Twelve hours ago, CoinMarketCap registered that the second most popular cryptocurrency, ETH, surged to a new all-time high and reached the $1,467 level on the chart.

Here are several reasons of why Ethereum was pushed to this new milestone.

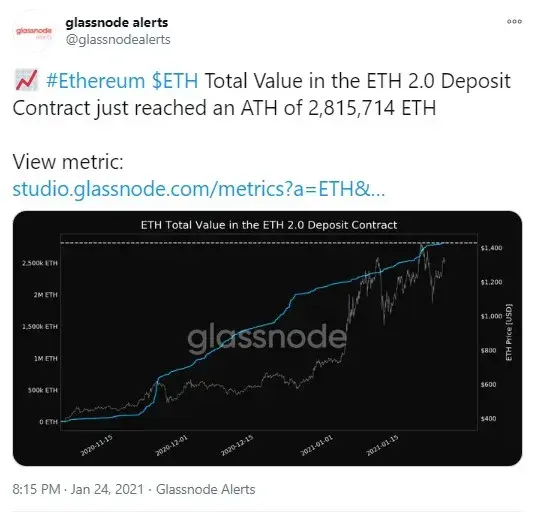

ETH total value in ETH 2.0 contract hits new ATH

The zero phase of the Ethereum 2.0 launch started in December last year and continues successfully. It started with a minimum of 524,288 ETH staked in the ETH deposit contract, when each staker had to send in a minimum of 32 ETH). ETH 2.0 is about switching from the proof of work (PoW) to the proof of stake (PoS) consensus mechanism, in which the reward of the staker will depend on how much ETH they put in.

However, the amount of ETH locked in the contract by stakers kept growing.

On Jan. 24, popular analytics agency Glassnode shared that the amount of Ethers locked in the ETH 2.0 deposit contract had spiked to a new all-time high of 2,815,714 ETH.

Phase 0 of the ETH 2.0 rollout will be followed by Phase 1, Phase 1.5 and Phase 2. Phase 1 is expected to kick off at some point later this year.

Upcoming launch of Ethereum futures for institutions on CME

At the end of 2020, CME, a Chicago-based platform that works with institutional customers, made an announcement to launch Ethereum-based futures on Feb. 8.

CME and CBOE were the first platforms to offer Bitcoin futures to institutional players in December 2017. This opened the gate for financial institutions to start investing in crypto. However, ironically, the crypto market dived into the long-lasting "crypto winter" right after that.

ETH supply on exchanges diminishes

As various analytics companies keep reporting, as 2021 kicked off, the amount of ETH on crypto exchanges has been declining.

ETH balances have been shrinking as users, including financial institutions, have been acquiring as much ETH as they could and been withdrawing those coins to hodl them long-term in cold storage devices/wallets.

This has been confirmed by data from IntoTheBlock and Glassnode. According to recent data by the latter, ETH balances on trading platforms have reached a 15-month bottom of around 15.5 million ETH.

Alex Dovbnya

Alex Dovbnya Tomiwabold Olajide

Tomiwabold Olajide Caroline Amosun

Caroline Amosun