Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Despite a spike in liquidation volume on the cryptocurrency market, the second biggest network in the industry has not faced any problems heading into the last week ahead of the Merge update. But things may change if the price plunges to $1,348.

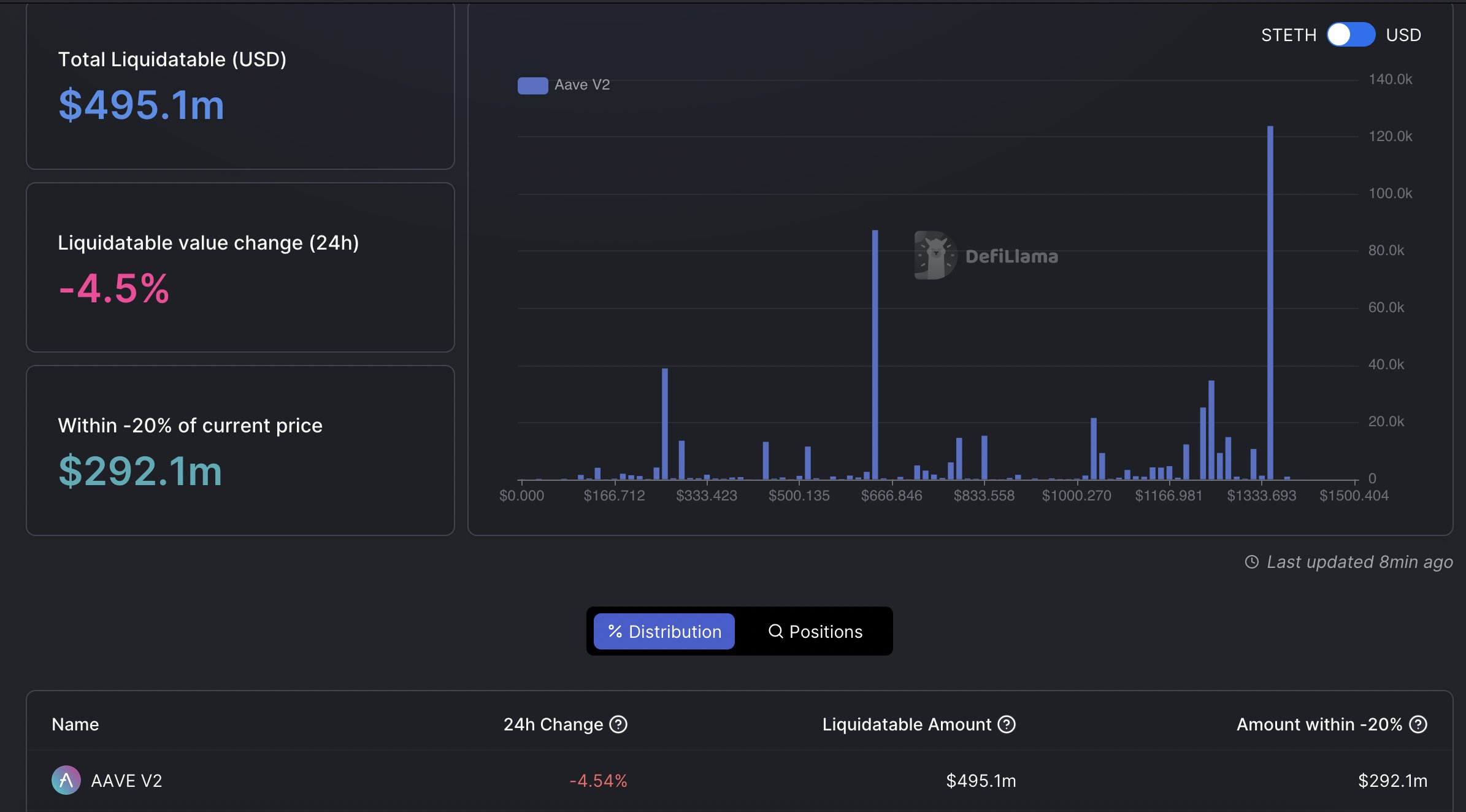

According to DeFiLIama, there are $167 million worth of stETH at risk of liquidation at $1,348. Compared to spot-based Ethereum futures, the liquidation level is almost two times higher.

In case of a liquidation, $167 million worth of tokens will be injected onto the market, creating enormous pressure on stETH, which will certainly cause a decoupling from the price of spot ETH assets. Such conditions can be used for arbitrage trading.

With an immediate spike in selling pressure, the price of the token might plunge far lower than Ethereum's price on the market. In order to take advantage of it, traders might start buying stETH at a lower price and then sell their regular ETH holdings, making an immediate profit, considering the high possibility of stETH returning to the same level as the spot asset.

One way or another, the liquidation might not happen at all if the price of the second biggest cryptocurrency market plunges to the aforementioned price all of a sudden. Investors and traders can always additionally fund their positions, pushing the liquidation price even lower and avoiding the crash.

In addition to financial reasons that may help the market avoid the cascade of stETH liquidations, the price of the spot assets might also avoid such a rapid and unexpected spike in selling pressure, considering its previous performance on the market.

At press time, Ethereum is trading at $1,512 and showing a mild 3% correction in the last 24 hours.