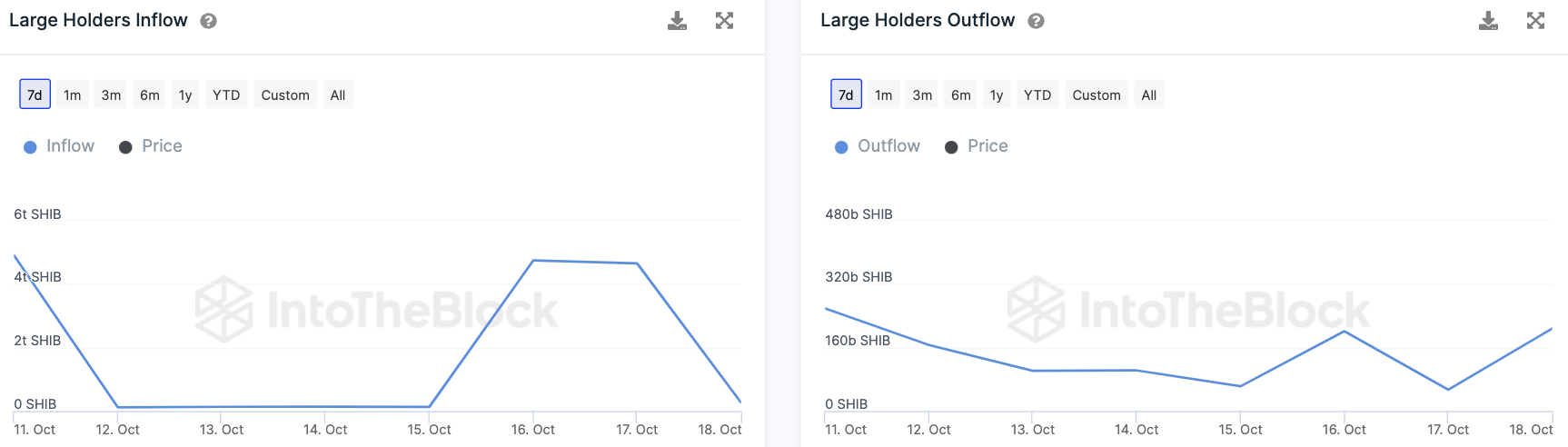

In a surprising twist, Shiba Inu (SHIB) whales have seen a remarkable 400% increase in token outflows within a 24-hour period. According to data from IntoTheBlock, the outflow of SHIB tokens from the wallets of large holders surged from 53.81 billion to 208.28 billion SHIB on a single Saturday, without any significant impact on the token's price.

What adds to the intrigue is the simultaneous sharp decline in daily inflows to these whale wallets. The data revealed a significant drop from 4.66 trillion tokens to a mere 271.32 billion during the same period.

This sudden surge in outflows is not accompanied by noticeable price fluctuations, leading experts to speculate that these anomalies could be related to token movements between exchange wallets, possibly orchestrated by the exchanges themselves.

Real owners of Shiba Inu

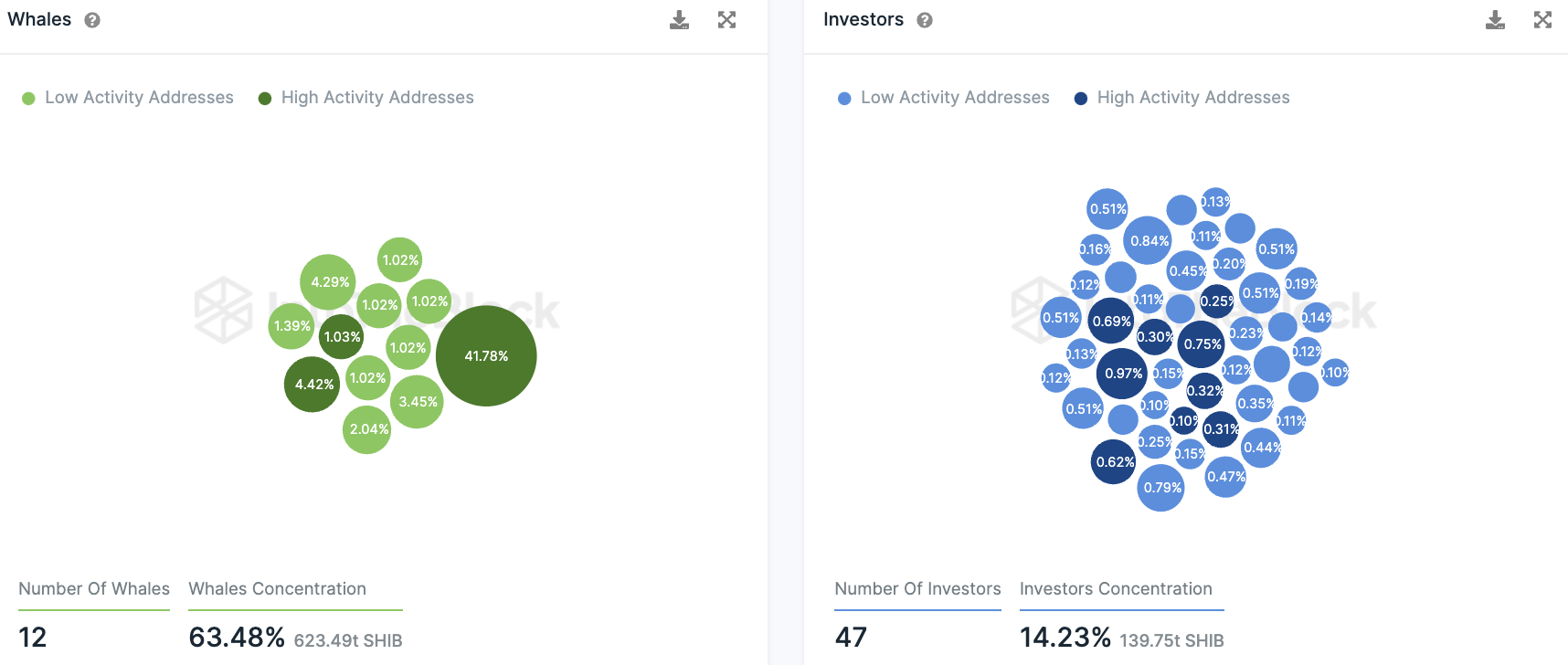

The majority of SHIB tokens, around 623 trillion SHIB, including the burn address, are held in whale wallets, many of which belong to large centralized exchanges. The fact that the SHIB price remained relatively stable amid significant outflows suggests coordinated efforts by these centralized entities.

However, this situation prompts concerns about the influence these major holders can exert on the Shiba Inu token market. The significant concentration of tokens within a small number of wallets raises questions about the potential impact of these whales on the market's stability.

As the crypto community closely monitors these developments, it is clear that the actions of these large holders are introducing uncertainty into the Shiba Inu market's future.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov