Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

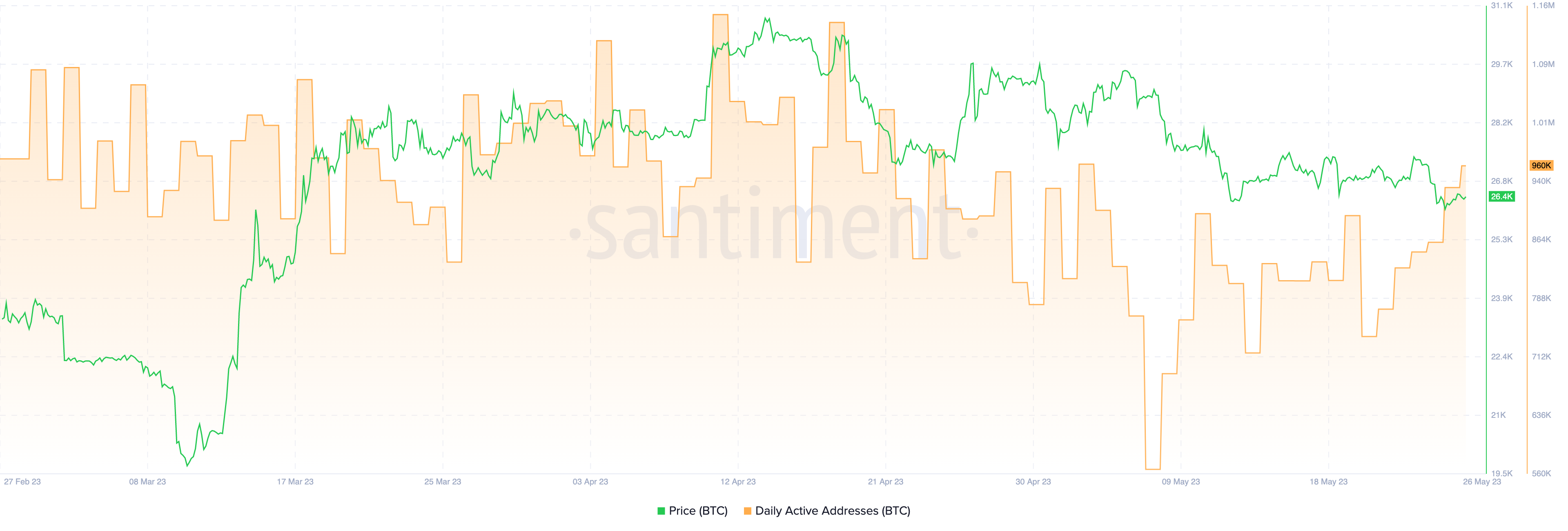

Bitcoin's active addresses have surged to a three-week high, indicating a notable uptick in utility, according to crypto intelligence portal Santiment. For the first time since May 3, the number of active addresses for BTC has reached 960,000.

This resurgence in Bitcoin address activity is a positive sign after the concerning decline observed in May. The increased utility is crucial for the sustained growth of cryptocurrencies, and it will be interesting to observe if BTC can surpass 1 million daily active addresses as we head into June.

The surge in activity is mirrored by a notable positive shift in the price of BTC. The cryptocurrency has experienced growth of nearly 4%, reclaiming levels above $27,000. This upward trajectory in price is particularly encouraging as it paves the way for the possibility of surpassing the April low of $26,942, with the market having at least four more days to close above this crucial threshold. Such a development carries significant implications for the price movement of Bitcoin.

Odd future

However, as for now, the future of BTC and the broader crypto market remains uncertain, presenting a unique challenge. The well-known adage "sell in May" is drawing to a close, resulting in a natural decline in market volatility and liquidity.

The scenario could change with the opening of Hong Kong's doors to cryptocurrencies on June 1. This move has the potential to generate a reverse spike in volatility and liquidity, introducing a new dynamic to the market.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin