Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

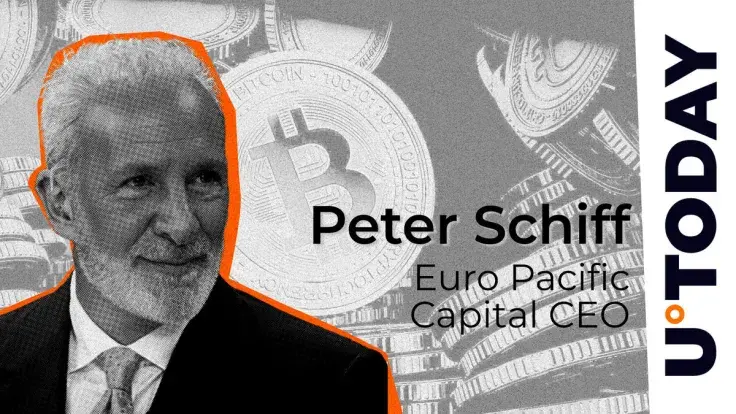

Renowned economist and cryptocurrency critic Peter Schiff has taken aim at Michael Saylor's recent excitement over the increasing adoption of Bitcoin as a strategic treasury asset by corporations.

Michael Saylor, a well-known Bitcoin advocate and chairman of MicroStrategy, recently shared his excitement on X about the growing adoption of Bitcoin as a strategic treasury asset.

Quoting a remark made by Bitcoin investor Bill Miller in a recent CNBC interview, Saylor tweeted, "We now have additional companies coming out and saying we’re going to put Bitcoin on our balance sheet as a strategic treasury asset."

However, not everyone shares Saylor's enthusiasm. Schiff, a vocal Bitcoin critic and gold advocate, quickly responded with his usual skepticism. In a pointed tweet, Schiff argued, "Bitcoin is neither strategic nor appropriate as a treasury asset. Companies shouldn’t flat out gamble with shareholder's funds. They should pay dividends and let shareholders gamble with their own money."

Bitcoin enthusiasts undeterred

However, Schiff's criticism should not deter Bitcoin enthusiasts, who often take Schiff's words with a pinch of salt. To put things in context, Michael Saylor began buying Bitcoin in 2020 as an inflation hedge and cash alternative. Saylor's company, MicroStrategy, is among the world's largest public Bitcoin holders. As of June 20, it has 226,331 BTC, purchased for around $8.33 billion at an average price of $36,798.

Over the weekend, Schiff was taken aback when 87% of the over 11,000 Bitcoin holders who replied to his X poll claimed they would not sell any of their Bitcoin even if the price fell by more than 99% to $120. They said not only that they would not sell but that they would continue to buy even when prices fell.

Schiff unexpectedly revealed that "the main sell point for investors to buy Bitcoin is its great track record of past performance."

At the time of writing, Bitcoin was trading at $66,067, having reached all-time highs of nearly $74,000 in mid-March.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov