Jeffrey Gundlach, founder and CEO of DoubleLine Capital, has taken to Twitter to share that he now believes Bitcoin to be the "stimulus asset" and doubts that gold can perform this function.

In the meantime, the largest buyer of Bitcoin and other digital assets, the Barry Silbert-affiliated Grayscale Investments, has announced that the amount of its crypto assets under management has surged to $40 billion.

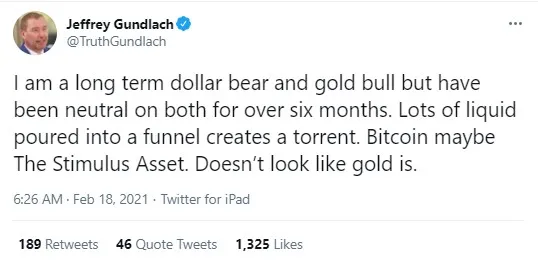

"Bitcoin may be the stimulus asset, doesn't look like gold is"

Jeffrey Gundlach has tweeted that he had been long-term bearish on the U.S. dollar and bullish on gold. However, over the past half-year, he has been neutral on both.

Now, he believes that the flagship cryptocurrency, Bitcoin, may be the "stimulus asset" for the economy that will help it thrive and work as a safe haven, rather than gold.

He mentioned "lots of liquid poured into a funnel" and the torrent that it creates, referring to the high interest that financial institutions have demonstrated toward Bitcoin this year.

As reported by U.Today earlier this week, business software giant MicroStrategy had issued another $900 million worth of debt to be sold to investors in order to get more Bitcoin.

Initially, the plan was to scoop up $600 million worth of Bitcoin, but then the sum rose to $900 million.

The CEO of SkyBridge Capital Bitcoin Fund, Anthony Scaramucci, told CNBC yesterday that he expects Bitcoin to rise to a staggering $100,000 by the end of 2021.

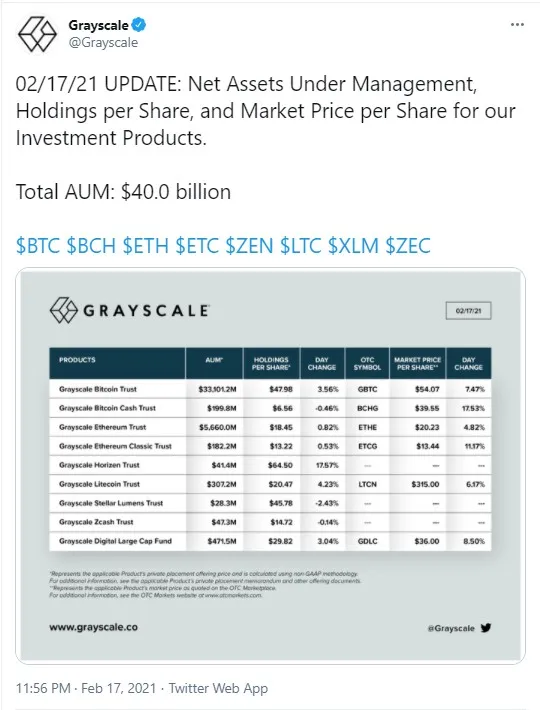

Grayscale AUM soars to $40 billion, adding $1.2 billion in one day

The largest Bitcoin buyer, Grayscale, has spread the word that, on Feb. 17, the total amount of crypto assets under its management surged to a whopping $40 billion.

This is $1.2 billion more than was reported on Feb. 16. As per a recent tweet by the company's CEO, Michael Sonnenshein, to date, the aggregate amount of crypto AUM held by the company has doubled since Jan. 1 of this year.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin