Recently, the market has experienced big fluctuations. In order to maintain the stable price of WUSD, WaykiChain changes the interest rate formula parameters and thus adjusts the collateral interest rate (stable rate). See the details below:

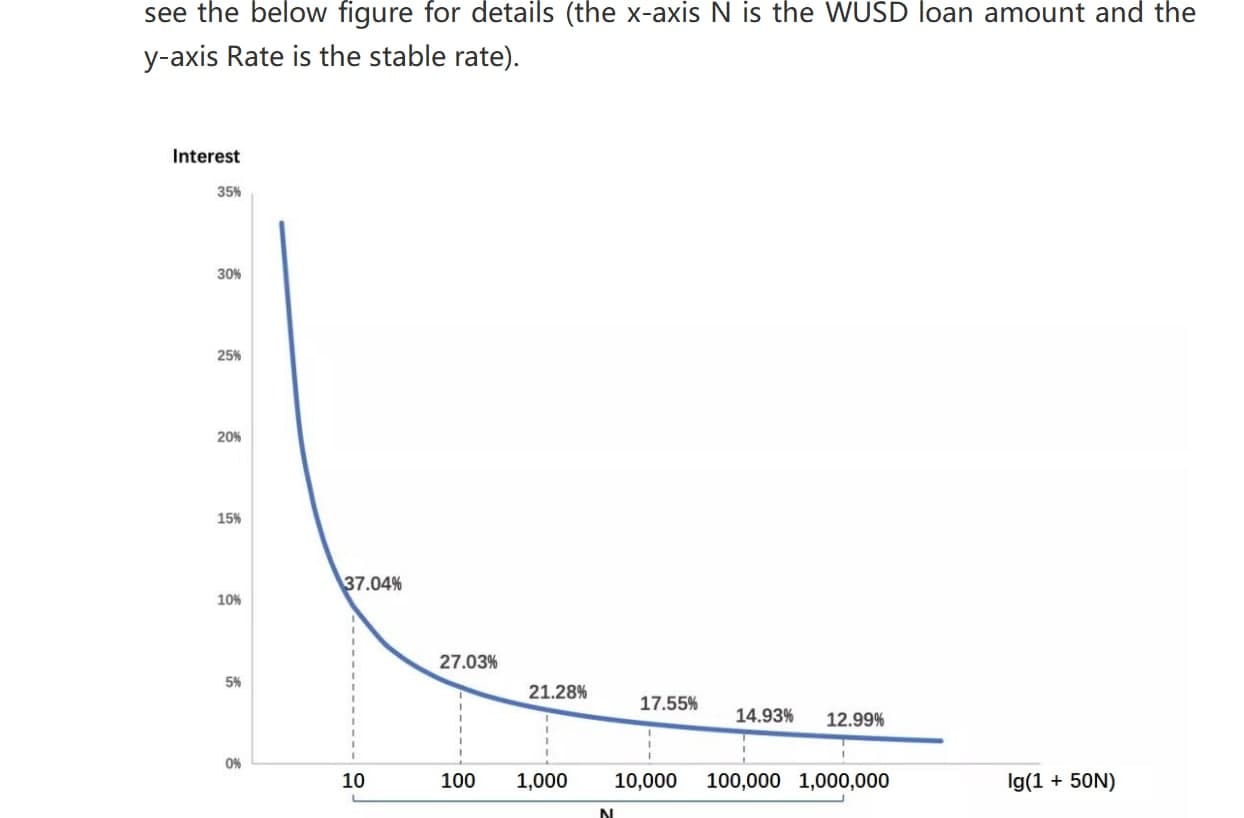

The original interest rate formula: r = 1.8 / lg(1 + 50N). The adjusted interest rate formula: r = 1 / lg(1 + 50N). After the adjustment, the average loan interest rate in WaykiChain’s decentralized collateral lending system Wayki-CDP is 17% p.a., see the below figure for details (the x-axis N is the WUSD loan amount and the y-axis Rate is the stable rate).

We ask all users to pay attention to the dept position changes in Wayki-CDP. For any questions, please feel free to contact @WaykichainHelen.

As of now, over 32.33 million WICC (15% of the total supply) has been pledged in WaykiChain’s decentralized collateral lending system Wayki-CDP. WUSD loans amount for USD 1.05 million. The main use cases of the borrowed WUSD are investment in Hong Kong innovative pre-IPOs through W Broker, cryptocurrency trading, and overseas payments.

Company details

-

OrganizationWaykiChain

-

Website:

Disclaimer:Disclaimer: This is sponsored content. The information on this page is not endorsed or supported by U.Today, and U.Today is not responsible or liable for any inaccuracies, poor quality, advertising, products or other materials found within the publication. Readers should do their own research before taking any actions related to the company. U.Today is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

Vladislav Sopov

Vladislav Sopov