Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

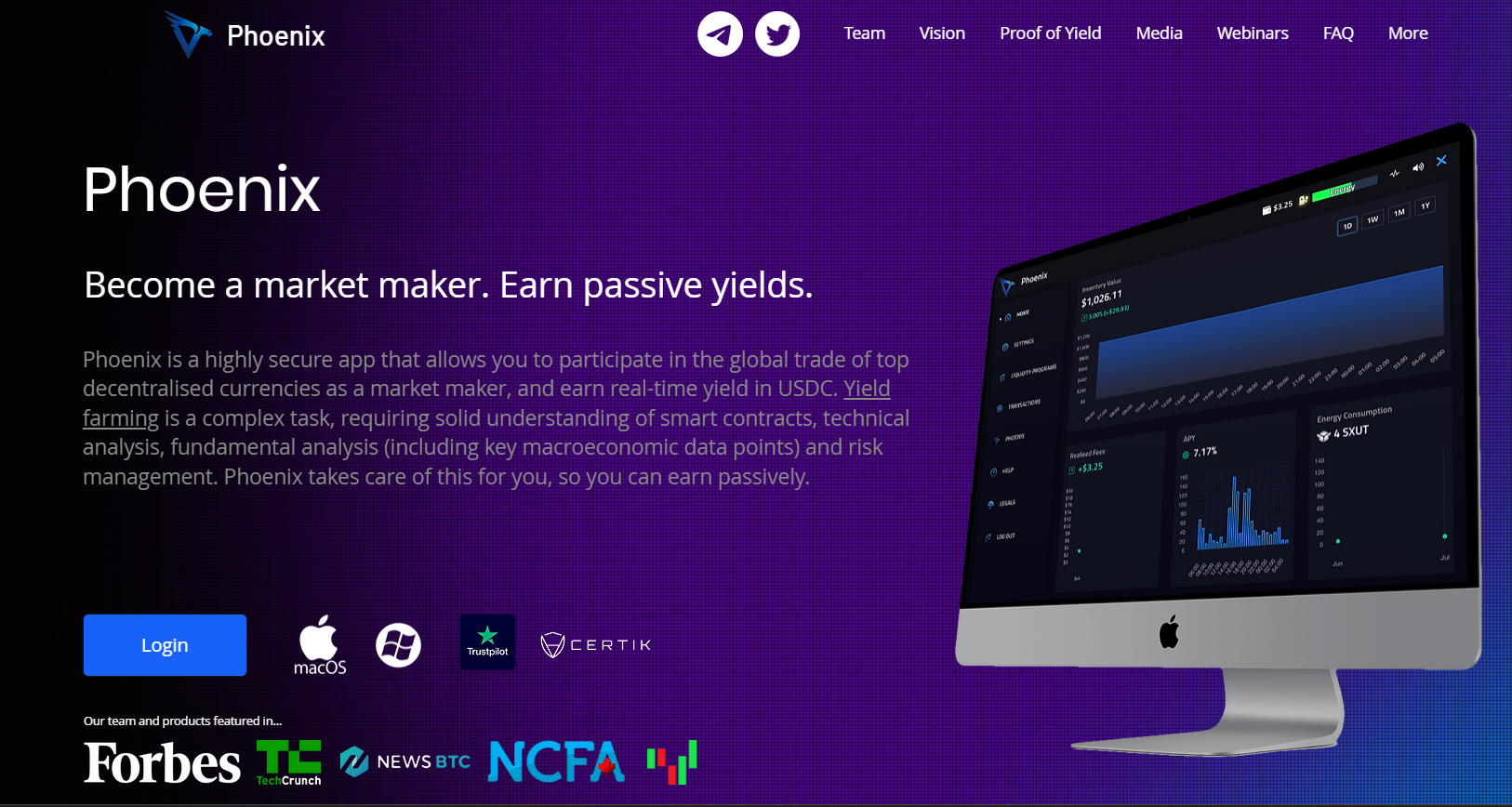

Phoenix is an easy to use liquidity mining platform with weekly payouts in the USDC stablecoin. It offers it’s users an easy and streamlined way of earning a legitimate passive income in crypto without having to have sophisticated expertise or a trading background.

Developed by industry experts, Phoenix unlocks new opportunities for crypto investors, who are looking for passive income. With it’s predictable payout model, no lock-ups, and its low, medium and high risk-reward yield programs, Phoenix has established itself as the go-to yield platform for investors from all backgrounds, where you can start with a deposit as low as $100.

Phoenix offers up to 30% APY on crypto deposits: Highlights

Launched in Q1, 2023 by representatives of Hatchworks VC firm and The Spectre Cryptocurrency Exchange, Phoenix merges the benefits of DeFi and CeFi in a single interface for passive yield generation.

- Phoenix is a one-stop shop for streamlined liquidity mining on decentralized exchanges across various blockchains.

- Phoenix generates yield for it’s users by providing liquidity to a range of top-tier cryptocurrency DEXes, including the likes of Uniswap, TraderJoe and 1 Inch.

- With Phoenix app, everyone can become a market maker without a need to interact with smart contracts or even on-chain wallets, private keys and so on.

- Depending on the chosen risk-reward program on Phoenix, a user earns between 7% and 30% in APY with payouts in USDC, the second-largest stablecoin.

- All the risk-reward programs offered on Phoenix are free from leverage, thus being less exposed to volatility and market manipulations.

In general, Phoenix builds a one-for-all liquidity providing marketplace designed to offer everyone passive income opportunities with predictable payouts in both the bull and bear phases of the cryptocurrency market cycle. The platform is aimed at lowering the barrier of entry for beginners and addressing risk management in a modern way.

What is yield farming in DeFi?

In the decentralized finance segment - the sphere of noncustodial cryptocurrency protocols - yield farming refers to techniques for generating interest on dormant deposits. Simply put, not unlike classic banks, protocols pay you interest for using your liquidity.

For the first time ever, yield farming went mainstream in Q3, 2020, when “DeFi Summer” pushed thousands of traders to Aave Finance (AAVE), Synthetix (SNX), Uniswap (UNI), SushiSwap (SUSHI) and other protocols. Customers of these platforms earned interest on their deposits and benefited from fluctuations in native token prices.

In the bear market of 2021-2022, the yield farming protocol segment lost part of its audience, but in 2024 it is actively recovering from “Crypto Winter.”

Passive income in crypto: Promises and challenges

Yield farming is far from being the only way to generate passive income in the cryptocurrencies segment. Besides that, customers can also inject liquidity into centralized lending protocols.

From an investor's point of view, such protocols normally operate similarly to decentralized finance protocols: liquidity providers deposit funds, and a centralized platform lends them to clients and rewards LPs with periodic payouts. However, such platforms provide low APYs for the majority of assets as they are only interested in Bitcoin (BTC), the largest altcoins and top-tier stablecoins.

Introducing Phoenix, yield platform from market veterans

Phoenix, a new-gen yield generation machine, addresses all bottlenecks of the segment: sophisticated UX, low APYs, high volatility and unpredictable rewards. Its solution is of paramount importance for the passive income generation scene in Web3.

Phoenix: Basics

Phoenix, a one-stop liquidity platform for yield generation, is designed to allow cryptocurrency owners to benefit from their idle holdings. With Phoenix, everyone can become a marketmaker on top DEXes without having to go use complex user interfaces, exorbitant fees, network congestion and so on.

On Phoenix, users are invited to deposit liquidity into their preferred risk-reward program(s). Phoenix then generates yield by routing this liquidity into leading decentralized finance protocols on Ethereum (ETH) and Avalanche (AVAX), two dominant smart contract platforms. For their contribution and deposits, investors enjoy weekly payouts in USDC. USDC is the second largest stablecoin (by market capitalization), backed by the company Circle.

Phoenix introduces the segment of market making to retail clients even with low deposits: the “entry barrier” on the platform is only $100 in equivalent. Compared to other competitive platforms, the Phoenix app offers attractive programs with high APYs and no minimum lockup period. With no lockup limitations, investors and traders can make their strategies more agile and flexible.

Phoenix: Tech concept

Phoenix offers both a responsive web interface (for desktop and phone users) and a native desktop applications for both MacOS- and Windows.

After setting up their account, users can deposit money. The process of registration is simplified and requires no specific crypto-related skills. Once the account is activated and validated, Phoenix users can top it up with cryptocurrency deposited from their own wallet.

Then, users can choose the particular liquidity mining program (see below), authorize the transaction and transfer money to the liquidity pool. Algorithms by Phoenix automatically start generating yield once liquidity enters the corresponding pool. Users should only wait for payouts in USDC; accurate APY depends on a liquidity mining strategy and a lockup period for the deposit.

As there is no minimum lockup period, users can withdraw their crypto with rewards to their own wallet at any time.

Phoenix: Liquidity pools and payouts

Per its documentation, Phoenix offers three programs to its customers depending on risk management details and preferable investing strategy. Phoenix introduced “Gearing level,” an indicator of exposure to the prices of top cryptos, for every available program.

- “Buffer” program works with Gearing of 0.1-0.2x on the downside and 0.3x on the upside. This is the most conservative program at Phoenix, as it only offers 7% in APY to its market makers.

- “Cruise” program runs with Gearing of 0.2-0.4x on the downside and 0.3x on the upside; 12% APY is available to customers. With its “medium” risks, the program is the most balanced one on Phoenix.

- “Ignite” program offers Gearing of 0.3-0.5x on the downside and 0.3x on the upside. The most aggressive one, it is running with 20% APY for all investors.

Describing the risk tiers on Phoenix, the team highlights that yields can expand significantly beyond these levels, depending on market volumes and news flow. Also, the platform’s representatives added that market makers should feel free to add further layers of protection to every liquidity mining portfolio to hedge capital risk using industrial strength shorting solutions.

The liquidity from Phoenix market makers is then routed toward three pools: AVAX/USDC on TraderJoe, and USDC/ETH on Uniswap and 1Inch, three top-tier DeFis on Ethereum and Avalanche.

Phoenix: Team

Phoenix platform is backed by a heavy-hitting team of seasoned trading, VC and Web3 tech professionals from various regions across the globe.

The tech development of the platform is helmed by George Violaris, the CTO of Hatchworks VC firm and a passionate innovative software developer and team leader with 15 years of experience in JavaScript, TypeScript, PHP, Java, Python, Go, databases and so on.

Phoenix's battle-tested Quantitative Strategy is developed and implemented by Harvard Business School alum Zen Zijlstra, who is also running due diligence and market data insight gathering at Hatchworks.

Microsoft veteran Oto-Rem Süvari is the head of the research and development department at Phoenix, curating further experiments with liquidity.

To advance the understanding of the product and its role in the market, the team is holding webinars for cryptocurrency enthusiasts. For further consultations, customers are encouraged to reach the Phoenix representatives in Telegram.

Wrapping up: What is special about Phoenix?

In a nutshell, Phoenix is a user-friendly app for liquidity mining and passive income generation. In three hedged strategies, it routes user deposits into liquidity pools on major decentralized exchanges, making the entire procedure easy for various groups of crypto owners.

Phoenix offers 7-30% in APY for all deposits over $100 in equivalent, with no minimum lockup time. Thus, the platform addresses all major bottlenecks of Web3 liquidity mining in the DeFi era.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin