The SEC recently passed new rules targeting market participants engaged in major liquidity-providing roles, expanding their reach to include crypto transactions. Under these regulations, individuals trading crypto assets, securities or government securities, with assets exceeding $50 million, will be subject to federal securities laws.

One notable aspect of the regulations is the requirement for individuals engaging in regular trading patterns, providing liquidity to other market participants, to register as dealers or government securities dealers. This move, according to the SEC, aims to address structural issues causing liquidity problems on the $26 trillion Treasury market. It forms part of a broader initiative to revamp market dynamics, including pushing more trades through clearing houses.

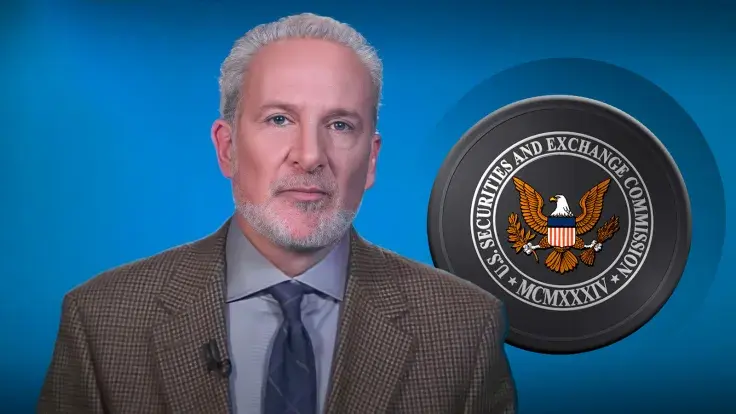

However, not everyone is welcoming these changes with open arms. Notably, financial expert and vocal Bitcoin critic, Peter Schiff, has expressed strong opposition to the SEC's decision. Schiff condemned the move as overreach, arguing that the SEC lacks the authority to redefine terms such as "security dealer" without explicit congressional authorization. He emphasized concerns over potential consequences, predicting higher trading costs and reduced liquidity as a result of the regulations.

Schiff's critique underscores broader debates surrounding regulatory oversight. While proponents argue for necessary safeguards to protect investors and ensure market stability, critics like Schiff warn against excessive intervention that could stifle innovation and disrupt established market dynamics.

As the SEC's new rules come into effect, the clash between regulatory oversight and the principles of decentralization and autonomy within the cryptocurrency ecosystem is likely to intensify, shaping the future landscape of digital asset markets.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin