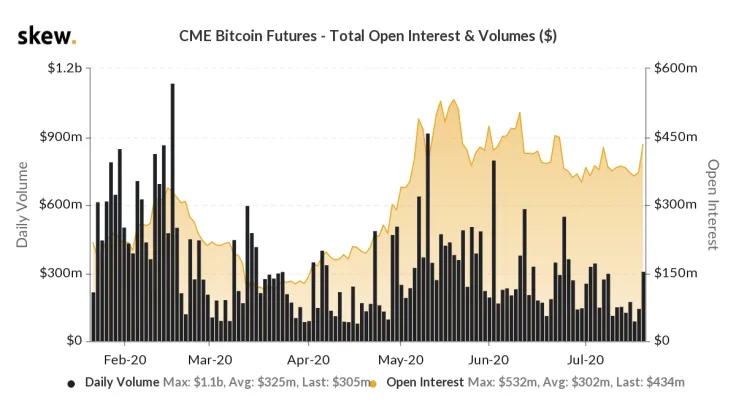

According to data provided by derivatives analytics platform Skew, open interest for Bitcoin futures offered by Chicago-based CME Group surged 16 percent to nearly $450 mln on July 21.

This impressive recovery from July lows shows that institutional money is now flowing back into Bitcoin after a period of drought.

Waxing and waning

Open interest (OI) is the term that is used to describe the total number of outstanding contracts that are awaiting expiration.

Coming off of its February peak of $316 mln, the sum dwindled to just $107 mln following the events of "Black Friday" on March 12, when the BTC price took a 50 percent cut in one painful day.

OI in CME Bitcoin futures surged to a new all-time high of more than $500 mln back in May after the market completely recovered from the collapse of the Bitcoin price.

In Q3, it started to decline yet again in tandem with trading volume due to subdued volatility.

Bitcoin's showing signs of life with its modest price rally on June 21 reinvigorated traders’ interest.

Growing institutional appetite

Unlike unregulated trading platforms like Huobi and OKex, CME’s Bitcoin futures are mainly changing hands among institutional investors, which is why their OI is useful for gauging their level of participation in the market.

As reported by U.Today, Galaxy Digital CEO Mike Novogratz opined that billionaire Paul Tudor Jones investing in Bitcoin futures with his hedge fund could entice other Wall Streeters to follow his lead.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin