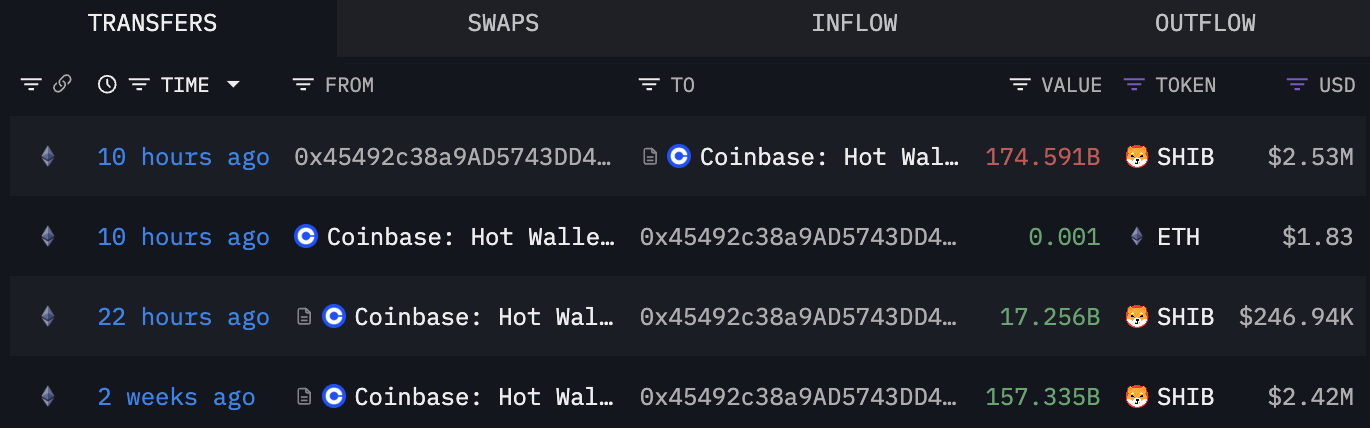

As became known thanks to on-chain data from Arkham Intelligence, an unknown Shiba Inu (SHIB) whale deposited all their meme coin holdings to Coinbase just 10 hours ago. Thus, almost 174.6 billion SHIB, which is roughly equal to $2.53 million, ended up in the hot wallet of the leading U.S. cryptocurrency exchange, sent there by the address "0x45492."

What prompted this mysterious large holder of Shiba Inu coins to make such a move? Still unknown.

What is interesting, though, is that this colossal amount of meme-inspired cryptocurrency was accumulated just two weeks ago, including from Coinbase. It makes one wonder. Could the wallet belong to the exchange itself? Possibly. But there is no proof of that theory.

What adds to the intrigue is the fact that, before this, the address had no transaction history whatsoever. No slow buildup of funds, no previous trades - nothing. Someone withdrew 175 billion SHIB from Coinbase, held it for two weeks and then deposited it back with a loss of around $100,000.

Now, considering what has been happening in the crypto market during this period, assuming this wallet does not belong to Coinbase, the whole thing could be seen as an attempt to cut losses on an ill-timed purchase. A misjudged bet, quickly undone - though not without cost.

The recent market rebound might have provided a convenient exit, a way to offload the holdings without a complete wipeout. An opportunity seized, or perhaps a lesson learned.

The timing is strange either way. It is too precise to be random but not smooth enough for a strategic move.

Is it a trader in distress? Or a liquidity test? Time will tell.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov