinking premium is most likely caused by institutional investors selling their shares after the expiration of the six-month lockup period.

They also believe that the launch of the world's first Bitcoin exchange-traded fund in Canada, which is singlehandedly responsible for reviving the country’s ETF sector, is to blame.

Despite ETFs now stealing Grayscale's lunch, McGlone is still convinced that its shares trading at a discount is a signal of Bitcoin's "firming foundation":

The increasing probability of exchange-traded funds in the U.S., on the back of launches in Canada are adding pressure to the trust price, but we see sustaining the upward trajectory as the more likely outcome.

Yes, Bitcoin is actually replacing gold

According to McGlone, an increase in Bitcoin inflows has coincided with a decrease in gold outflows.

The yellow metal is currently sitting near its 8.5-month low, with the price of one ounce coming awfully close to dipping below the $1,700 level on March 3.

The senior commodity strategist predicts that Bitcoin's volatility will drop if it reaches the aforementioned $100,000 threshold:

Once the crypto settles in at a new threshold with greater market depth, potentially near $100,000, volatility should drop, we believe.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin