Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

2018 was a difficult period for Bitcoin, the beginning of 2019 did not foreshadow positive changes, because the downtrend continued. Results of 2018 for Bitcoin show that the cryptocurrency tumbled almost 75% from the high price of $18 000 to the low price of $3,265 in December.

Many prophesied Bitcoin infamous demise, but everything changed in the spring, or rather in April, when bullish rally instantly raised BTC to a height of $5,000. Now it seems that the worst is behind and only growth is ahead, but are these really so? Let's try to figure out and give a clear forecast for 2019.

Bitcoin price in 2018

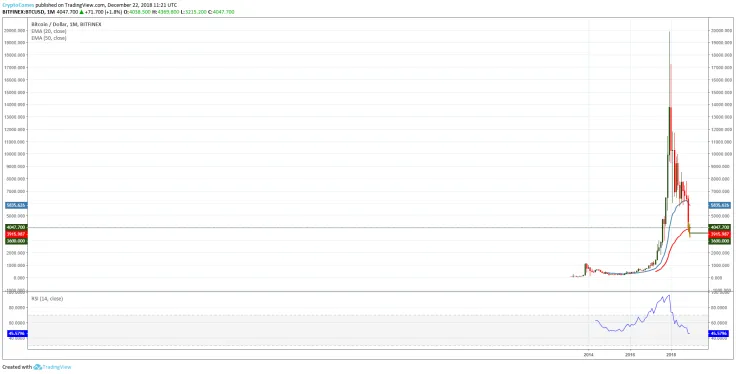

To foresee the future, you need to know the past. Therefore, it is worth looking at the events of 2018. The following monthly Bitcoin chart is indicative of the continuous and very strong selling pressure in 2018, making a Bitcoin forecast today a very hard task. We will, nonetheless, make a Bitcoin price prediction for 2019 and beyond, based on some opinions of experts and on technical analysis. After a top formed in early January 2018, the price of Bitcoin followed only one trend — a very strong downtrend for the rest of 2018. Worth the mention, that the trend continued until the end of winter.

From the above chart it is not unreasonable to argue that the immense price acceleration of Bitcoin in late 2017 and the collapse of its price in 2018 is what they call in financial textbooks a bubble. Was it only speculation and momentum trading that moved the price so high and was it the realization that this price of about $20 000 was unjustified based on the fundamental key drivers of Bitcoin that made 2018 one of the toughest years for the cryptocurrency market?

One should always remember that Bitcoin is an unusual asset and many standard financial instruments are not applicable to it. Bitcoin predictions are mostly an opinion, although supported by some arguments and even technical analysis may make a Bitcoin forecast attempt at least to have some solid arguments to back it up and have some validity.

In 2018, both bulls and bears had trouble predicting the Bitcoin price due to the increased volatility experienced all year long, which made the task almost an impossible mission. For 2018, we read forecasts about Bitcoin at $50 000, $100 000 on the optimistic side, and at $3 000, $6 000 and almost to zero from the well-known Economist Nouriel Roubini. As time shows, the pessimists were right in 2018, as at the beginning of 2019, there was no growth.

Will the second part of 2019 see a rise or a steeper selloff for the price of Bitcoin? What do the experts forecast?

card

Bitcoin price forecast 2019

What is the Bitcoin outlook for 2019? Some of the experts in the cryptocurrency market have talked about the future of the largest cryptocurrency by market capitalization and have also provided a range for Bitcoin’s price forecast in the coming year. Will bear market and intense selloff come back in 2019? Many investors, both individuals and professionals, have lost a lot of money if they picked the long-only side, buying the cryptocurrency as it was moving to lower price levels, perhaps trying to catch a falling knife and the real bottom of the price.

Here are some of the forecasts experts have made for Bitcoin in 2019:

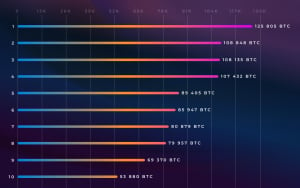

Some potential institutional candidates are Marco funds CTAs, multi-strategy funds and alternative strategies have about $600 billion AuM. Commodity assets alone that are held by hedge funds were $300 billion as at 2017. It makes up for 10% of the AuM. BTC may fall into this bucket. Macro funds are potential institutional candidates. However, the current circumstances are bleak. Boris Hristov

According to Boris Hristov, who is a Bitcoin and technology researcher, one catalyst for the price to find a potential bottom and move higher in 2019 will be the scenario of large institutional investors entering the market. But this scenario may occur in the future only if volatility in the market will be less extreme than current market conditions.

If you’re short we think you should be very careful and reducing your short exposure. I think if you’re looking to be long this is where you start adding here to your long exposure said Robert Sluymer from Fundstrat

In other words, a potential bottom for Bitcoin is near and a trend change form downward to upward is possible at these low levels of about $3900, but as always a confirmation of this trend change is required.

A very optimistic Bitcoin price prediction is made by John McAfee, Bitcoin supporter and founder of the popular McAfee antivirus software, predicting that the Bitcoin price will hit $1 million by 2020.

Crypto Kirby Trading Analysis

Bitcoin price prediction 2020

Here are some Bitcoin price predictions for 2020:

We expect the mining economy to grow over the next several years, and project a BTC price of $36 000 by year end 2019 based on the historical average 1.8x P/BE multiple Sam Doctor, Quantamental Strategist at Fundstrat Global Advisors

Bitcoin’s price can be anywhere in 5 years, from $10 000 to $100 000. An exact prediction is hard to provide because there are numerous fundamentals that are likely to change between now and [then]. Digital currencies and assets are the future of transactions and value storage, and Bitcoin is leading this revolution. But this doesn’t make it easy to guarantee a specific price tag five years down the road says Joe DiPasquale, CEO of BitBull Capital

I think BTC could potentially hit bigger figures by the year 2020. But for the next year or two, it’ll still be hovering just under the $10 000 mark. But then again, the end of 2019 is essentially millennia away mentions Fred Schebesta, Co-Founder and CEO of Finder

Your guess is as good as mine. My price prediction for Bitcoin in 2020 is $30 000 professes Craig Russo, Co-founder of sludgefeed.com

In 2020, my BTC estimate is $75 000, which is roughly 10x today’s price, and a total market cap of $1.3 trillion mentions Brandon Quittem, Cryptocurrency Analyst & Writer

Bitcoin price prediction 2025

I’m unable to guess as there are so many factors are involved that is impossible to say. I’d say that lack of proper security is currently the biggest obstacle for mass adoption of cryptocurrencies puts forward Alessandro Benigni, Founder of coinhooked.com

We agree with this opinion, adding the regulatory and tax issues as well. Making a prediction for 2025 is only an opinion, and by no means financial advice. As history has shown, predictions about financial instruments tend to be very inaccurate, and this is something we witnessed in 2018 as many experts were optimistic about the price of Bitcoin moving much higher than the top formed at $20 000.

We will conduct a technical analysis for the Bitcoin price to express our thoughts, but this will be only for 2019, a short-term forecast.

card

Bitcoin technical analysis for 2019

If you look at charts for the end of last year, you can see important indicators that influenced the Bitcoin rate in 2019. The value of +DI line in the ADX/DMI indicator was at 23.52 and has crossed above the value of -DI line at 16.88. This crossover after a selloff from the $6 500 price level to the low price of $3 265 was very important.

The importance of 200-period exponential moving average was hard to ignore for Bitcoin forecast in 2019. This moving average is widely followed by institutional investors as it represents the long-term trend which takes a lot of time to change. The figure for the 200-period exponential moving average was at $6 080. This was a target price for 2019 if a change in trend from downtrend to upward is to occur in 2019.

The indicators were correct, there was a trend reversal and the so-called crypto winter is over. Along with the arrival of spring 2019, Bitcoin began to grow rapidly. The gradual price strengthening was replaced by explosive growth in early April when the price jumped from $4,000 to $5,000. A month later another pump occurred, then the price of Bitcoin soared from $5,600 to $7,000, and then to $8,000. There was an attempt to push the price down, but it stopped at around $7,200, after which Bitcoin returned to the value of $8,000. About here we are now.

A popular analyst and investor Joseph Young said about recent price movement next:

Bitcoin dropped to $6,400 on May 17 triggered by a 5,000 BTC sell order on Bitstamp that led to massive BitMEX liquidations. Rapid recovery to $8,000 is a testament to how positive the sentiment around the market is currently

By and large, the mood of the market and the opinions of most experts coincide — there is enough fuel for Bitcoin to conquer the height of $10,000. It is more difficult to speak how soon will this happen, but certainly in 2019 and even in the coming months.

We offer to consider several popular analyzes from TradingView users. The first of these is the forecast of the Bitcoin price and the analysis of the current market situation and recent events from the user goldbug1.

In his opinion, the pullback occurred was not a change of trend, it’s still bullish. The current state of affairs also brings this to the fore. The rally continued and Bitcoin returned to about $8,000. According to goldbug1, the next intermediate target is $9,000 and many factors indicate that it will be reached soon. The movement may even begin beyond the $10,000 mark. Going short with such a move would be very dangerous.

In today's conditions, the lower price is unlikely to fall below $5,500. Nobody speaks about $4,500 or $3,500 anymore, but even $6,000 will be a peculiar bottom. Knowing Bitcoin, you can expect a lot of things, but goldbug1 is leaning toward growth and movement to $24,000. By systematizing the analyst’s thoughts, the price of bitcoin may be the following:

- $9,000 — in the near future.

- $6,000 — the lowest possible price.

- $24,000 — long-term aim.

Another popular analyst with a nickname Wave-Trader has his own thoughts about the minimal price of Bitcoin and the subsequent movement. Important events will take their place in the next few days. If the price fails to be pushed down, then another bull run will follow. Now growth may be postponed by correction, but as soon as it ends, the bulls will take their own.

Another idea is that the price will be able to break down. With such a scenario, the price may reach the bottom, up to $3,000, but then all the same, active growth will begin. The main goal of Bitcoin in the opinion of Wave-Trader is $20,000. Maybe it can be achieved as early as 2019, and maybe beyond. According to Wave-Trader scenario could go like this:

- Price could break down or blow up.

- Drop to $3,000 with subsequent growth.

- Rapidly growth toward $20,000.

In contrast to the two previous opinions, the user AIMORAN is confident in the fall of Bitcoin price. He spends analogy with July 2018, then the price collapsed from $ 8,200 to $ 6,100. At the same time, the graphs are very similar.

In addition, after the last growth of 7200 to 8000 dollars, a gap was formed, which is likely to be closed. Therefore, we should expect a consistent fall, which can last for several weeks or even months.

We also want to say a few words from ourselves. Make a prediction that we are waiting for Bitcoin in 2019. Perhaps it will coincide in some way with the analysis already voiced. Perhaps what is happening now is the so-called FoMO growth, after which we are waiting for the closure of the gap. In this case, a $6,000 order seems an adequate option. Only how quickly the price will fall to such limits is hard to say.

If we consider the growth of Bitcoin, then the mark of $8,400 dollars will become important now if the rate consolidates higher, the height of $9,000 dollars may be conquered. However, in this situation, there will be a correction. It is difficult to say how strongly the rate will fall, but, again, the amount of $6,000 seems to be the bottom.

Conclusion

Certainly, the scenario of institutional investors entering the market is optimistic for the Bitcoin price. For now, the challenges for Bitcoin in the coming year are both many and severe. What drove the price collapse is possibly the momentum trading which suddenly at the price level of $20,000 rapidly changed direction. The market pessimism about Bitcoin’s short-term prospects surely stopped after winter 2019, so as the bear market of 2018.

Now, there is a clear bullish trend, which is gaining momentum. In such conditions, it’s difficult to predict specific highs and bottoms, because the market is rushing upwards at an insane speed. And, as you know, the higher you climb, the lower you have to fall. Summarizing the predicted price of Bitcoin for 2019, we can say the next things:

- Price can get to $10,000 and stop.

- There is a small percentage of that price will rush to $20,000.

- BTC will likely break through $9,000;

- The price will not fall below $3,000;

- A pullback to $6,000 dollars is possible but then Bitcoin price will still go up.

What to believe from all this is up to you. The truth is always somewhere in the middle. This is not financial advice, but rather our Bitcoin price prediction for 2019.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov