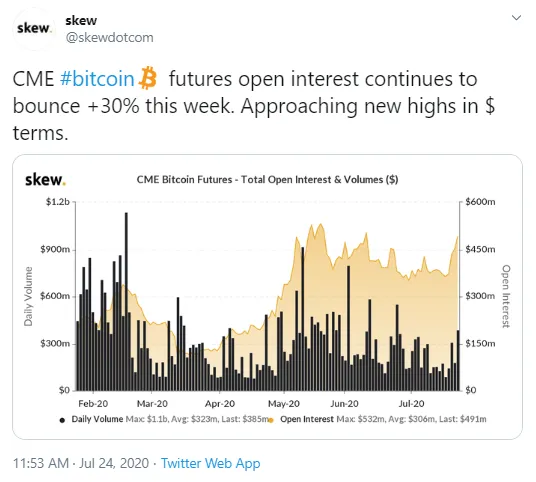

According to a recent tweet from analytics company Skew, the Chicago-headquartered CME Group has shown another rise in open interest (OI) in its Bitcoin futures product.

Up 30% this week already

After a recent bounce of sixteen percent, says Skew, the Bitcoin futures OI on CME has gone higher, by now gaining thirty percent in total.

Today, according to the analytics team, open interest for BTC futures on this platform reached the mark slightly below $500 mln.

The previous surge this week was reported on Wednesday, after Bitcoin futures OI rose to slightly under $450 mln the day before.

Institutional investors’ appetite is growing

CME is a regulated trading platform, so a spike in OI in BTC futures is indicative of institutional investors’ interest growing stronger in Bitcoin derivatives.

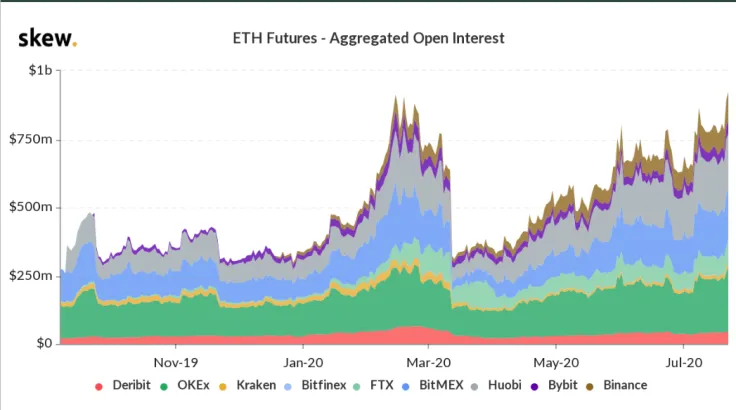

Ethereum futures OI about to surpass $1 bln

On Thursday, Skew shared a tweet regarding aggregated open interest for Ethereum futures on several trading platforms.

The chart showed that OI in ETH futures is on the verge of breaking above the $1 bln mark. The chart showed total data from such crypto exchanges dealing with derivatives as Binance, Deribit, Kraken, OKEx, and Huobi.

Ethereum price on the rise

On July 23, the price of Ethereum printed big spikes, first surging from $245 to $262 and then continuing its upward movement to the $275 mark.

This spike in the ETH market value took place after the public trials of a new upgrade—"Medalla"—was publicly announced by developers. This is the last step before Ethereum is expected to roll out the long-awaited Ethereum 2.0 upgrade later this year.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin