Decentralized finance, or DeFi, is an umbrella term for peer-to-peer financial services on public blockchains. DeFi components take the form of stablecoins and services like crypto exchanges and borrowing/lending services. DeFi borrowing/lending protocols have drawn billions of dollars in liquidity by promising high returns, but the market requires more capital-efficient frameworks.

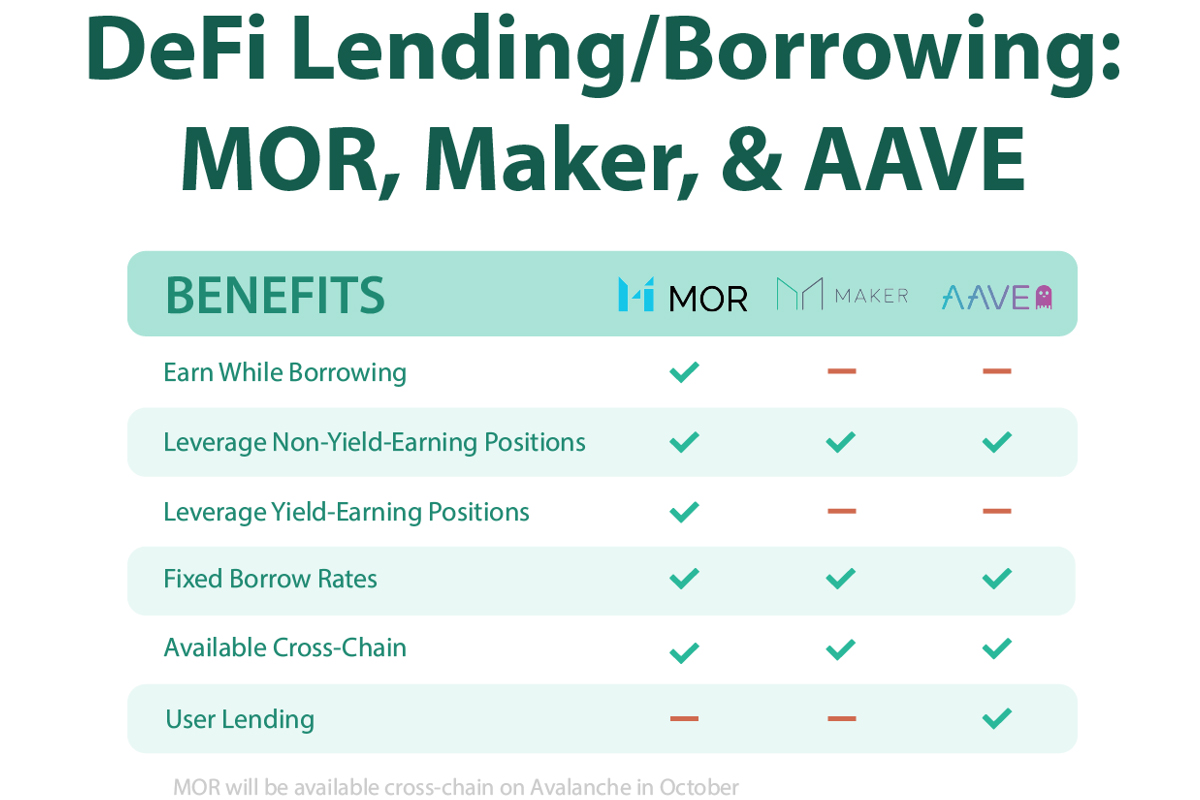

Various protocols, such as AAVE and MakerDAO (DAI), are now dabbling in fixed-rate lending and borrowing markets for crypto collateral, but capital efficiency is still a work in progress. One prominent critique of DAI is that it is inefficient in terms of capital because it requires a large quantity of ETH or other tokens as collateral to mint it.

Another platform, MOR, whose collateralization mechanisms resemble those of DAI, focuses heavily on supporting collateral earning yield. MOR is a decentralized, overcollateralized stablecoin being made available on BSC (with plans to be implemented cross-chain in the future). MOR stablecoin is backed by the assets supplied as collateral to mint it and can be sold/traded into other assets on BSC (such as BUSD) or used to supply liquidity.

The aforementioned protocols, however, take the fixed term approach to crypto borrowing rates, which seems to be an advantage.

It's not just in the numbers!

The latest statistics by DeFi Pulse indicate that over $79.93 billion is tied up in the DeFi market, with AAVE, CurveFinance and Maker accounting for the greatest shares of value locked. Various DeFi projects and platforms have recorded outstanding growth as DeFi users continue to increase.

The potential for DeFi remains enormous as it is an integral part of disrupting the financial sector. Other key protocols have been slowly and steadily redefining the nascent space. Platforms such as MOR provide the growing DeFi ecosystem with innovative mechanisms such as the crucial addition of minting/borrowing MOR stablecoin with collateral that earns yield, thus tackling capital efficiency concerns. MOR users can also increase the usually substandard yield gained when holding stablecoins as the Minimum Collateralization Ratio remains at 102% (50x max leverage).

Aave, a decentralized non-custodial liquidity market protocol, enables users to participate as depositors or borrowers. Decentralized platforms, such as Uniswap, provide the DeFi ecosystem with innovative mechanisms such as automated market-making, which settles trades automatically. Despite the buzz around DeFi, this niche of the crypto industry is still in its infancy, and there are still several things that have to be addressed before DeFi can move from its novice stage into a full-blown financial market shaper.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov U.Today Editorial Team

U.Today Editorial Team