Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Solana (SOL), dubbed the "Ethereum killer," has recorded significant gains in a key metric to justify that name. In the last 24 hours, Solana’s chain fees have outranked those of Ethereum (ETH) as the two crypto assets continue to battle for users’ attention.

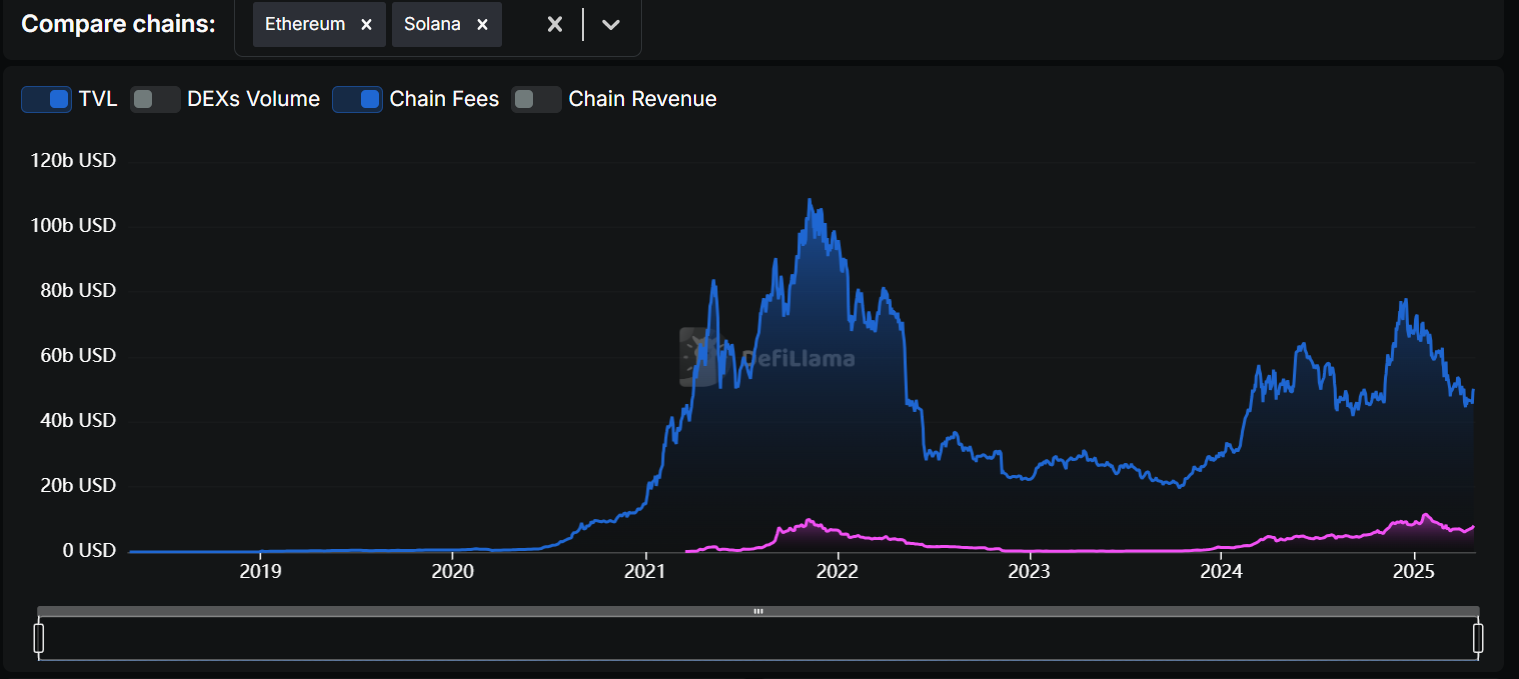

Solana tops Ethereum in daily fees despite lower TVL

Data from DefiLlama shows that SOL earned $1.49 million in fees in the period under consideration. This was from its Total Value Locked assets worth $8.841 billion.

Despite having a higher Total Value Locked of $58.741 billion, Ethereum could only manage chain fees of $1.09 million.

This suggests that Solana is seeing more vigorous DeFi activity than Ethereum. This could signal that users are shifting increasingly toward Solana due to its cheaper and faster transaction throughput. As seen from the data, users are interacting less with Ethereum.

The development has led to Solana outranking the second-largest crypto asset by market capitalization in this critical metric.

Meanwhile, on the broader crypto market, SOL also has an edge in price gains over ETH. Notably, in the last 24 hours, CoinMarketCap data shows SOL taking the lead among altcoins.

As of press time, the price of SOL has grown by 5.01% compared to ETH, which has increased by 2.27%.

Additionally, while both coins are experiencing a decrease in trading volume, SOL’s decline stands at 5.78% at $3.96 billion, while ETH has plunged by a significant 25.16% to $14.06 billion.

Ethereum gears up with protocol upgrades

As reported by U.Today, Peter Brandt recently predicted that Solana could double in value in key technical indicators compared to Ethereum. The legendary trader opined that Ethereum will continue to grow weaker as Solana ascends.

This suggests that the outranking of Ethereum in chain fees might signal more developments in the making.

However, the Ethereum ecosystem is not crossing its arms in the face of this challenge. The blockchain has just approved the EIP 7907 upgrade, and Ethereum Pectra is set to go live on the mainnet in May 2025. The move could impact growth dynamics for Ethereum.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov