Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

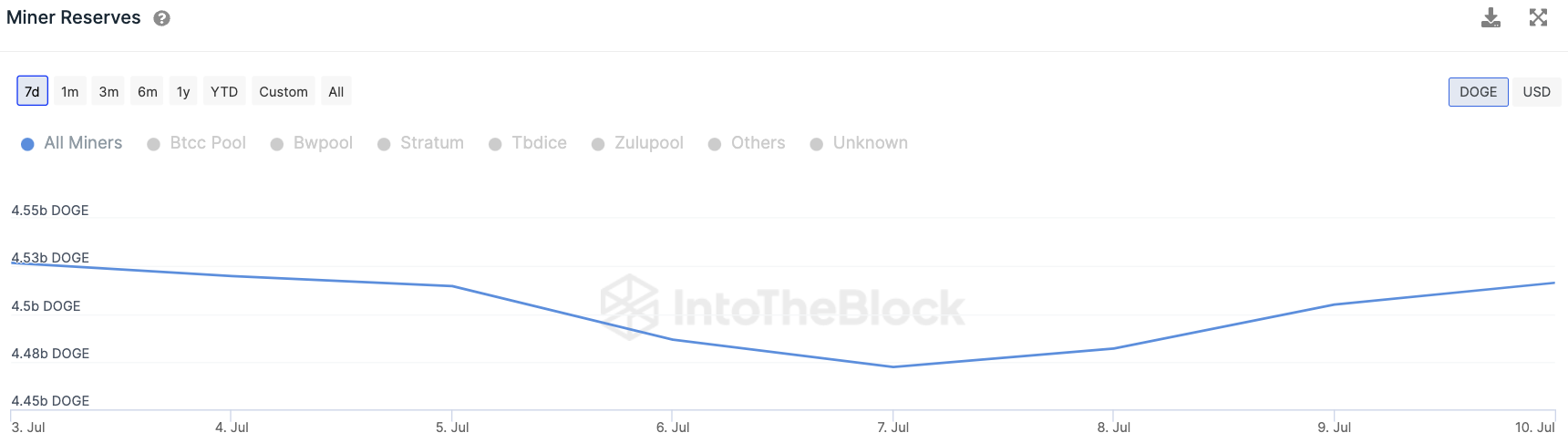

Over the last five days, Dogecoin (DOGE) miners have witnessed a significant surge in their reserves, according to data from crypto intelligence portal IntoTheBlock. The reserves of direct network participants have grown from 4.47 million to 4.52 million DOGE during this period, marking a notable increase.

In the crypto realm, such developments often serve as potential indicators of an imminent price surge for the token. Per traditional wisdom, an accumulation of reserves is viewed optimistically, implying bullish sentiment. Conversely, a sell-off by miners is typically perceived as a bearish sign. However, it is essential to consider the broader context surrounding these trends.

Taking a closer look at the larger picture, it becomes apparent that the spike in Dogecoin miners' reserves follows an outflow of 60 million DOGE earlier this month. This suggests that, in July alone, approximately 10 million more DOGE flowed out of these addresses than entered them.

While this may initially raise concerns, it is crucial to understand that Dogecoin miners' reserves merely account for 3.22% of the total tokens in circulation. Consequently, these fluctuations are less likely to exert a significant impact on the overall DOGE price. Instead, they may reflect current sentiment among network participants and provide insights into the DOGE market's dynamics.

Is this ultimately a signal of an imminent Dogecoin rally? It is an open question, but the sentiment hints at such a possibility.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team