Head of the CryptoQuant analytics firm, Ki Young Ju, has noted major outflow of Ethereum from crypto exchanges.

He concluded that the Ethereum market may be facing the liquidity crunch that has already hit Bitcoin,.

“ETH liquidity crisis seems to be here”

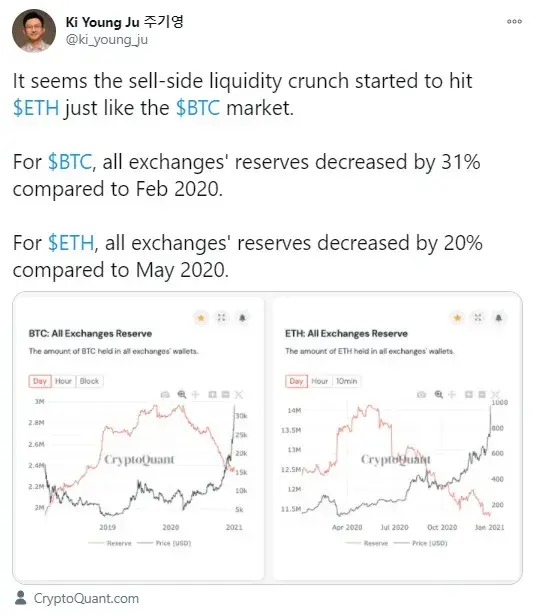

Ki Young Ju has shared data about large outflows of Ethereum from crypto exchanges. He has tweeted that since May 2020, the amount of ETH on digital exchanges has decreased by twenty percent.

The same thing is already happening to Bitcoin, he wrote, as the amount of BTC on exchanges has dropped by 31 percent since February 2020.

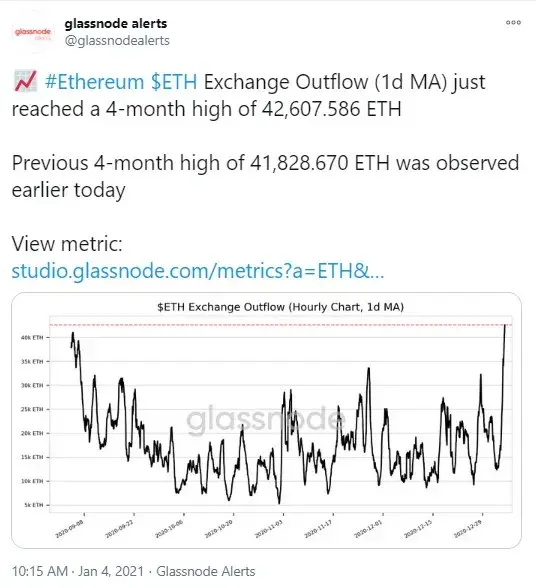

This data about ETH withdrawals from trading platforms has been also shared by Glassnode analytics company.

As per its recent tweet, ETH exchange outflow (1-day MA) has now hit a four-month high and amounts to 42,607.586 coins.

Meanwhile, number of ETH active addresses has surged 8.3 percent over the past twenty-four hours. The amount of newly created ETH wallets has reached a 9-month high, as per Glassnode data.

Earlier, reports about Bitcoin liquidituy crisis have come from other companies as well. From the CEO of the UK-based exchange CoinCorner, Danny Scott, and the Skew analytics team, in particular.

A great amount of Bitcoin was accumulated by MicroStrategy and Grayscale last year, which has also added to the decline of Bitcoin stored on digital exchanges. Grayscale has also been purchasing large quantities of Ethereum.

Ethereum soars to $1,152 level

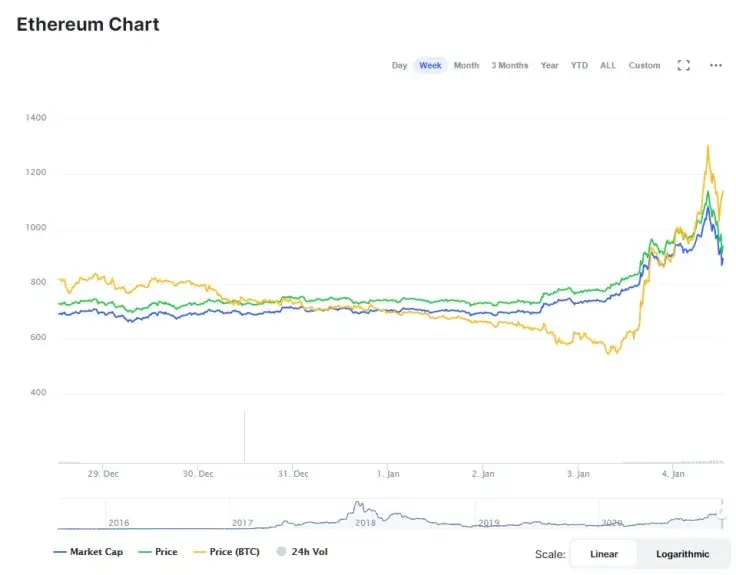

Earlier today, the second largest cryptocurrency, ETH, surged to the $1,152 price mark unseen since early January 2018, prior to ETH hitting its all-time high of $1,358 on January 15, 2018.

On January 3, 2021, Ethereum topped the $800 level and went higher almost hitting $950 but then showing a small pullback.

At the time of writing, ETH is sitting at $939.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin