Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

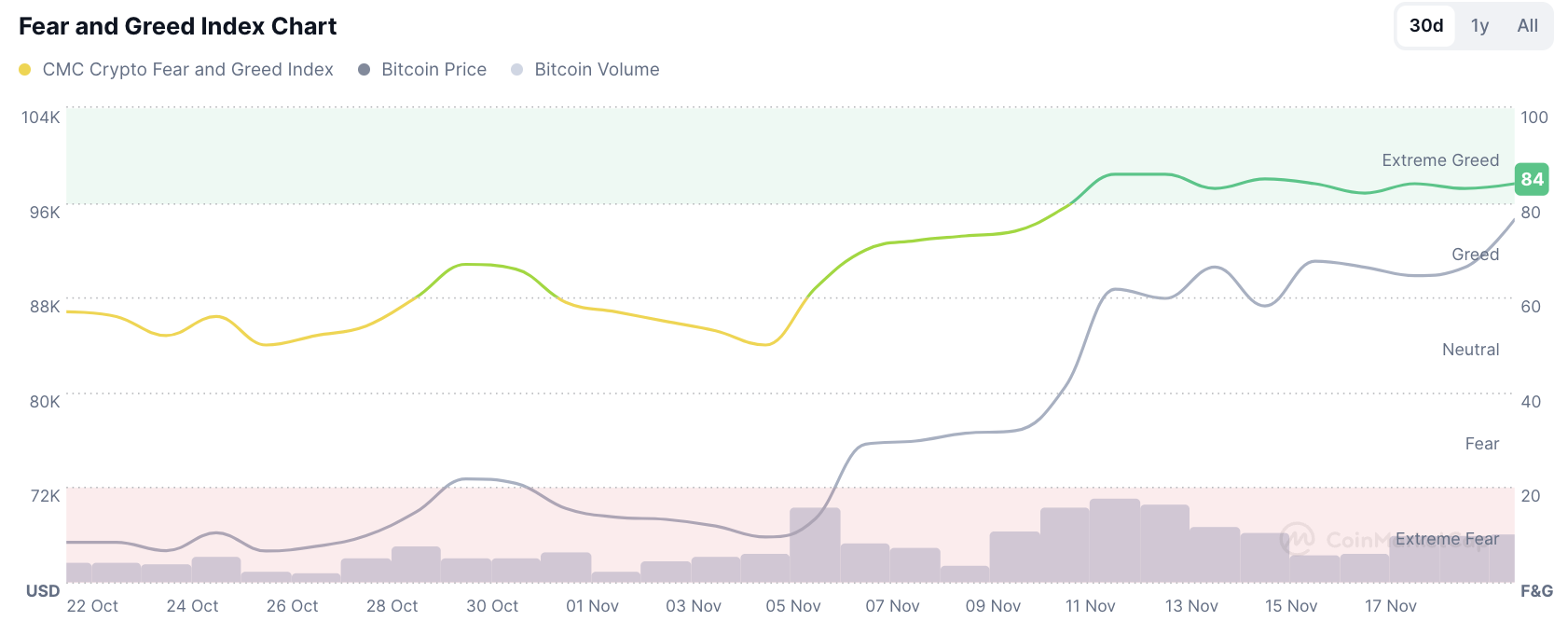

Reaching an unprecedented price of $94,585.23 on Binance, Bitcoin (BTC) continues to dominate the cryptocurrency. The surge coincides with the fear and greed index by CoinMarketCap registering a figure of 84, firmly placing market sentiment in the “extreme greed” zone. It is not the highest point of late, though.

Previously, on Nov. 16, the indicator reached a high of 86, with Bitcoin trading at $87,930 with $133.67 billion in trading volume. The newest all-time high was reached when the Bitcoin trading volume totaled just $76.14 billion.

While Bitcoin is grabbing most of the market's attention with its price gains, other segments of the cryptocurrency space seem to be lagging. The TOTAL2 indicator, which tracks the market capitalization of altcoins, shows a modest 1% rise.

Meanwhile, Bitcoin itself saw double that performance, with a more substantial 2.2% price increase during the same period, which just goes to show how much of a beneficiary it is of the bullish sentiment.

It is worth mentioning that the Ethereum-to-Bitcoin ratio has dropped to levels last seen in March 2021. This also shows a big shift in investor preference, when even Ethereum, the second-largest cryptocurrency by market cap, is struggling to keep up with Bitcoin's recent momentum.

All in all, the bigger picture shows that all attention, enthusiasm and mainly capital is going into Bitcoin, while other assets on the market are growing more slowly or even getting sucked of liquidity. While greed is usually a good sign, the uneven distribution of market gains raises questions about whether these trends can last and whether there will ever be an altcoin season or this market will stick with BTC only.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov