State-backed stablecoins, or central bank digital assets (CBDCs), will be in the crypto community spotlight in 2020. But the transparency of these systems remains in doubt for professionals.

Where is the proof?

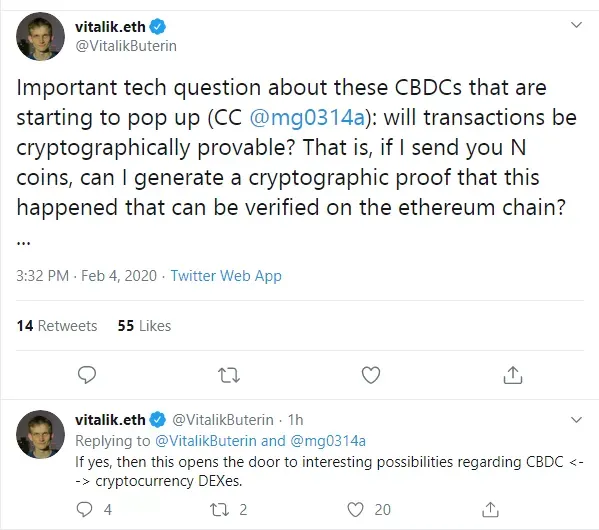

Today, co-founder of Ethereum Foundation, Vitalik Buterin, named a couple complex issues related to the stablecoin field. First of all, it is the verification of transactions that Mr. Buterin is interested in.

He asked whether the mechanism of cryptographic proof generation is reliable. Literally, can the transaction of CBDC be verified through a third-party blockchain, e.g. Ethereum?

Most likely, this question addresses the central banks striving to built their own blockchains for CBDCs. Bitcoin (BTC), whose transactions can be verified by the Ethereum (ETH) network, has been held up as an example of this type of cross-chain interoperability.

Also, Vitalik predicts that if central banks manage to built reliable verification frameworks, it may breath some life into the sphere of decentralized exchanges (DEXs).

Easy way

But currently, it looks like some institutions are planning to use the Ethereum (ETH) network directly for their stablecoin release. As reported by U.Today, this option has already been chosen by Australia and France.

If the idea of CBDC integration into DEXs comes true, decentralized exchanges will open a new epoch for cross-border payments. It will replace the cumbersome classic financial tools by non-custodial multi-chain ecosystems.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov