Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

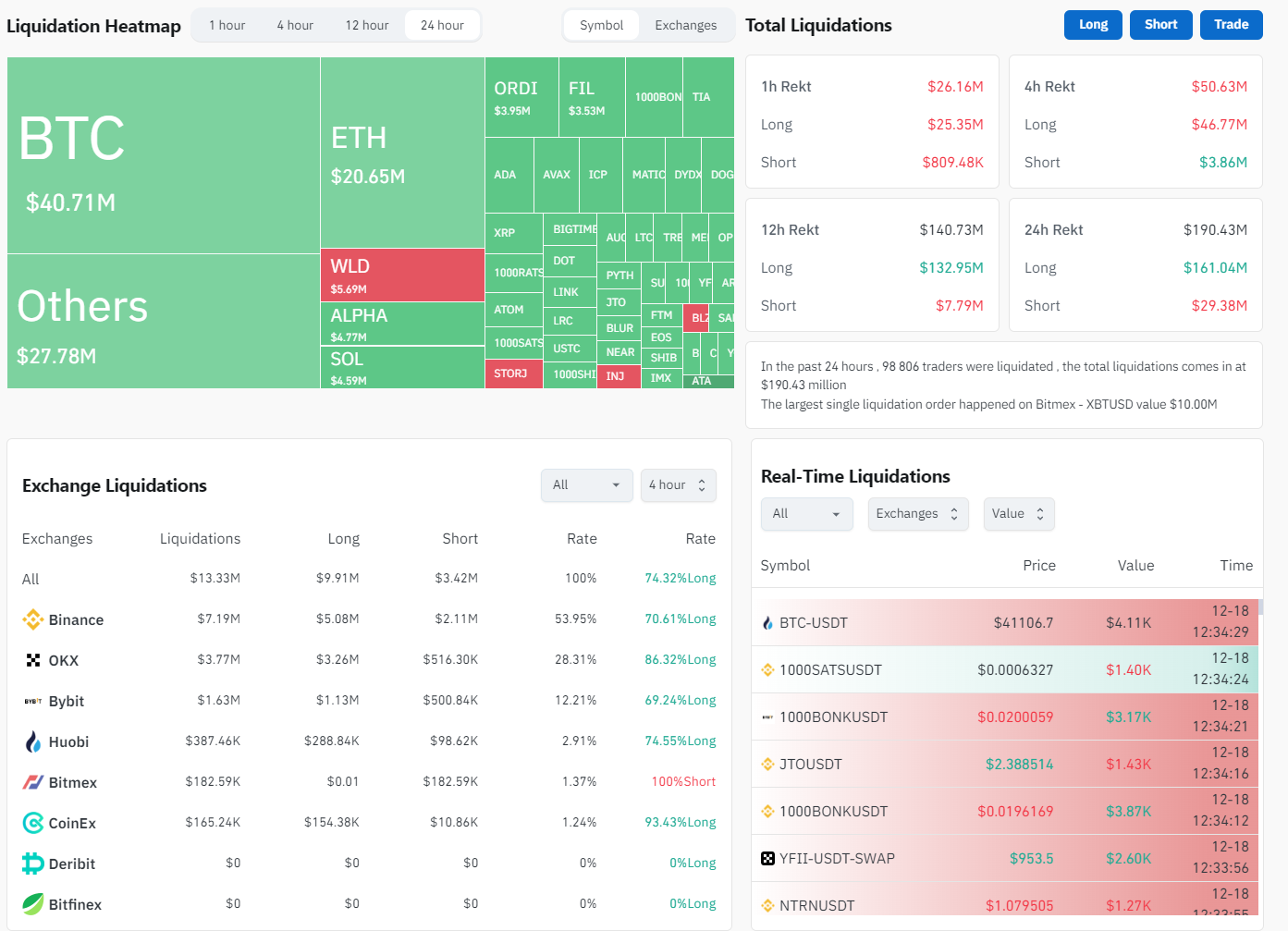

The crypto markets have recently been through an increased volatility phase, resulting in a significant $130 million wipeout of long positions. Liquidations occur when the market moves against traders who have bet on rising prices, leading to an automated sell-off to cover their positions. The liquidation heatmap reveals the scale of the impact, with Bitcoin and Ethereum taking the most severe damage out there.

The Bitcoin chart indicates a substantial correction in the price of BTC. The price movement of Bitcoin often sets the tone for the wider market, and this time was no exception. The price dip has been tied closely to the cascade of liquidations, where a large number of leveraged long positions were eliminated in quick succession. This suggests that traders, perhaps overly optimistic about continued bullish momentum, were caught off guard by the sudden change in market direction.

However, despite the grim narrative of liquidated positions, the market's reaction tells a more nuanced story. While the term "bloodbath" conjures images of drastic drops and market panic, the reality has been more subdued. The BTC chart indicates a lack of extreme volatility, with the market not showing signs of a violent drop. Instead, what we are witnessing could be described as a healthy correction.

Corrections are a natural part of market cycles, helping to prevent the market from becoming too overbought. Before the liquidation event, the market was not in an overextended state, indicated by the absence of an overly high RSI reading. This suggests that the market was not in a bubble about to burst, but rather in a state of rebalancing.

The liquidation of $130 million in long positions can also be seen as a release valve for the market, reducing the number of speculative bets and bringing more stability. As the dust settles, the market may find a new foundation upon which to build the next leg of the journey.

Gamza Khanzadaev

Gamza Khanzadaev Tomiwabold Olajide

Tomiwabold Olajide Arman Shirinyan

Arman Shirinyan Godfrey Benjamin

Godfrey Benjamin