Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In the latest episode of Anthony Pompiliano's "Best Business Show," guest expert Nic Carter, a well-known Bitcoin maximalist and partner at Castle Island Ventures, shared a number of insights, explaining how miners selling their Bitcoin is a bullish signal.

bullish miner selling explained pic.twitter.com/ALsyYW1ehR

— nic carnival barker carter (@nic__carter) June 16, 2022

According to Carter, at the moment when miners start selling their assets, cryptocurrency market participants should expect another market decline, similar in cause and nature to what they may have seen in 2018-2019, when the price of Bitcoin fell to $3,000. In his opinion, that drop was caused directly by the liquidations of miners who could not afford to keep unprofitable positions on their balance sheets and, as a consequence, were forced to liquidate and be bought out by their more affluent competitors.

Nic Carter also stated, citing the Bitcoin Treasuries portal, that miners currently own a total of 40,000 to 50,000 Bitcoins and that their being forced to sell their coins has not yet come to an end, but it will definitely happen. It is when miners start selling out that we can catch the real bottom of the market, Carter summed up in his speech.

Stats prove the thesis

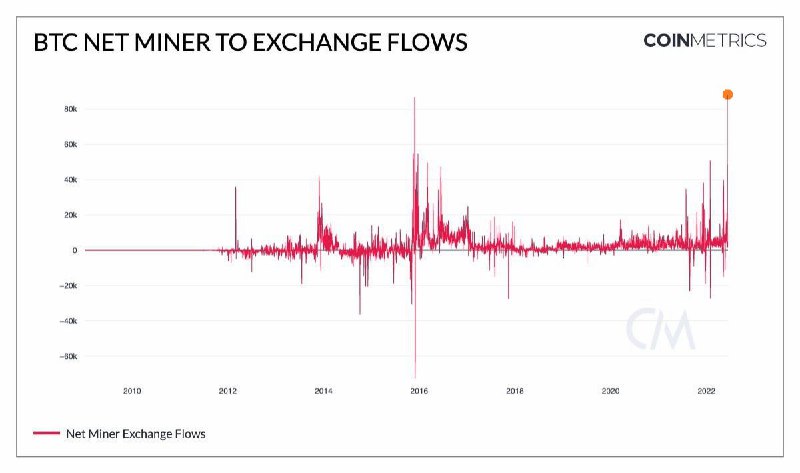

At the same time, according to Coinmetrics, a platform specializing in crypto analytics, there was a record net inflow of Bitcoin to exchanges by miners at the $20,000 mark for Bitcoin. Correlating this fact with the words of Nic Carter—that large sales of miners will mean the bottom signal for Bitcoin—and considering the fact that the $20,000 level has not been broken through, one might wonder if the fall is over, or should we expect a continuation of the downward trend?

Tomiwabold Olajide

Tomiwabold Olajide Arman Shirinyan

Arman Shirinyan Gamza Khanzadaev

Gamza Khanzadaev Yuri Molchan

Yuri Molchan