- Introduction to the state-of-the-art technology

- Decentralization: A 1,000-year-old concept

- Philosophical and technical bases behind Blockchain

- Blockchain’s public debut in Satoshi’s white paper

- Blockchain separates from Bitcoin

- The rise of Ethereum

- Transition to proof-of-stake Blockchain consensus algorithm

- Tackling the scalability trilemma with altcoins

- The growth of Blockchain: talking numbers

- The future of Blockchain

Introduction to the state-of-the-art technology

Blockchain is a disruptive technology that is making waves throughout the globe, revolutionizing a slew of industries (from banking to the global shipping industry). Many pundits, including Zillow’s CEO, believe that this nascent technology has more potential than the Internet, while Binance’s founder believes that the idea of mainstream decentralization is not that far-fetched. In this article, we will take a closer look at the history of Blockchain to eventually make a prediction about what the future holds for this technology.

Decentralization: A 1,000-year-old concept

Before we begin discussing the history of Blockchain in detail, we would like to share with you an outlandish suggestion made by cultural anthropologist Natalie Smolenski, who believes that Blockchain could have actually appeared almost 1,000 years ago (of course, not in the form of a distributed ledger). Smolenski says this is one of the “old wine in a new bottle” situations when the already established transitions of some ancient tribes have a lot of in common with (you guessed it) Blockchain.

“Like all breakthroughs, Blockchains are a profoundly new way of doing old things,” Natalie Smolenski

In 500AD, the tribe of the Yap Island used gargantuan Fei stones as their form of currency, but they had to tackle the problem of mobility: these stones were too bulky to move around. Subsequently, they came up with an idea to create what could be considered the very first decentralized ledger in history — every tribe member knew exactly who owned a specific stone, which would eliminate the need for further disputes.

Remarkably enough, such ‘transactions’ lasted up to the 19th century on Yap Island. Then the villagers ditched this tradition and switched to the US dollar. It is also worth mentioning that such a practice was never adopted outside of the tiny island. It actually represents what exactly Blockchain is today; instead of a mental ledger, there is a mental one, which binds together millions of computers around the globe. Most probably, the Yap villagers never realized that they’d come up with a truly revolutionary technology.

Philosophical and technical bases behind Blockchain

While claiming that the inhabitants of the Yap Island might indeed be responsible for the emergence of Blockchain technology sounds far-fetched, the seeds of this state-of-the-art invention may go back directly to the 1940s. During the peak of the World War II, genius British cryptographer Alan Turing made a breakthrough by deciphering the Enigma machine.

1974 Nobel Prize winner Friedrich Hayek, who became famous because of his magnum opus ‘Decentralization of Money’, is considered to be one of the biggest philosophical influencers in the history of the cyberpunk movement. Ayn Rand was among other inspirations: she came up with the idea of ‘Galt’s Clutch’, a secluded community that would one to distance himself from corrupt institutions.

This magnum opus predicted the decentralization of money, which would help stomp out government-backed monopolies. Bitcoin, the first privately issued money, is a stepping stone for the implementation of Hayek’s vision.

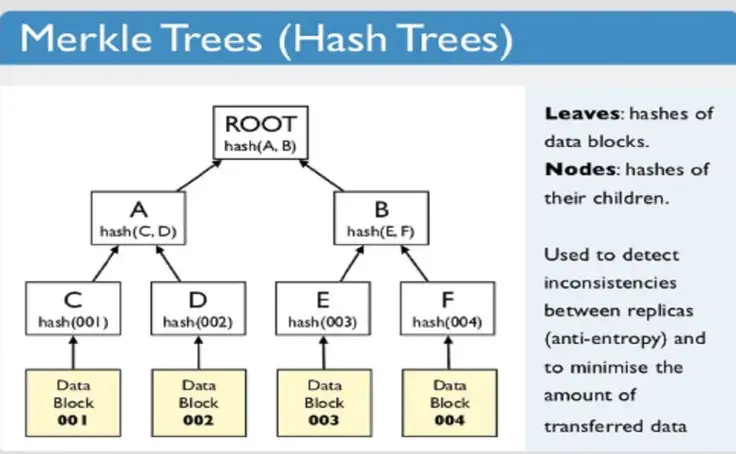

When it comes to technical bases, Bitcoin — as well as the technology that underpins it — is based on cryptography (a huge chunk of information is shared between encrypted computers worldwide). In 1976, the Diffie-Hellman algorithm allowed securely exchanging cryptographic keys by dividing them into private keys and public keys. Ralph Merkle, in turn, is responsible for the creation of public-free cryptography (Merkle Tree). These inventions were essential for the establishment of Blockchain technology.

In 1991, way before Blockchain became the ultimate ‘buzzword’ of recent years, Haber and Stornetta published a paper entitled “How to Time-Stamp a Digital Document”. The document describes a tamper-proof method of time stamping, which would make it impossible to stamp an inaccurate date on a document. This seemingly groundbreaking technology went unused, and the patent expired in 2004, remaining a remnant of history.

Blockchain’s public debut in Satoshi’s white paper

Since then, the development of the Blockchain technology remained in limbo. In 2008, however, everything has changed for good with Satoshi Nakamoto introducing the white paper of Bitcoin, the first decentralized digital currency that later took the whole by storm. The rest is history.

(Source: Bitcoin.com)

Bitcoin became the first known use case of Blockchain technology in history (if we don’t count the aforementioned Fei stones). After the release of the white paper, the first open source client of Bitcoin appeared back in January 2009.

The term “Blockchain” made its first public appearance only in Satoshi’s ubiquitous white paper. It is worth mentioning that Satoshi didn’t use the term ‘Blockchain’ in his work — the technology was actually represented by two separate words (‘block’ and ‘chain’).

While there were some remotely similar technologies, there is no doubt that Satoshi (whoever this elusive creator is) can be regarded as the founder of Blockchain. There is also an alternative opinion that Blockchain wasn’t created by anyone, and it simply represents an evolution of a technology that combines three elements (cryptography, distributed networks, and consensus protocols).

The thing is, Satoshi’s white paper actually suggests that Blockchain and cryptocurrencies are two inextricably connected notions, and there was no life for this technology outside of the digital money space (despite almost a decade-old history).

Blockchain separates from Bitcoin

While Bitcoin remains the biggest use case of Blockchain, more and more companies and organizations are inching closer towards decentralization in order to increase their efficiency.

(Source: Bitcoin.com)

The very first precedent was set by a startup dubbed Namecoin that wanted to democratize the current management system. The domain names are mainly controlled by centralized entities, and they have long been a matter of grave concern for Internet freedom advocates. There have already been a couple of occasions when the US government would seize the site’s domain. By storing all domains on a distributed ledger, Namecoin would make it impossible to correct the registration data. The government would need an encryption key in order to seize this domain.

As the popularity of cryptocurrencies began to grow, many people started confusing Bitcoin and Blockchain, the technology that underpins all decentralized digital assets. During 2013-2014, when Bitcoin started showing the first signs of mainstream adoption, Blockchain also appeared in the limelight, and many realized that its use cases might extend far beyond crypto with this technology being actively applied in a myriad of industries (healthcare, transportation, etc.). Individual companies and even whole countries started pouring money into Blockchain. For instance, the South Korean budget is set to allocate a staggering $925 mln to further develop the Blockchain technology (one of the biggest fintech-related investments in recent history).

The rise of Ethereum

The next era in the development of Blockchain is associated with one name: Vitalik Buterin, one of the developers behind the Bitcoin codebase who decided to come up with his own project due to numerous programming limitations. While he saw the Bitcoin ecosystem forming a distinctive shape, he realized that many crypto projects that were still in a stage of inception needed the common ground to build on.

As a result, Ethereum, the second public Blockchain, appeared on the horizon along with a groundbreaking invention of the so-called ‘smart contract’. The 2013 Ethereum white paper already went down in history. In mid-2014, the Ethereum yellow paper was released, with Gavin Wood specifying the modus operandi of the Ethereum virtual machine (EVM).

(Source: Getty Images)

The major advantage of the Ethereum Blockchain consists of the ability to record various kinds of assets, not being restricted strictly to cryptocurrencies. Smart contracts have already witnessed a widespread adoption with tech giants such as Microsoft using it to cut red tape. Even critics who argue that Ether (the currency) is doomed to fail, they admit that the Ethereum, which embodies the second-generation Blockchain system, is here to stay. There are hundreds of active projects that were built on the Ethereum Blockchain, representing a huge imprint on the history of the technology.

Apart from smart contracts, Ethereum birthed the concept of the so-called decentralized organizations (DAO), which represent the whole corporations that are operating with the help of smart contracts.

The creation of Ethereum eventually resulted in the ability of developers to create the applications that run inside it. Decentralized application (dApps) represents the next logical step in the development of the technology — there are already hundreds of such applications that are powered by Ethereum. Instead of Twitter or Spotify with a centralized governing model, dApps offer more freedom to users, enhancing stability and eliminating numerous censorship issues. Still, there are numerous caveats that are linked to their adoption: dApps fail to grow their user base due to their poor usability.

In general, the evolution of Blockchain could be described in several stages:

|

Stage 1: Bitcoin |

At first, the Blockchain was solely used as an underlying technology for Bitcoin (and later other cryptocurrencies). Bitcoin became the first decentralized digital currency in history. |

|

Stage 2: Ethereum Blockchain |

With the implementation of smart contracts, a slew of assets could be recorded on a distributed ledger. Furthermore, the technology gave a huge boost to the adoption of Blockchain outside of cryptocurrencies. |

|

Stage 3: DApps |

Blockchain is inching closer towards run-of-the-mill users with decentralized applications that are supposed to come as a viable replacement for traditional applications. |

|

Stage 4: Cross-Blockchain |

The scenario when Blockchain finally becomes usable in the real world, disrupting many industries. |

Transition to proof-of-stake Blockchain consensus algorithm

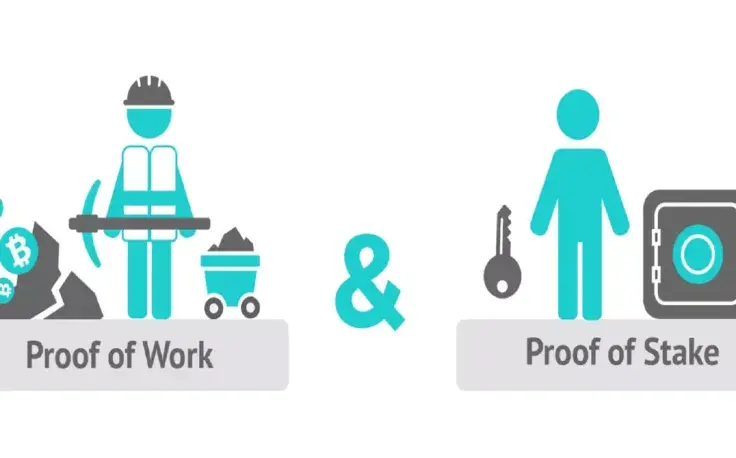

If you are somehow familiar with cryptocurrencies, you are definitely now new to the concept of cryptocurrency mining. This is a process of cooperating Bitcoin many nodes on the network. Blockchain technology allows recording all the data on a distributed ledger, which basically means that it is stored on a gargantuan number of computers around the globe. For the whole network to function properly, there should be a robust consensus mechanism in place.

The original consensus mechanism is called Proof-of-Work (PoW). The peculiar thing is that the PoW mechanism dates back to the 90s, long before Satoshi came up with a ubiquitous Bitcoin white paper (the actual term was proposed by Markus Jakobsson). Still, this consensus algorithm became commonly known along with Bitcoin. According to the white paper, PoW would help solve security concerns, preventing the much-feared 51 percent attack. There is a block reward involved for every cryptographic puzzle solved by an individual miner or a group of miners.

However, due to numerous disadvantages of PoW (huge energy consumption, geographical limitations, etc.), a new consensus algorithm emerged on the horizon: Proof-of-Stake (PoS). When it comes to proof of stake, the creator of a new block is defined based on his stack of coins.

The currencies that are based on this consensus algorithm do not presuppose a block reward; miners profit off transaction fees. Hence, the PoS algorithm is a significantly more cost-effective option. PoS-based coins help to tackle the problem of energy saving that has always been an issue as far as Bitcoin mining is concerned. As U.Today reported earlier, Bitcoin mining has such a great impact on the environment that it could potentially boost climate change.

Tackling the scalability trilemma with altcoins

The next logical step in the history of Blockchain development consists of finding new scaling solutions. Some naysayers bash Blockchain because transactions take a very long time to be conducted compared to more established financial systems (VISA, Swift). With Bitcoin Blockchain, it is only seven transactions per second (TPS). Ripple, on the other hand, shows much more impressive results with 1,500 TPS, but there is still much homework that needs to be done in order to match the processing power of the VISA network that is able to process 24,000 TPS (although, Ripple is already six times faster than PayPal). Ripple shouldn’t be confused with the actual cryptocurrency (XRP) — it’s a Blockchain-powered startup that is currently getting a big number of banking clients on board with its new xRapid product.

Coming up with a scalable Blockchain solution is an easy feat due to what is known as the scalability trilemma. The essence of this trilemma is that the Blockchain network is only capable of having only two out of the following three features: decentralization, security, and scalability. Blockchain and Ethereum put emphasis on the first two, which takes a toll on the speed of transactions. Still, a scaled Blockchain that would be able to outperform them — conducting millions of transactions in a snap — is yet to be done in history, but some promising projects are already in the offing.

Altcoins with separate Blockchain seems like a plausible solution to the scalability problem since it would significantly reduce the user base. Notably, there is a full stack of scalable Blockchains in the offing, with Ethereum 2.0 leading the way. Cardano, on the other hand, is already here: the reputed project spearheaded by Charles Hoskinson is considered to be the third generation of Blockchain because of its scalability and interoperability.

Other third-generation Blockchains to watch in 2018:

-

Zilliqa;

-

EOS;

-

ArcBlock;

-

Aion.

Each of the aforementioned third-generation Blockchains aim to tackle the main issues of Bitcoin and Ethereum in their own way with a major emphasis being placed on scalability.

The growth of Blockchain: talking numbers

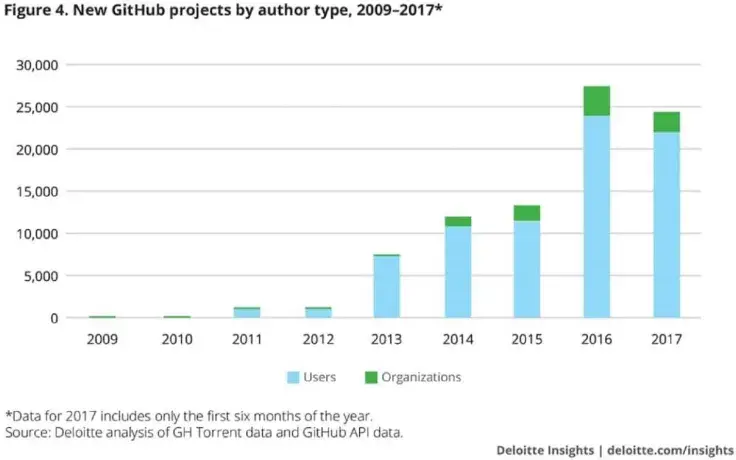

According to one of Deloitte’s research papers — which aims to illustrate the evolution of Blockchain with the help of GitHub data — there have been more than 87,000 Blockchain-related projects. Perhaps the most striking finding actually pertains to the number of currently working projects; the longevity in the Blockchain industry is very poor, with only 8 percent of projects still being maintained by their developers.

Nevertheless, there is still a very positive trend when it comes to the number of projects developed by commercial organizations: it has skyrocketed since 2009, serving as a clear indicator of wider Blockchain adoption. It is especially important for the industry because such projects tend to be updated more often while holding more significance.

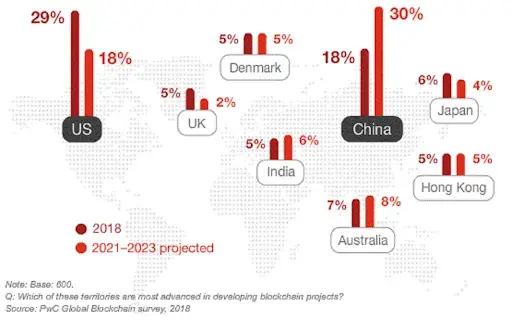

However, Blockchain adoption is still rather snail-paced with regulatory uncertainty being the main issue. A new PwC survey showed that 27 percent of CEOs think that lack of legal clarity remains the main hindrance with lack of trust among users coming in second place (25 percent).

The future of Blockchain

As mentioned above, a lot of banking institutions (including such behemoths like Morgan Stanley, are already jumping on board with Blockchain adoption since the technology has the potential to increase the efficiency transaction processing. However, it doesn’t stop there — dozens of industries are already unitizing it. Whether it’s giving refugees a chance to restore their identity or preventing food poisoning, there’s one ‘magic wand’ that helps to modernize everything with the help of decentralization.

Since no one is able to alter data on a Blockchain, it’s a perfect solution for record keeping, and there is a myriad of future use cases where Blockchain could come in handy. Ironically, there’s even a Europe-based startup called Kapu that puts the whole history on a Blockchain in order to have a risk-proof source of all kinds of historical data.

With that being said, Blockchain has many critics (and their list not limited to the unhinged Bitcoin opponent Nouriel Roubini). They claim the technology is overhyped, and cryptocurrencies still remain the only major use case. dApps (decentralized applications) fail to get a grip of a real user base while many Blockchain-related projects are only in a trial phase. While it is partially true, it is quite reasonable to assume that the mass adoption of Blockchain won’t happen overnight – it would take years or even decades for the technology to catch up, and there has been a lot of progress since the inception of Bitcoin. Case in point: it took the Internet almost four decades for this technology to break into the mainstream (its foundations were created as early as in the 60s).

Meanwhile, the US — the current leading market for Blockchain development — is expected to cede ground as early as 2023. China, which retains its hawkish stance towards crypto, is betting big on Blockchain, going as far as issuing Blockchain-related guidelines for its officials. Remarkably, the UK’s current 5 percent share in the crypto space is expected to shrink to just 2 percent.

One also cannot exclude the possibility that Blockchain might not be the same technology that we know today. A lot of companies, for instance, are already trialing so-called ‘private’ Blockchains that allow sharing data only within a small circle of individuals, and there is always a chance that another groundbreaking invention will turn Bitcoin and Ethereum into history.

No matter what future holds for Blockchain, one thing is crystal clear: the world will never be the same after its invention.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin