As Bitcoin keeps trying to breach the $10,000 resistance, two exchanges report a major surge in the open interest regarding Bitcoin futures and Bitcoin options.

The former hits an all-time high on the Chicago Mercantile Exchange and the latter has exceeded the 100,000 BTC level of the Deribit exchange.

This could be a signal of more institutional investors rushing to purchase Bitcoin.

Bitcoin options open interest on Deribit crosses 100k BTC

Three Arrows Capital CEO Su Zhu has shared some data that confirms a major rise in interest towards Bitcoin derivatives recently.

He has tweeted that the Bitcoin options open interest on Deribit exchange has surged to exceed the 100,000 BTC ($976,3 mln) since the launch of the product.

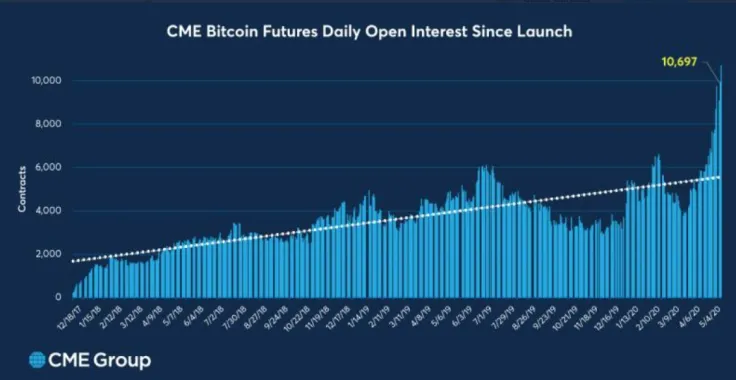

The Chicago Mercantile Exchange, one of the first platforms to launch BTC futures, has also printed a record – the Bitcoin futures open interest on has hit an all-time high since December 2017 when it launched BTC futures together with the CBOE.

This could be seen is a clear bullish sign – seems that institutional investors are buying more Bitcoin futures and options thus showing their attitude to Bitcoin as a valuable asset.

Wow, @DeribitExchange $BTC options open interest crosses 100k BTC for the first time ever

— Su Zhu (@zhusu) May 20, 2020

Impressive interest on CME as well lately https://t.co/gpxKwmoAca?from=article-links

Bitcoin futures open interest on CME hits an ATH: VanEck’s chief expert

The digital asset director at VanEck, Gabor Gurbacs, has shared the same information regarding the CME on his Twitter page.

He points out that this ATH signifies an increase in Bitcoin adoption.

“Bitcoin futures open interest at an all-time high since launch! CME Group just sent around this chart. Bitcoin adoption continues!”

Institutions hodling paper: Mati Greenspan

Earlier, U.Today reported that the CME had printed a 10-percent surge in the Bitcoin options open interest.

Back then, on May 15, the expert trader and the founder of Quantum Economics, Mati Greenspan, tweeted that this was due to a growing interest to Bitcoin from the side of financial institutions.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov