The Group of Thirty (G30) has recognized XRP cryptocurrency as a solution to slow and expensive correspondence banking in its most recent report that focuses on various risks and opportunities associated with all types of digital currencies.

While hypothesizing about the introduction of a global official-sector stablecoin, G30 suggests that it could perform a similar function to Ripple’s existing remittance network:

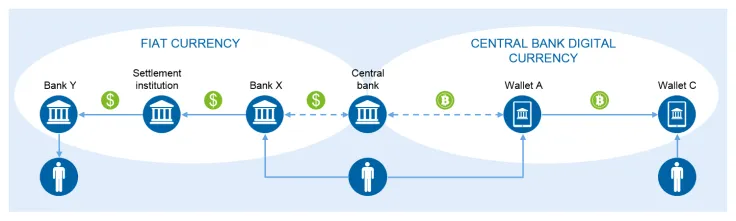

It is possible that such a stablecoin could be valuable for cross-border payments, serving a function similar to that offered in the private sector by Ripple, a real-time gross settlement system, currency exchange, and remittance network whose digital currency, XRP, leapfrogs slow, and expensive correspondent banking.

MAS chairman recognizes crypto’s potential

G30 is an international forum founded in 1978 that unites the most senior executives of central banks and commercial banks. Back in 2011, former European Central Bank President Jean-Claude Trichet became the forum’s chairman.

It is currently spearheaded by Singaporean politician and economist Tharman Shanmugaratnam, who was appointed as the chairman of the Monetary Authority of Singapore (MAS).

Shanmugaratnam claims in the report that, if implemented properly, digital currencies could speed up cross-border payments and cut down their costs while ensuring financial inclusion and uprooting crime.

The G30 sets out the key considerations for policymakers in deciding how digital currencies should be designed and implemented, so as to achieve their potential to bring about cheaper and faster cross-border payments, financial inclusion, and help root out illicit finance.

A closer look at CBDCs

The study concludes that new technologies should be embraced by central banks once they undergo a substantial testing period. However, banks must play an active role in exploring them.

It takes a particularly deep dive into central bank digital currencies (CBDCs) that are currently being explored by a slew of countries around the globe.

As reported by U.Today, the Bank of England (BoE) formed a task force with other major central banks, including the ECB, to assess the potential use cases of CBDCs as well as their bottlenecks.

Earlier this week, the Philippines became the latest country to reveal a plan to issue its own digital currency.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin