Those who are willing to buy the shares of the Grayscale Ethereum Trust (Nasdaq: ETHE) have to shell out a 730 percent premium to the native asset value (NAV).

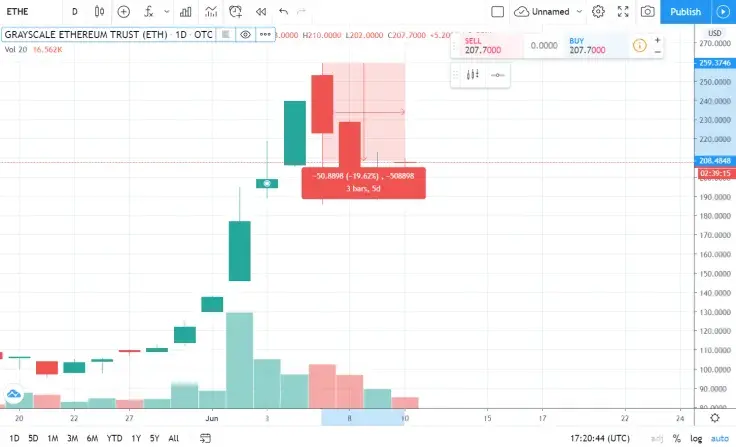

Presently, investors have to pay $207 for a single share that is equivalent to 0.094 ETH.

Even though the stock down 20 percent from its recent high of $259 set on June 5, the implied value of Grayscale’s second-biggest product still surpasses an eye-popping $2,000 per ETH.

Convenience comes at a price

Grayscale’s clients are content with paying a much higher price for getting exposure to the cryptocurrency without worrying about custody and regulations.

The ETHE trust is still an anomaly. For comparison, Grayscale’s Bitcoin Trust historically has a much lower premium, which currently stands at just 20 percent.

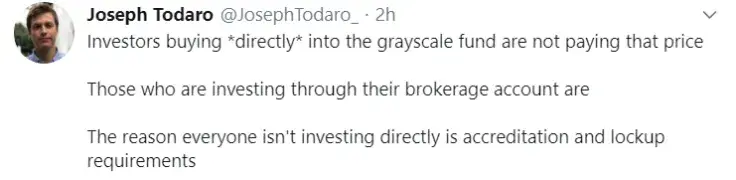

In a recent tweet, Blocktown Capital’s managing partner Joseph Todaro explained that those are buying shares directly from Grayscale are not required to fork out $2,000 per coin. This only applies to those who buy the stock via their tax-deferred brokerage accounts.

It’s just a fad

Investors are required to hold onto their ETHE shares for one year since their issuance.

The astronomical premium will likely wane substantially in the coming weeks when investors start liquidating those shares that were purchased last year.

$50 million worth of shares will be able to hit the secondary market after the expiration of their lock-up period.

Caroline Amosun

Caroline Amosun Godfrey Benjamin

Godfrey Benjamin Denys Serhiichuk

Denys Serhiichuk Tomiwabold Olajide

Tomiwabold Olajide