Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

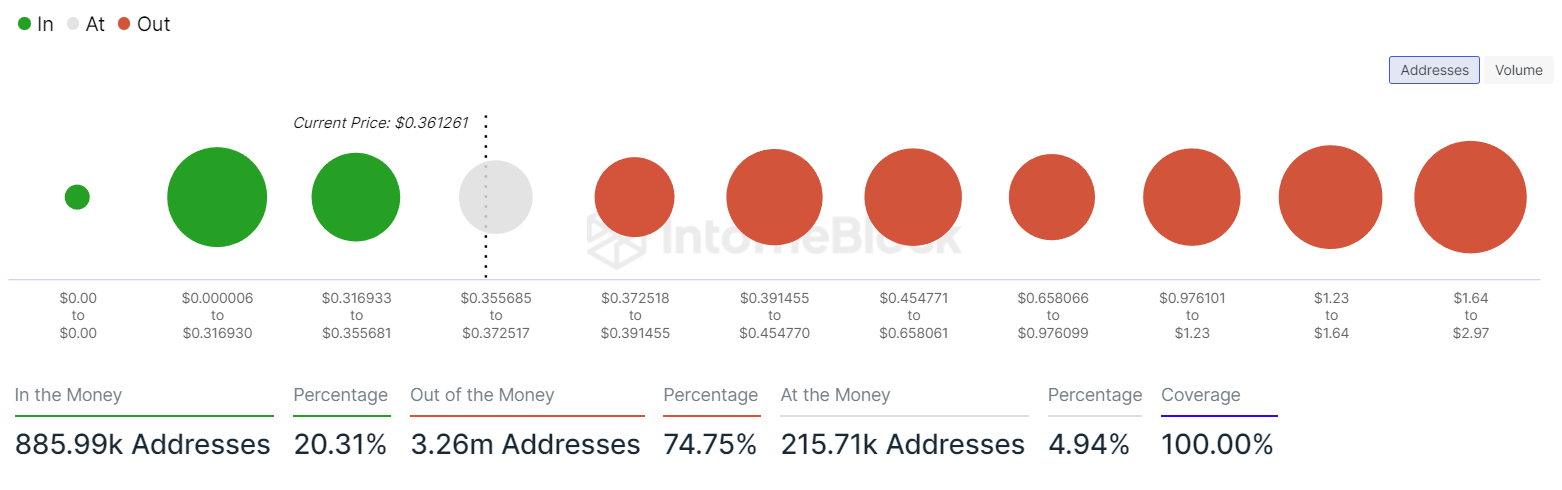

Cardano (ADA) has recently experienced a downturn in its price, with a significant number of addresses acquiring ADA at a price range between $0.35 and $0.37. As ADA trades around $0.36, many investors wonder whether it can recover from the current slump and regain its upward momentum.

To analyze ADA's future performance, we need to examine the "In the Money" and "Out of the Money" metrics. This involves calculating the average cost at which tokens were purchased and comparing it to the current price. If the current price is greater than the average cost, the address is "In the Money." Conversely, if the current price is lower than the average cost, the address is "Out of the Money."

Currently, ADA is sitting at the 3.28 billion level, with a minimum price of $0.35 and a maximum of $0.37. About 215,000 addresses acquired ADA within this range, creating a resistance level. Resistance is formed when a large number of addresses hold ADA at a specific price range, making it difficult for the price to break through that level. ADA is currently trading at $0.36 and moving in a local downtrend, with descending trading volume.

Despite the current downturn, there are several factors that could contribute to ADA's recovery, including market sentiment: positive sentiment within the broader cryptocurrency market could also benefit ADA. If other cryptocurrencies rebound and experience growth, it could create a ripple effect and bolster ADA's price.

If ADA can break through the current resistance level, it could trigger a wave of buying activity that propels the token to new highs. A significant increase in trading volume could also help overcome the resistance and push the price upward.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov