Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

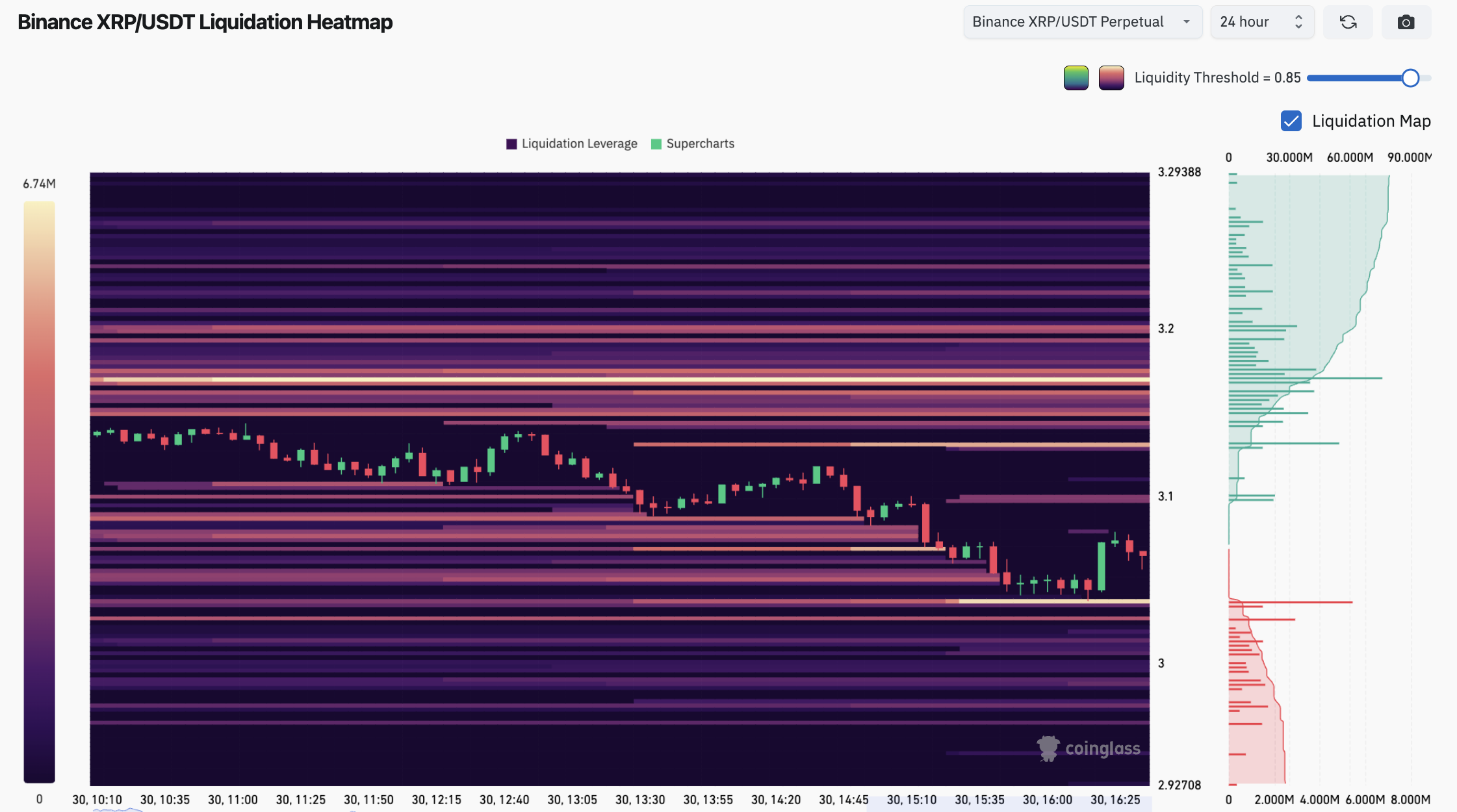

For XRP, the battleground is not some distant resistance or far-off support; it is right here, in the tight $3-$3.10 pocket, where nearly $30 million in leveraged bets are waiting to be liquidated, per CoinGlass. The market calls this the "max pain" zone, and XRP has just walked straight into it.

In the last month or so, there have been loads of long and short liquidations in this area. On the one hand, short positions start to unravel around $3.13.

On the other hand, short liquidations kick in at just under $3.03. That is less than a 3% difference between the two pressure points, which is basically a trap. When the price is going up or down in such a narrow range, someone is bound to lose out.

Liquidation heatmaps for Binance's XRP/USDT pair back this up. Some thick yellow bands showing high-leverage density stacked around $3.05 to $3.10.

It is a classic setup — the kind of high-stakes compression that often ends not with a blow but with a forced move triggered by cascading stop-outs. The XRP price has been stuck here for over 48 hours, which suggests that the pressure is building, not easing off.

XRP could well be next domino to fall

Zoom out to the one-month view and see even more concentration. There is a $3.67 short liquidation cluster hanging over us, and below $3.00, another batch of longs starts to look a bit vulnerable. This creates a middle ground that is a bit all over the place; there is no clear safety, just risks that overlap.

The moral of the story? This is not a range to trade in casually. With the liquidation thresholds being so tight and the leveraged volume so high, any decent push from market makers or a sudden influx of spot volume could trigger a chain reaction.

It is not about being optimistic or pessimistic anymore. It is about who can keep their head above water when things go wrong.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov