Bitcoin's market is gearing up for a significant shift, according to trader and crypto analyst Gert van Lagen.

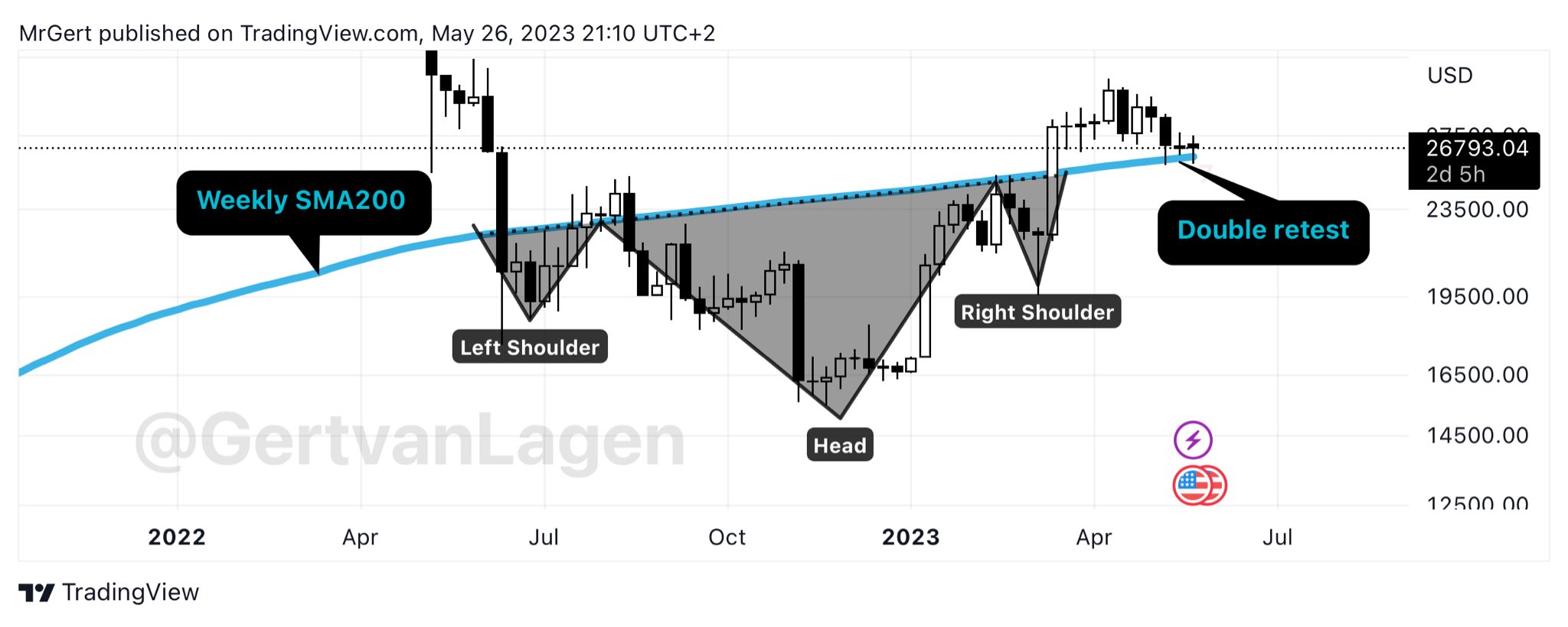

In a tweet shared with his followers, van Lagen highlighted the formation of a "perfect head-and-shoulders bottom" below the weekly simple moving average (SMA) over the last 200 days. This pattern is typically seen as a bullish signal.

Van Lagen's tweet further detailed a successful double bullish retest of the neckline/SMA200, suggesting a strong potential for upward movement.

He also flagged a "perfect bear trap" that he believes has now been completed. This assertion signals that pessimistic traders, who might have anticipated further dips, could find themselves on the wrong side of a possible price rally, hence the term "bear trap."

Van Lagen's analysis of Bitcoin's trajectory anticipates what he terms a "blowoff top", a strong surge in price.

JPMorgan's latest Bitcoin prediction

The bullish analysis aligns with recent predictions from banking giant JPMorgan. The firm's strategists, led by Nikolaos Panigirtzoglou, forecast a potential Bitcoin value of $45,000. They argue that given the rising gold price – now over $2,000 – and with the total value of gold held for investment purposes outside central banks standing at around $3 trillion, this figure for Bitcoin is plausible.

The assumption is that Bitcoin could achieve parity with gold in terms of volume in private investors' portfolios, adjusted for risk capital.

At present, the Bitcoin price stands at $26,783 according to CoinGecko, having fallen over 60% from its all-time high of $69,044.77 in November 2021.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov