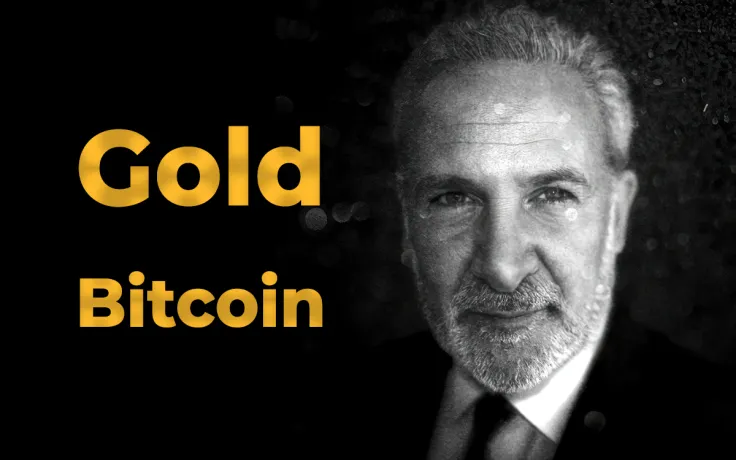

Major Bitcoin critic, Peter Schiff, has taken to Twitter to announce that the USD has become cheaper than gold (with XAU surging above $1,800) and that now crypto enthusiasts will be able to buy less gold with Bitcoin, thus placing the USD and BTC on the same scale class of assets that are inferior to gold.

Gold breaks above $1,800

The head of Euro Pacific, Peter Schiff, has tweeted that he expects inflation to come soon now that the USD has become cheaper than gold.

He stated that the Fed cannot continue printing more trillions of USD out of thin air without causing the existing global USD pile to start losing its purchasing power.

Now investors will need more USD to get gold and more USD to buy everything else, he wrote.

‘You can buy less gold with Bitcoin now’

Users in the comment thread started pitching Bitcoin to Schiff. In response to one comment, the renowned Bitcoin critic stated that now you will be able to buy more Bitcoin with USD, since the dollar is becoming weaker.

However, he pointed out that you will also be able to buy less gold with both USD and Bitcoin, thus drawing a line of similarity between USD and BTC, intending on making both sound inferior to gold.

He pointed out that Bitcoin has been the trend for only two and a half years, implying that gold has been the store of value throughout most of human history.

Schiff also summarized that 'gold is the new gold', calling Bitcoin the 'new fool's gold'.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov