Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

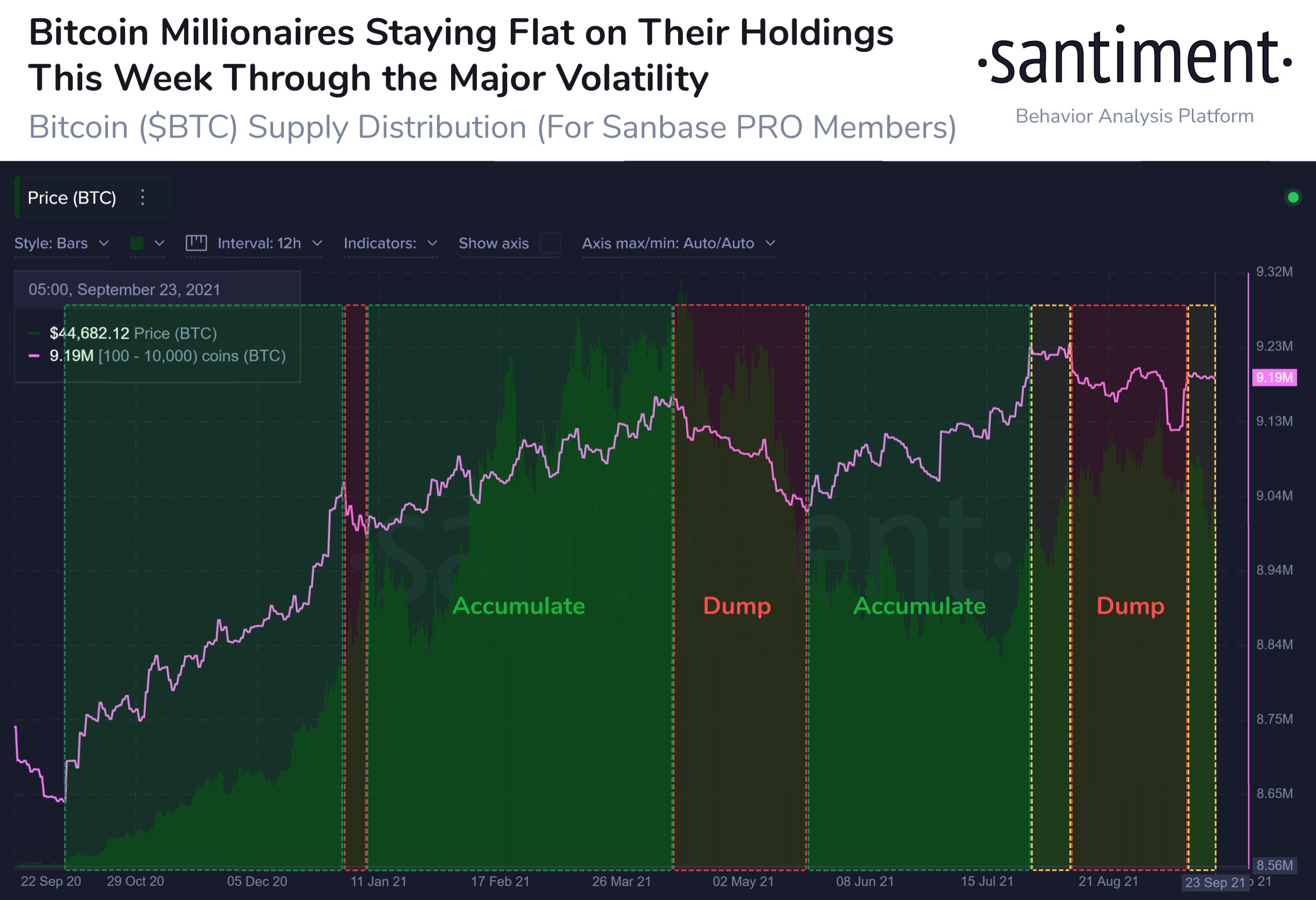

According to recent on-chain data provided by Santiment, the current Bitcoin market just entered a new market phase. The indicator suggests that the Bitcoin spending rates of millionaires, or "whales," have significantly dropped.

Increased volatility and the recent drop in the market have led to increased spending rates on the markets. After a slight market recovery, the spending rates of large Bitcoin wallets, or "whales," have returned to normal.

The previous accumulation period was followed by the significant growth of Bitcoin's value. The first cryptocurrency's price rose by more than 60% from July to September. Accumulation periods are usually followed by low spending rates on both small and large Bitcoin wallets. Whenever spending activity decreases, holders keep their funds in their personal wallets instead of moving them on various crypto exchanges.

Whenever market participants hold funds on cryptocurrency wallets, there are always more chances for funds to be realized on the market as increased volatility appears. Analogous to previous periods of accumulation, whales have stopped moving funds amongst each other and exchange wallets.

At press time, Bitcoin is trading at $42,585 after China's central bank stated that all cryptocurrency-related transactions will be counted as illegal activities and that those are tied to money laundering.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin