Barry Silbert's Digital Currency Group is set to pour $250 million into the shares of the Bitcoin Trust owned by leading cryptocurrency money manager Grayscale, its largest subsidiary.

As per the company's 8-K filing with the U.S. Securities and Exchange Commission, these shares will be purchased on the open market.

DCG has not provided any information about the timing of its planned purchases, claiming that they will depend on market conditions:

The actual timing, amount, and value of share purchases will depend entirely upon a number of factors, including the levels of cash available, price, and prevailing market conditions. Information regarding stock purchases will be available in the GBTC periodic reports filed with the Securities and Exchange Commission on Forms 10-K and 10-Q as required by the applicable rules of the Exchange Act.

Advertisement

Grayscale is also rumored to have jumped into the Bitcoin ETF race based on its recent job offerings, but nothing has been confirmed for now.

GBTC's biggest sell-off to date

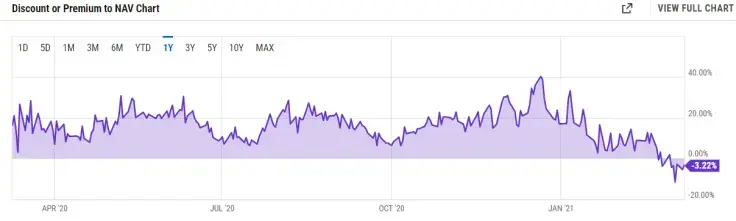

The news comes after Grayscale Bitcoin Trust's shares started trading at their greatest discount to date.

As reported by U.Today, they started changing hands at a negative premium for the first time since 2015 in late February.

Due to the double-whammy of Bitcoin taking a bearish turn and Bitcoin ETFs exploding in Canada, the discount just kept growing, entering panic-selling mode last week.

Despite Bitcoin recovering to $56,000, GBTC shares are still trading at a 3.22 negative premium to the net asset value (NAV).

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov