Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

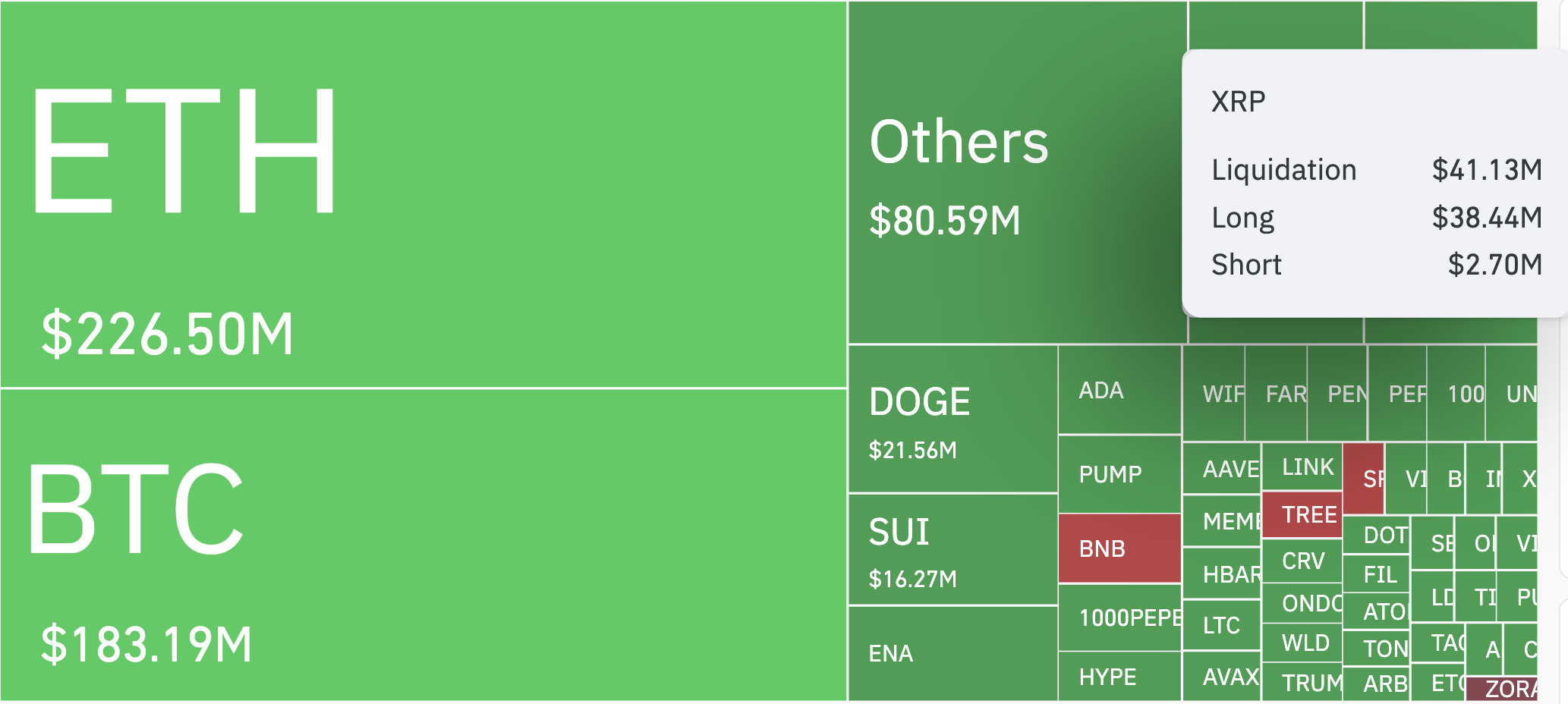

In the middle of an already turbulent day for crypto markets, XRP found itself at the center of a liquidation event that was less about price and more about positioning. The token lost just under 4% in quotes — not exactly a dramatic collapse — but that was enough to trigger more than $38 million in long liquidations, against a comparatively tiny $2.7 million on the short side, as per CoinGlass.

That is not just imbalance — that is a market leaning so far in one direction it made bulls trip over their own weight.

It is not the largest liquidation event in dollar terms — Ethereum and Bitcoin took bigger nominal hits — but in terms of imbalance, XRP was in a league of its own. More than 93% of all liquidations were from longs, which gives a pretty good indication of how traders were positioned heading into this move.

The price traded around $2.99 earlier in the day, and with the general sense of greed, the crowd was clearly leaning too far forward. When the pullback kicked in, it did not take much to send the dominoes falling.

What's next?

The drawdown to just below $2.95 forced a reset. Price is still holding that zone for now, but with funding rates likely cooling and leverage getting flushed out, the real question becomes whether this was just a liquidation shakeout or the start of a larger recalibration.

A move below $2.90 would put bulls in a tight spot, especially if general market weakness continues.

For now, XRP’s chart looks deceptively calm. But the liquidation footprint it left behind suggests that underneath the surface, a lot of conviction just got liquidated — and markets may not be as one-sided next time around.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov