Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Spencer Noon, the head of DTCCapital, says long-term fundamental indicators show Ethereum has never been healthier.

The user activity on Ethereum has been increasing, mostly due to the expanding decentralized finance (DeFi) market. Consequently, daily active addresses, fees, and overall transaction activity on Ethereum surged. Noon wrote:

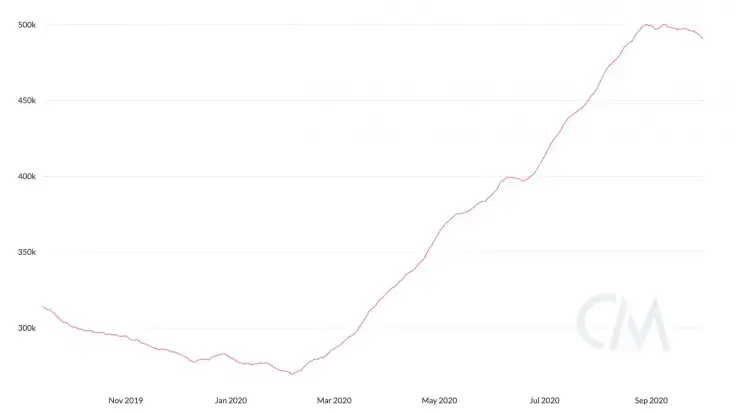

“L1 Health — long term fundamental indicators show Ethereum has arguably never been healthier. 1. $ETH now dwarfs $BTC in daily total USD fees paid 2. 115m contract calls in Sept, up from 57m in June 3. Daily Active Address consistently over 400k”

Advertisement

Based on the optimistic fundamental metrics of Ethereum, Noon pinpointed the positive outlook of the dominant smart contract protocol.

The Sentiment Around Ethereum Strengthens Heading Into 2021

Ethereum’s positive on-chain metrics mostly come from the growing appetite for DeFi and yield farming.

Compared to August and September, the craze around DeFi and yield farming has significantly declined. With the slump of DeFi giants, like Yearn.finance, extreme-risk yield farming platforms have subsided.

But, there is still a relatively high demand for DeFi and various DeFi services. Noon emphasized that $300 million worth of ETH were sent daily to DeFi applications. He said:

“Mainstream Adoption — Whatever you think this means, #DeFi doesn't need it. $300m $ETH sent daily to DeFi apps vs $156m to centralized apps. Apps on pace for ~$500m annualized revenue 600k users, still going parabolic.”

Atop the rising usage of DeFi protocols, the consistently rising volume of decentralized exchanges is further fueling Ethereum’s blockchain activity.

Decentralized Exchanges Continue to Outperform in 2020

A surprising trend in 2020 which buoyed the overall optimism around Ethereum has been the activity of decentralized exchanges.

Led by Uniswap, decentralized exchanges outperformed top centralized exchanges at times, which previously never occurred.

At its peak, Uniswap briefly surpassed the volume of Coinbase Pro, currently the largest spot exchange in the world, according to Skew.

In the last 12 months, Noon said decentralized exchanges processed $52 billion in volume. He explained:

“DEX — undoubtedly DeFi's killer app. 10. 3.4m $ETH (3% of $ETH in existence) currently sits in Uniswap. Uniswap regularly beats Coinbase in daily volume 12. DEXs have done $52B volume the past 12 months.”

Despite the steep correction of major DeFi tokens in the past two months, the volume of decentralized exchanges and the capital in DeFi have remained resilient.

In the medium to long term, the resilience of the DeFi market could continuously cause on-chain metrics of Ethereum to strengthen.

Godfrey Benjamin

Godfrey Benjamin Yuri Molchan

Yuri Molchan Gamza Khanzadaev

Gamza Khanzadaev Tomiwabold Olajide

Tomiwabold Olajide Arman Shirinyan

Arman Shirinyan