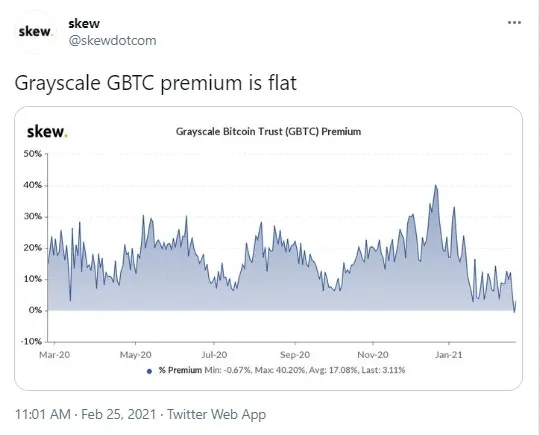

Data provided by Skew analytics agency shows that the premium on which Grayscale Bitcoin Trust (GBTC) shares are trading at the moment is above zero but is flat so far.

On Wednesday, the GBTC premium turned negative but has risen slightly since then.

GBTC rises 5.54 percent from negative

U.K.-based analytics company Skew, focused on crypto derivatives, has shared a chart that shows that Grayscale Bitcoin Trust shares are now trading at a higher premium than the day before.

The daily growth amounts to 5.54 percent compared to Wednesday when GBTC went negative for the first time.

Grayscale BTC premium rises: good but not good enough

Asset premium is the difference between where an asset (Grayscale Bitcoin Trust shares in this case) is trading on the market compared to the price of the underlying asset (Bitcoin).

When the premium rises, the asset becomes overbought. It reverses when the premium declines.

When the premium is high, investors tend to lock in their profits. When the premium is low, buyers become active.

On Wednesday, Feb. 24, the GBTC premium went below zero for the first time since 2015. But now, GBTC is trading 5.54 percent higher than the NAV (net asset value).

Grayscale adds $0.6 billion in a single day

As reported by U.Today earlier, Barry Silbert-affiliated Grayscale Investments lost $4.1 billion of its crypto assets in management in a single day between Feb. 22 and Feb. 23.

Back then, the crypto manager's AUM value fell from $42 billion to $37.9 billion.

Judging from Grayscale Bitcoin Trust's website, the total value of Bitcoin under its management now amounts to $32.5 billion— compared to $31.9 billion a day earlier.

Grayscale crypto AUM started losing value as Bitcoin plunged to the $44,900 level briefly on Tuesday.

At press time, the world's flagship cryptocurrency is changing hands at $49,319 after dropping from $51,200 on Wednesday.

Grayscale's got a new rival

The second factor is that Grayscale inflows have shrunk in size as the world's first Bitcoin exchange-traded fund has emerged in Canada.

The Purpose Bitcoin Fund now holds 9,320 BTC in assets under management.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin